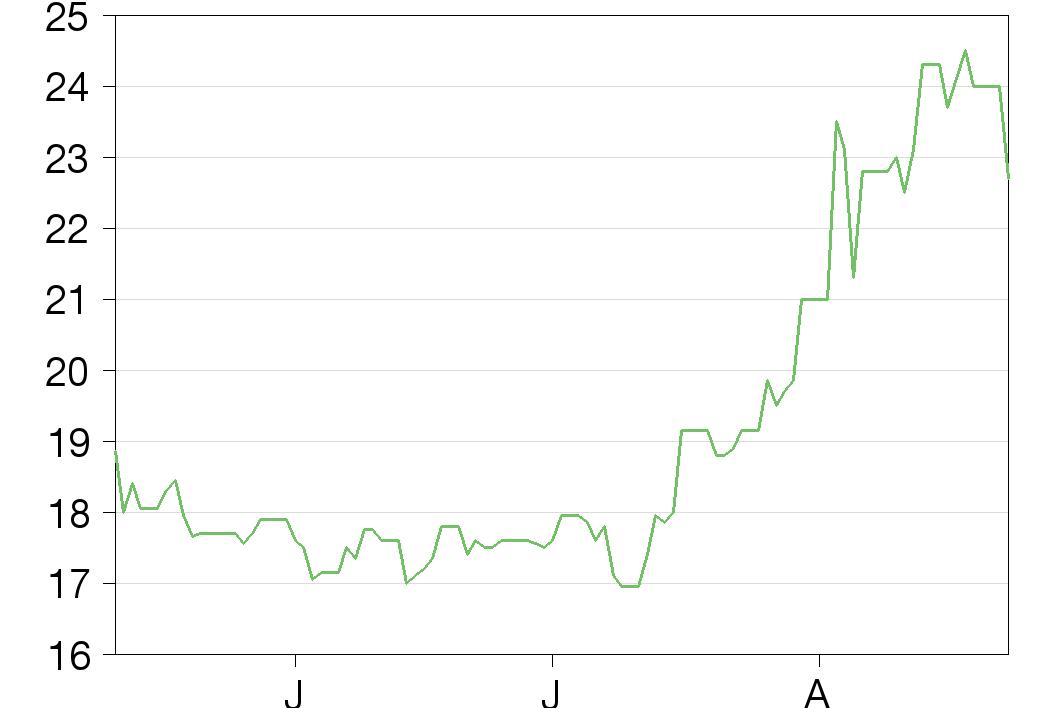

Following its successful IPO in May, Apontis Pharma's (DE:APPHG) maiden results highlight that the expansion of its single pill franchise continues at pace and should continue to provide high double-digit sales growth. These pills are combinations of commonly co-prescribed generic drugs that have been reformulated into one branded pill. We believe an increasing mix of these higher-margin single pills will improve profitability. Apontis’s shares have appreciated since they were initially priced at €19.0/share (up c 16%) and the company has a market cap of €187m with an EV of c €157m.

Share Price Graph

Business description

Apontis Pharma is focused purely on the German market, where it has a rich commercial heritage (formerly Schwarz Pharma and then UCB Innere Medizin). Its current focus is on driving uptake of its single pills for cardiovascular disease, but it also co-markets branded respiratory and diabetes drugs for large-cap pharma companies.

Bull

- Growing recognition of the compliance, patient outcome and cost benefits of its single pills presents a strong tailwind.

- Cardiovascular disease remains on the rise in Germany and is the leading cause of death.

- Co-marketing agreements with AstraZeneca (NASDAQ:AZN) and Novartis offers synergies for its reps.

Bear

- Failure to execute on co-marketing agreements could lead to early termination; failure to replace or renew these would impact growth ambitions.

- Public tenders in Germany could place pricing pressure on its drugs and squeeze margins.

- Capitalised R&D inflates intangibles; pipeline attrition may lead to write-downs or impairments.

Single pill franchise continues to grow at pace

During H121, revenues grew by 36% to €24.0m, primarily driven by single pill sales which grew 83% to €14.0m. Apontis continues to benefit from prescriber and payor adoption of its single pills, with AXA Health Insurance recommending its antihypertensives to policy holders during the period. Single pills represented 58% of the revenue mix and margins are improving as a result, with the adjusted EBITDA margin up at 11.8% (H120: -8.1%). Substantial investment in its single pill portfolio can be expected over the mid-term to sustain growth momentum, and c €20m of the IPO proceeds are ear-marked for this purpose. Following the IPO, the company is now debt-free with cash of €30.5m at 30 June.

Promising mid-term outlook

Management has guided that based on its existing and developmental portfolio, single pill sales could grow by c €100m from a base of €19.0m in 2020. Assuming these are fully realised by end-2030 would imply a c 20% sales CAGR. An increasing mix of these higher-margin products (>70% gross) should enable it to hit its mid-term group EBITDA target of 30%. Despite being lower margin, co-marketing agreements with AstraZeneca and Novartis for several respiratory and diabetes drugs clearly offer synergies to its single pills and ultimately provide an entry point for its c 130 sales reps, who market to c 23k physicians in Germany.

Valuation: High growth and an enticing margin story

Based on revenue expectations for FY21 (consensus: €49.3m; management: €48.5m) Apontis currently trades at c 3.2x EV/sales, a slight discount to the peer average of c 3.6x. Based on FY21 adjusted EBITDA it trades at c 39x (consensus: €4.0m) or c 28x EV/EBITDA (management: €5.5m), a premium to the peer average of c 14x. Recognition of its double-digit sales growth potential, coupled with the potential for a strong margin story, should continue to underpin share momentum.

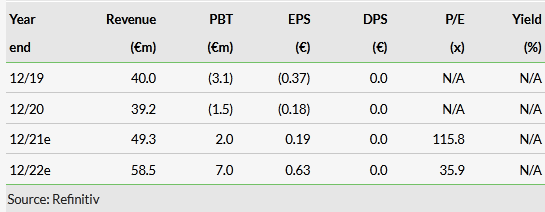

Consensus Estimates