Applied Graphene Materials (LON:AGMA) (AGM) specialises in providing graphene in the form of dispersions of nanoplatelets that can be readily incorporated by customers into their products. It is initially concentrating on the global protective coatings and composite materials markets where the financial benefits of the performance enhancements achievable from incorporating graphene may be calculated, encouraging adoption.

Share Price Graph

Bull

- Understanding of dispersion technology enables AGM to support customers developing commercial applications.

- Standardisation of some graphene dispersion products reduces length of sales cycle.

- Expansion of distribution network accelerates the pace of introducing AGM’s dispersions.

Bear

- Revenue development dependent on success of individual customer product launches.

- Extensive testing required prior to customer acceptance.

- COVID-19 pandemic prolonging sales cycles and dampening demand from end-users who cannot access sites to deploy coating products.

Graphene has exceptional properties

Graphene’s novel single layer structure gives it unusual and desirable properties. However, incorporating graphene into materials so that these desirable properties are transferred has proved difficult, so graphene as a materials technology has taken a long time to live up to its early hype.

Enhancing performance of coatings with graphene

AGM’s commercialisation strategy addresses the key issues delaying graphene adoption. (1) Although its products have attracted interest from potential customers in a diverse range of markets, AGM is currently focusing primarily on the global protective coatings market where it has recently established a global network of distributors to accelerate roll-out. (2) Rather than investing in the development and marketing of end-products containing graphene, AGM is selling graphene additive dispersions to customers with extensive experience of the coatings market, which use the material to enhance the performance of their products. (3) AGM sells customers graphene formatted as additive dispersions of nanoplatelets. This makes it easier for them to incorporate graphene in their products in a repeatable, consistent fashion at volume, thus helping cut the time it takes for customers to develop their graphene-enhanced products. Similarly, AGM is engaged in programmes incorporating graphene into composite materials used in the aerospace industry and into thermal adhesives for a broad range of applications.

Scenario analysis

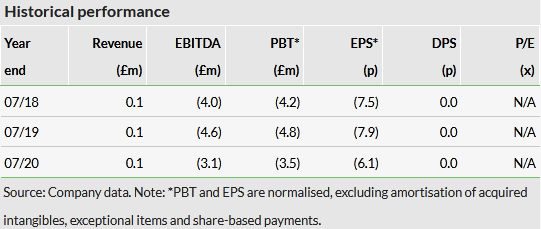

Engagement so far has been with numerous relatively small coatings customers, so at the end of January 2021, management had identified an opportunity pipeline totalling £7.6m annual revenues (£3.0m probability weighted). Our scenario analysis extends to annual revenues of £25m, which is a very small proportion of the total global protective coatings market (2019: US$146.2bn). This analysis shows that the pipeline at end January 2021 is not sufficient to take AGM to cash break-even, which is reached at annual revenues of around £10m. We note that AGM will require additional capital investment of around £2m to support £10m annual revenues.

Click on the PDF below to read the full report: