Axiom European Financial Debt (LON:AXI) has made a 21% total return over the last 12 months, well above the average of its debt investing closed-end funds peers. AXI’s investment space, European financials regulatory capital debt, has remained buoyant. Bank capital equity ratios remain high, NPLs are falling, balance sheet liquidity is comfortable and profitability is growing (eurozone banks’ average ROE was 7.2% in Q121). Rising interest rates (if not excessive) should be good news for banks’ margins and profitability at this stage of the cycle. AXI’s portfolio has a 7.8% running yield; 8.3% to perpetuity. AXI is trading on an 11% discount to NAV with a covered 6.4% dividend yield.

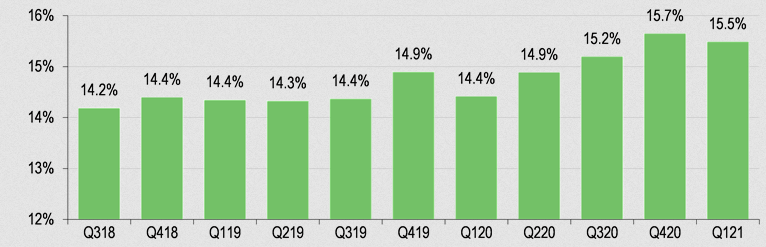

EU banks’ common equity tier 1 ratios (CET1) continue to rise

Why invest in bank regulatory capital now?

Although the bank regulatory debt market has been robust in 2021, it continues to offer yields that are usually above similarly rated debt. We expect these instruments to do well as banks demonstrate good balance sheet resilience in the face of ongoing reductions in government and central bank support. Moreover, there is still much legacy regulatory debt that needs to be called in by the banks and replaced with debt that is regulatory-wise more efficient under new, stricter rules; this is good news for niche investors such as AXI that use their expertise to position themselves.

The analyst’s view

Our view remains that there will be no cliff-edge economic scenario, as central banks and governments will be pragmatic and careful as support measures are tapered off. Potentially higher than expected (and generally elevated) loan impairments are mainly an equity story. Banks now tend to have strong equity bases and de-risked business models due to stricter regulatory requirements. For the sizeable majority of banks, the regulatory capital instruments that AXI invests in will not be called upon to absorb asset losses, allowing AXI to benefit from their premium yields.

Valuation: Dividend 6.4%, NAV discount 11%

AXI is trading at an 11% NAV discount (this has ranged 3–14% in recent quarters), with a trailing dividend yield of 6.4%. The dividend has been stable since 2016.

Fund objective

Axiom European Financial Debt Fund is a Guernsey-domiciled, London-listed, closed-end fund investing in regulatory capital securities in Europe. It seeks opportunities presented by Basel III and Solvency II transitions. It has a diversified approach across a broad range of subordinated debt issued by financial services companies. It uses five sub-strategies to obtain attractive current income and capital gains. AXI has a target return of 10% pa over seven years.

Bull points

- Investment niche requiring expertise allows for relatively good returns.

- Bank regulatory capital instruments carry premium yields and should remain resilient as government and central banks support is tapered.

- Further capital optimisation means more investment opportunities for Axiom.

Bear points

- Bank equity and debt securities have been out of favour since the financial crisis.

- Rising interest rates could affect debt prices.

- Macro shocks can affect risk perception.

Click on the PDF below to read the full report: