Investor appetite for Microsoft (NASDAQ:MSFT) stock remains strong. During the past year, every dip has attracted more buyers, pushing the software and infrastructure giant's stock to a new high.

Even after a 125% rally since the market crash in March 2020, there are reasons to believe the stock has more upside. The Redmond, Washington-based company last month reported sales and profit that exceeded analyst estimates for a 10th straight quarter, showing that Chief Executive Officer Satya Nadella’s strategy to make Microsoft the largest cloud-computing provider remains on track.

Microsoft’s cloud-computing business has contributed massively to the stock’s 425% advance in the past five years—a period in which Nadella also branched out into additional new growth areas. During his tenure, more than $45 billion was spent on acquiring companies, including business social network LinkedIn, video game developers Mojang and Zenimax, and the code-storage service GitHub.

These bets have largely paid off. Microsoft's Intelligent Cloud segment accounted for 33.8% of the company’s 2020 revenue, making it the largest of the technology behemoth's major business lines for the first time. As well, the unit was up from 31% in 2019.

Last year, the division showed revenue growth of 24%, compared with the 13% growth in Productivity and Business Processes, and the 6% growth of Microsoft’s More Personal Computing unit.

In addition, the pandemic has further accelerated MSFT growth. Millions of workers and students stuck at home during lockdowns used the company’s meeting software Teams to remain in touch and connected. As well, large corporate clients accelerated their shift to the cloud, while younger retail customers bought Xbox gaming subscriptions.

More Upside In Store

Still, the relentless rally over the past five years likely raises a question in investors’ minds: Is MSFT stock too expensive to buy?

Most analysts believe that the relatively expensive share price appropriately reflects expectations for the company’s growth. In a note to its clients yesterday, Goldman Sachs reiterated its buy call for Microsoft, saying the bank sees more upside in the stock after the tech giant announced a price increase for Microsoft 365.

Its note said:

“We believe the recent announcement underscores the company’s strong competitive positioning and long-term pricing power, particularly with respect to Commercial Office 365, which represented ~18% of total revenue in FY21.”

In its first “substantive” cost change since launching Office 365 a decade ago, Microsoft said in a blog post last week that the price for its 365 Business Basic plan will jump 20% to $6 per user, while the high-end version of the suite will see a bump to $36 per user from $32.

Microsoft justified the move by highlighting three key areas where its products have advanced: communication and collaboration, security and compliance, and AI and automation. The company also announced it’s adding unlimited dial-in capabilities for Teams, to allow users to join in to meetings from virtually any device regardless of location.

Just like Goldman Sachs, Mizuho Bank also reiterated its buy for MSFT. In a note to clients, the Japanese lender raised its price target on the stock to $350 from $325, saying the Microsoft 365 price hike will have a “significant” effect in FY23 and beyond.

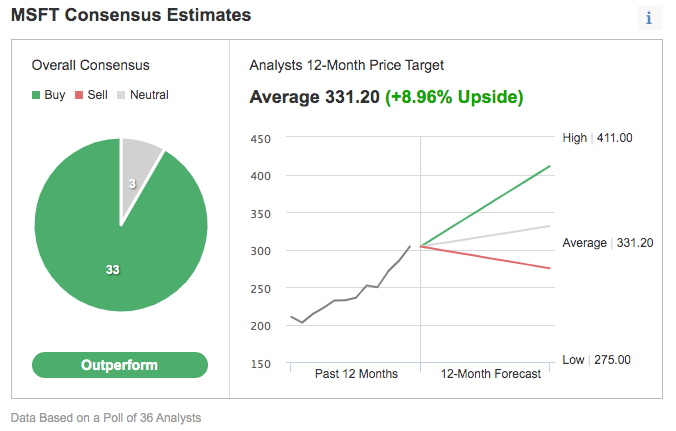

These bullish sentiments are also reflected in Investing.com's consensus price target for the stock. Of 36 analysts polled, 34 have an “outperform” rating for Microsoft, with about a 9% upside from its current price.

Chart: Investing.com

Bottom Line

Shares of Microsoft, after a powerful rally this year, have indeed become expensive. But in our view, the stock isn’t overvalued.

The current share price of $304.65 as of Monday's close, takes into consideration Microsoft’s success in both the short- and longer-term. In addition, Microsoft pays a healthy dividend of $2.24 annually that continues growing steadily. That makes owning the stock even more attractive.