Barclays PLC (LON: LON:BARC) has experienced a dynamic year in 2024, navigating through market volatility and economic shifts while maintaining its strong presence in the banking sector. This analysis delves into the company's performance, recent updates, and future outlook, offering readers a comprehensive view of Barclays' journey and what to expect moving forward.

Performance Overview

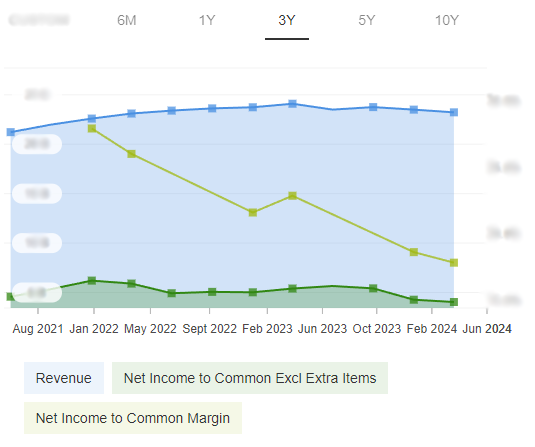

In 2024, Barclays has shown resilience in the face of economic uncertainties. The company's stock (BARC) has experienced fluctuations, reflecting broader market trends and investor sentiment. As of June 2024, Barclays' stock has shown moderate recovery from earlier lows, currently trading around 150p, indicating cautious optimism among investors.A significant driver of Barclays' performance has been its strategic focus on digital transformation and cost management. The bank has continued to invest in technology to enhance its online banking services, aiming to provide a seamless experience for its customers.

This digital push has not only improved operational efficiency but also attracted a younger, tech-savvy customer base.

Financial Health and Strategic Initiatives

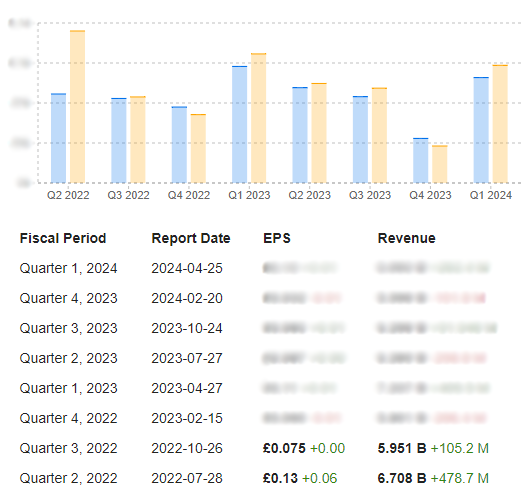

Barclays' financial health remains robust, with steady revenue streams from its diverse range of services including retail banking, investment banking, and wealth management. According to the company's latest financial report, Barclays reported a pre-tax profit of £6.2 billion for the first half of 2024. This growth is attributed to strong performance in its investment banking division and effective cost-cutting measures.The bank's strategic initiatives in 2024 have also focused on expanding its presence in sustainable finance. Barclays has committed to aligning its financing activities with the Paris Agreement goals, aiming to facilitate the transition to a low-carbon economy. This commitment is evident in the bank's increased funding for renewable energy projects and green bonds, positioning Barclays as a leader in sustainable finance.

Market Sentiment and Analyst Opinions

Market analysts have expressed mixed views on Barclays' prospects. According to a report by Reuters on 15th May 2024, “Barclays’ strong performance in investment banking is a positive sign, but challenges in the retail banking sector and economic uncertainties remain a concern.” Meanwhile, analysts at JP Morgan, in their report dated 20th April 2024, have maintained a neutral rating on Barclays, citing the need for the bank to navigate regulatory pressures and competitive challenges in the banking industry.

Challenges and Future Prospects

Despite its strengths, Barclays faces several challenges. The economic environment in the UK remains uncertain, with potential impacts from interest rate changes and geopolitical events. Additionally, the banking sector is highly competitive, with fintech companies and traditional banks vying for market share.However, the future outlook for Barclays is promising. The bank's focus on digital transformation, cost efficiency, and sustainable finance provides a solid foundation for growth. According to the Financial Times on 10th June 2024, “Barclays' commitment to innovation and sustainability positions it well for long-term success, despite short-term challenges.”

Conclusion

In summary, Barclays PLC has navigated a complex landscape in 2024 with resilience and strategic foresight. The company's emphasis on digital transformation and sustainable finance, coupled with its robust financial health, offers a positive outlook for the future.While challenges remain, Barclays' proactive approach and commitment to innovation make it a strong contender in the banking sector.For investors, Barclays presents a blend of stability and potential growth, making it an attractive option for those looking to invest in a leading UK bank with a forward-looking strategy.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!

Get an extra 10% discount by applying the code UK10 on our 1&2 year plans. Don't wait any longer!

How to buy pro InvestingPro