This article was written exclusively for Investing.com

Despite a pandemic, an economy in contraction, and unemployment near historically high levels, stocks have raced up in 2020, and in many cases, to record highs. With the reality-check from earnings season imminent, that may all be about to change, as traders begin to load-up on bearish bets and risk assets start to show signs of fatigue.

It could mean that bonds and bond-like proxies are likely to take over the leadership. Should that happen, it may indicate that bond yields will fall to even lower levels, while defensive sectors of the equity market take over. The second half of 2020 may prove more challenging.

Bets Pile Up

After plunging sharply in March on fears of the impact of coronavirus, the Nasdaq 100 has not only recovered all of its losses, but risen to record highs. Now, options traders are beginning to heavily bet that with earnings season in full swing, stocks will come off those record levels.

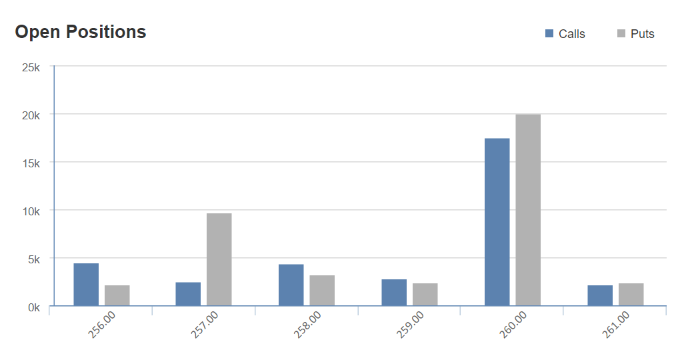

The Nasdaq 100 ETF, the Invesco QQQ Trust (NASDAQ:QQQ), has seen open interest for Aug. 21 puts at $260 puts rise by almost 13,000 lots in recent days. The puts were bought for around $7.75. It suggests traders are betting the QQQ will fall to $252.25, or lower, by the middle of August, from around $260 right now. The biggest strike by open interest is the Aug. 21 200 puts, with over 50,000 contracts, indicating investors are preparing to cash in on a drop of over 20% in the space of a month.

Similarly, there has been an increase in the number of contracts that bet on a continuation of weakness further ahead. Open interest in Sept. 18 $230 puts, at a premium of around $6.70 per contract, has risen by roughly 9,500 contracts. In this case, traders are wagering that the QQQ ETF could trade around $223.30 by the middle of September.

(Investing.com – QQQ August 21 $260 Puts)

The same type of activity is taking place across some key technology-related names, such as Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), and AMD (NASDAQ:AMD). With Amazon seeing bearish betting taking place for expiration on Aug. 21 at the $3,100 strike price. Meanwhile, AMD has seen bearish positioning ahead of the Aug. 21 expiry, with an increase in open interest on $55 puts, compared with the current share price of around $54.90, while open interest in downside strikes on Nvidia for the same options expiry has also grown.

For the broader S&P 500, the options market shows investors are betting heavily on a steep retracement. The largest strike by open interest for the Dec. 18 expiry is for 2,500 puts, with over 77,000 lots, followed closely by 2,000 puts, with 72,000 lots of open interest. With the index trading around 3,200, this implies investors could be betting on a drop of at least 30% by the end of the year. And the S&P hasn't traded at 2,000 since mid-2016.

Risk-On Nearing Its End?

But it isn’t just technology stocks that may suffer. We have seen a recent move lower in copper prices after a big run-up. Technically, the metal is overbought. Copper, which is often used as a gauge for global growth, is showing a bearish reversal pattern on the charts, known as a "bump and run". It could result in copper prices falling back to $2.65 from current levels around $2.90.

Risk-Off Mood Taking Over

Supposing investors are positioning themselves for a weaker than expected earnings season, or at the very least, a post-earnings season sell-off. Then it seems likely that bond yields may only continue to decline from their current levels. The 10-year Treasury has slowly been drifting lower and is drawing very close to a significant breakdown based on the technical chart, should the yield fall below 50 basis points.

If risk-on assets do come under pressure and yields decline more steeply, investors might move into more defensive sectors of the equity market, such as utilities, consumer staples, and health care. It means that these sectors are likely to outperform during periods of market turbulence.

The run-up in stocks and risk assets since the March lows has undoubtedly been one of the greatest bull runs over such a short period in history. However, the historic run is likely to come to an end at some point. After all, no index or stock can go up infinitely in a straight line. However, a pullback, should one occur, would be a welcome event as it would allow for the market to reset and start a second push higher, in what could be just the beginning of a more long-term and sustainable rally.