- Ambev looks undervalued with 24-30% upside potential backed by strong financials and optimistic valuation.

- The company boasts good financial health alongside healthy profit margins, making it well-positioned for positive returns.

- We'll take a look at why the stock could be a good bet at current price levels.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Founded in 1999 through the merger of Brazil’s top breweries, Brahma and Antarctica, Ambev (NYSE:ABEV) quickly became one of the world’s largest beverage manufacturers.

Today, Ambev operates in 14 American countries, making it the largest brewery in Latin America and the fifth-largest food and beverage company globally.

Ambev produces and markets a wide range of beverages, including beers, sodas, juices, and teas. Its well-known brands include Skol, Brahma, Antarctica, Budweiser, Stella Artois, Pepsi, and Guaraná Antarctica.

However, Ambev’s performance is closely tied to the macroeconomic environment. In a highly competitive market, where consumer spending and confidence influence demand, Ambev has diversified its portfolio to include sodas, energy drinks, and other beverages.

Using advanced tools from InvestingPro, we'll take a look at what the company needs to achieve to fulfill its upside potential.

Undervalued Gem?

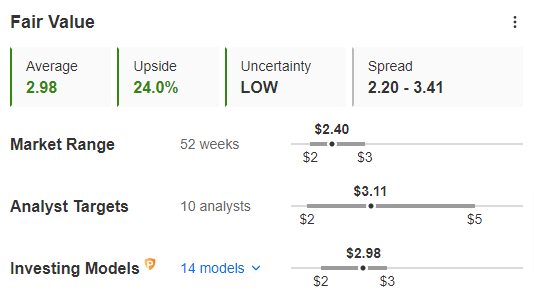

InvestingPro estimates Ambev’s fair value at $2.98, based on 15 valuation models. With the stock currently priced at $2.4, it has a potential upside of 24%. This is a significant opportunity, especially in a market where investors seek resilient companies with growth potential.

Source: InvestingPro

Several optimistic valuation models available on InvestingPro support this view, including the 5-year Discounted Cash Flow (DCF) with a Growth Exit, the 10-year DCF with a Growth Exit, and the 10-year DCF with an EBITDA Exit.

These models suggest Ambev is undervalued and could see substantial growth. The 5-year and 10-year growth-based models highlight the company’s strong growth potential, while other models point to stability in revenue and EBITDA, suggesting consistent long-term appreciation.

Analysts have an average target price of $3.11 for the stock, offering an almost 30% upside from current price levels.

Robust Financials

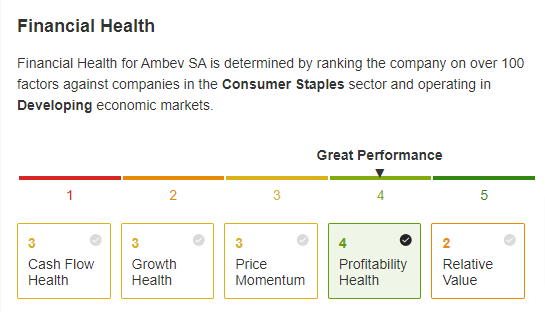

Ambev’s robust financial health supports its bullish potential. InvestingPro rates its Financial Health score at 4 out of 5, which indicates financial stability. Profitability stands out with a score of 4, among all the financial metrics measured by InvestingPro.

Source: InvestingPro

Key indicators include a 24% Operating Margin, 29.1% EBITDA Margin, and a 21.4% Return on Invested Capital. These metrics show Ambev’s efficiency and strong returns for investors. The company’s strong financial position is bolstered by a net cash position (Net Debt/Total Capital of -5.7%), which lowers its financial risk.

Other favorable indicators include a 6.4% Shareholder Yield, a 50.8% Gross Margin, a P/E Ratio of 14.1x, an EV/EBITDA of 8.2x, and a 10% Free Cash Flow Yield. With profit margins expected to remain healthy, Ambev appears well-positioned for positive returns.

Challenges and Threats

Despite its strengths, Ambev faces challenges such as shifting consumer preferences and rising production costs. While the high PEG Ratio of 15.7x suggests slower growth compared to the stock price, other indicators like the P/E Ratio and EV/EBITDA suggest that the company still offers attractive value.

The Growth and Relative Value categories of Financial Health score below average, reflecting potential concerns. For instance, the EV/EBITDA Growth Ratio of 2.2x suggests the market may overvalue the company’s future growth. Additionally, a -0.8% Gross Profit Growth indicates rising production costs or margin pressures.

To address these challenges, Ambev should continue its cost-reduction strategies, boost operational efficiency, and explore new markets. If the company maintains its innovative edge and adapts to market changes, it can mitigate these risks.

Bottom Line

On a broader scale, Ambev’s performance is also influenced by the economic and political conditions in Brazil, its largest market. Economic volatility in Latin America and changing consumer preferences towards healthier options pose risks.

Furthermore, government policies, such as increased taxes or stricter regulations, could impact costs and profitability. Inflation and currency volatility are ongoing challenges, but Ambev’s operational efficiency and innovation position it well to navigate these issues.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.