After its more than 450% surge during 2020, the meteoric rally in Moderna (NASDAQ:MRNA) shares continues this year. The gains—propelled by the biotech's breakthrough vaccine against COVID-19—have been so powerful that this 11-year-old company is now approaching a market capitalization of $100 billion.

The stock jumped almost 5% on Wednesday, to trade at a record $246.92, before closing at $246.40, valuing the Cambridge, Massachusetts-based Moderna at almost $99 billion.

This elevated level of valuation—which puts Moderna in the same league as global pharma giants such as Sanofi (NASDAQ:SNY) and GlaxoSmithKline (NYSE:GSK), also raises an important question: Where do MRNA shares go from here?

The answer to that question very much depends on the path the global health crisis takes and the company’s success at moving beyond vaccines in order to unlock the full potential of mRNA technology, on which the COVID vaccine is based, as a remedy for other diseases. For the time being, analyst predictions for the company's near-term sales potential range widely.

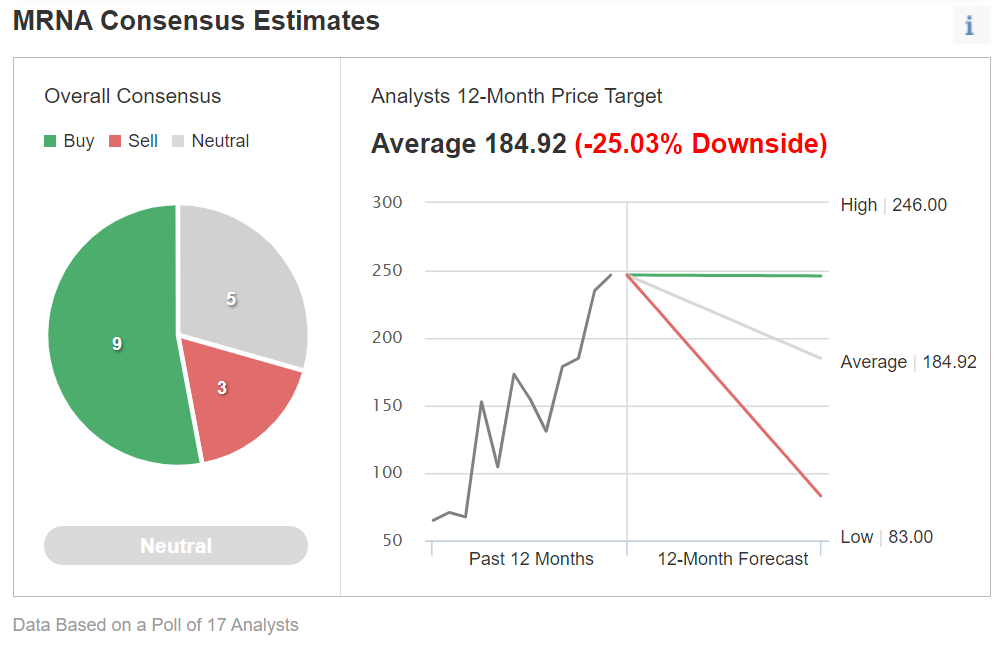

According to consensus estimates published on Investing.com, though the majority of analyts polled currently have a buy rating on the stock a significant minority don't hold the same conviction on the biotech.

Moderna, which had nominal sales before the pandemic, could bring in revenue ranging from $13 billion to $22 billion in 2021, according to analysts’ forecasts. But beyond this year, forecasting vaccine sales becomes trickier.

Morningstar analyst Karen Andersen in a Bloomberg report says the vaccine market could top out at $72 billion worldwide this year, and then fall to $65 billion in 2022 and $8 billion the following year.

“The extent of the slide will depend on how many people need booster shots, how often and whether Moderna, Pfizer (NYSE:PFE) and others will be able to raise prices to compensate for a smaller market,” the report says.

Already At Peak Valuation?

Analysts covering biotech companies, which thrive on their first set of products, say that in such cases, companies peak at about 10 times future sales, which they have the potential to fetch in the next three to five years.

Applying this rule to Moderna suggests that the company may have already achieved its peak valuation, and it will be tough for the stock to move higher from these levels. Companies as diverse as Alexion (NASDAQ:ALXN) and Gilead (NASDAQ:GILD) have shown investors a similar path after launching their breakthrough drugs.

Gilead, which launched a ground-breaking hepatitis C drug in late 2013, saw its sales surge to $19 billion in 2015 but then started to decline as competition grew. Gilead's value followed suit, dropping as much as $100 billion from its peak of almost $180 billion.

Beyond the COVID-19 pandemic, Moderna executives are optimistic their technology will bring cures for other respiratory-infectious diseases, such as respiratory syncytial virus, or RSV; and cytomegalovirus, or CMV; as well as other potential therapies for ailments including cancers and inflammatory diseases.

Betting on other breakthroughs may not bring windfalls as quickly as those fueled by the emergency authorization for the COVID vaccines. Most of Moderna’s experimental vaccines remain in early stage human trials, except its shot for cytomegalovirus. That could turn into a multi-billion-dollar product if it works. Moderna also plans human trials this year of a vaccine against Epstein-Barr virus, which causes mononucleosis.

Bottom Line

Moderna stock has proved a great bet for early investors. Its future path, however, is still uncertain after such a powerful rally which has pushed the stock beyond the fundamentals of future vaccine sales.