- Amazon reports earnings today, with investors focusing on AI, cloud, advertising, and the macro impact.

- Analysts expect strong growth, with EPS projected at $0.83 and revenue at $142.5B.

- The Fed meeting tomorrow adds a layer of post-earnings market volatility for the stock.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

- Returns on Investment in Artificial Intelligence: Amazon's AI investments and their impact on various business segments.

- Cloud Computing Profitability: Growth trends within the Amazon Web Services (AWS) business.

- Advertising Segment Growth: Expansion and monetization of Amazon's advertising platform.

- Macroeconomic Impact: How global economic conditions are affecting Amazon's financial health and operations.

- Strong Short-Term and Long-Term Returns: Amazon boasts a history of impressive returns for investors.

- High Profitability Expectations for This Year: Analysts anticipate significant profit growth for Amazon in the current year.

- High Valuation Ratios: Amazon's P/E, P/B, and EBITDA ratios are currently high, indicating a potentially overvalued stock.

- Average Debt Level: While not a critical concern, Amazon's debt level remains at an average level, which could become a risk factor in certain economic conditions.

E-commerce and cloud computing giant Amazon (NASDAQ:AMZN) reports its first-quarter earnings today after the market closes. Investors will be keenly focused on several key aspects of the report:

Ahead of the earnings release, analysts' consensus forecasts point to earnings per share (EPS) of $0.83, representing a 73% increase year-over-year, and quarterly revenue of $142.5 billion.

While analysts revised EPS estimates upwards, the projected $0.83 falls short of the previous quarter's figure. However, it still signifies a significant 167% increase compared to the same period last year.

Source: InvestingPro

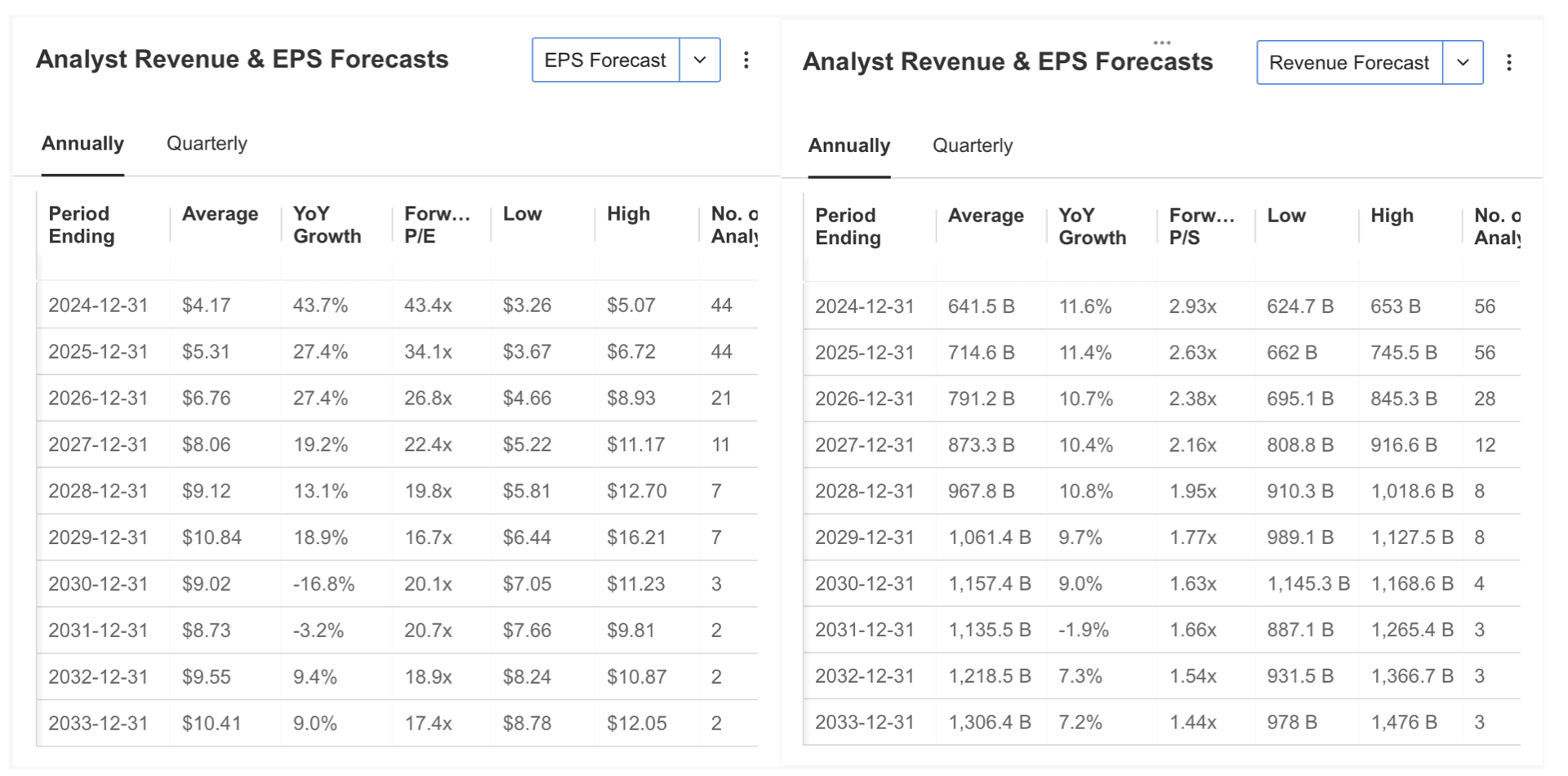

Analysts are bullish on Amazon's future growth, projecting strong increases in both earnings per share (EPS) and revenue over the next two years:

Analysts forecast an annualized EPS growth rate of 43.7% for both this year and next year, reaching $4.17 and $5.31 per share, respectively.

Revenue is expected to reach $641.5 billion by the end of this year and further climb to $714.6 billion by the end of 2025, representing an average annual growth rate of 11%.

Source: InvestingPro

Amazon Earnings: AI, Cloud Dominance, and Growth Strategies in Focus

Following Microsoft's (NASDAQ:MSFT) strong cloud earnings report, anticipation is high for Amazon's first-quarter results. Investors are particularly eager to see the impact of the company's significant investments in AI.

Earlier this month, CEO Andy Jassy touted AI as a potential game-changer, even surpassing the impact of cloud technology and the internet. This sentiment is reflected in Amazon's recent $2.75 billion investment in AI startup Anthropic, bringing its total commitment to $4 billion. This aggressive move underscores Amazon's ambition to become a leader in the field, potentially generating new revenue streams from existing customers through AI-powered services.

Beyond AI, Amazon's competitive pricing, diverse product range, and swift delivery are expected to continue driving sales growth. Additionally, the company's burgeoning advertising business holds significant potential, particularly with the Prime Video platform.

In the cloud sector, Amazon Web Services maintains its dominance with a 30% market share. The recent Anthropic investment further strengthens its position against competitors like Microsoft Azure and Google Cloud. However, Amazon is also implementing cost-cutting measures, including recent layoffs, indicating a focus on efficiency alongside its growth strategy.

In the e-commerce sector, Amazon faces stiffer competition from Chinese rivals like Temu and Shein, while its advertising business lags behind Google (NASDAQ:GOOGL) (NASDAQ:GOOG) and Meta Platforms (NASDAQ:META). However, market analysts believe Amazon's Prime Video service offers significant growth potential.

Source: InvestingPro

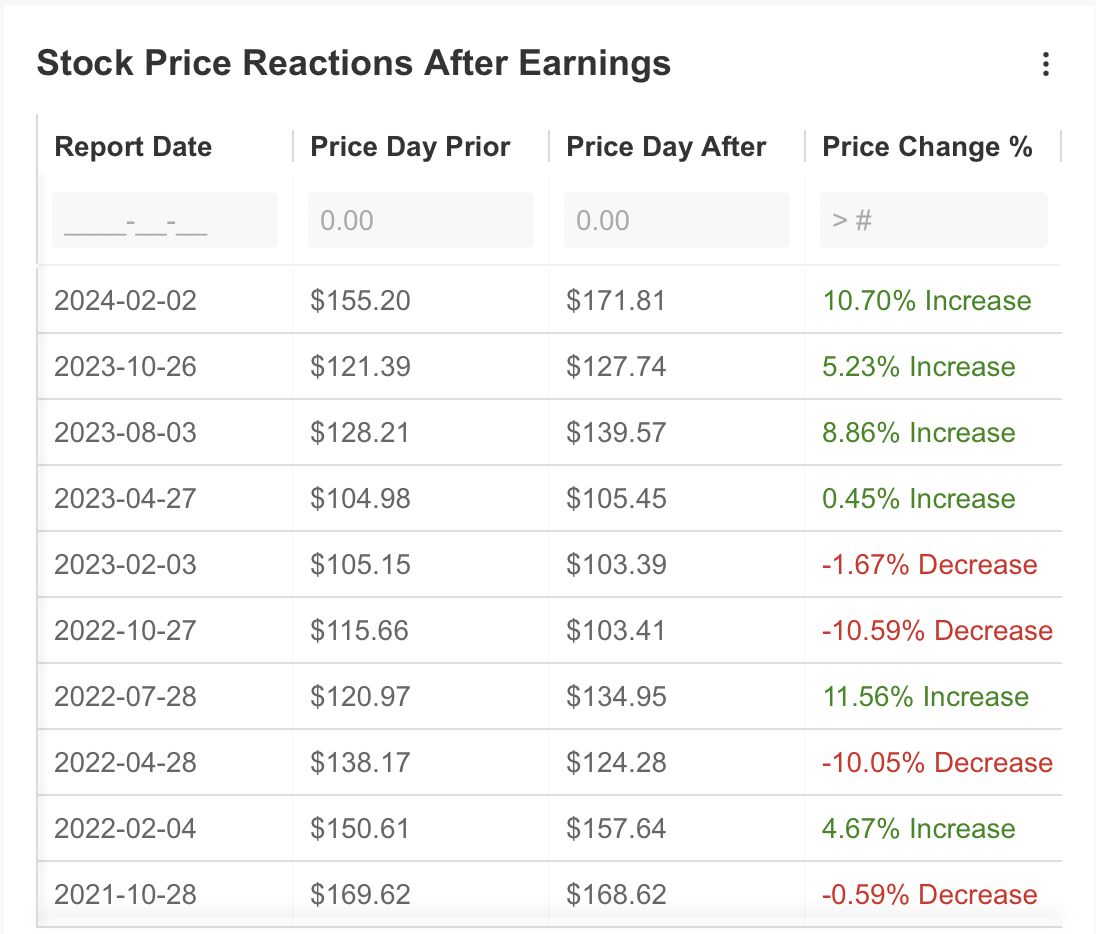

Following the release of its earnings report, Amazon's stock price often experiences increased volatility. This time, the earnings report coincides with the Federal Reserve's interest rate decision, further raising the potential for market fluctuations.

While the Fed is widely expected to maintain current interest rates, Jerome Powell's accompanying remarks could significantly impact the stock market overall, potentially causing additional volatility for Amazon specifically.

Financial Health and Fair Value Analysis

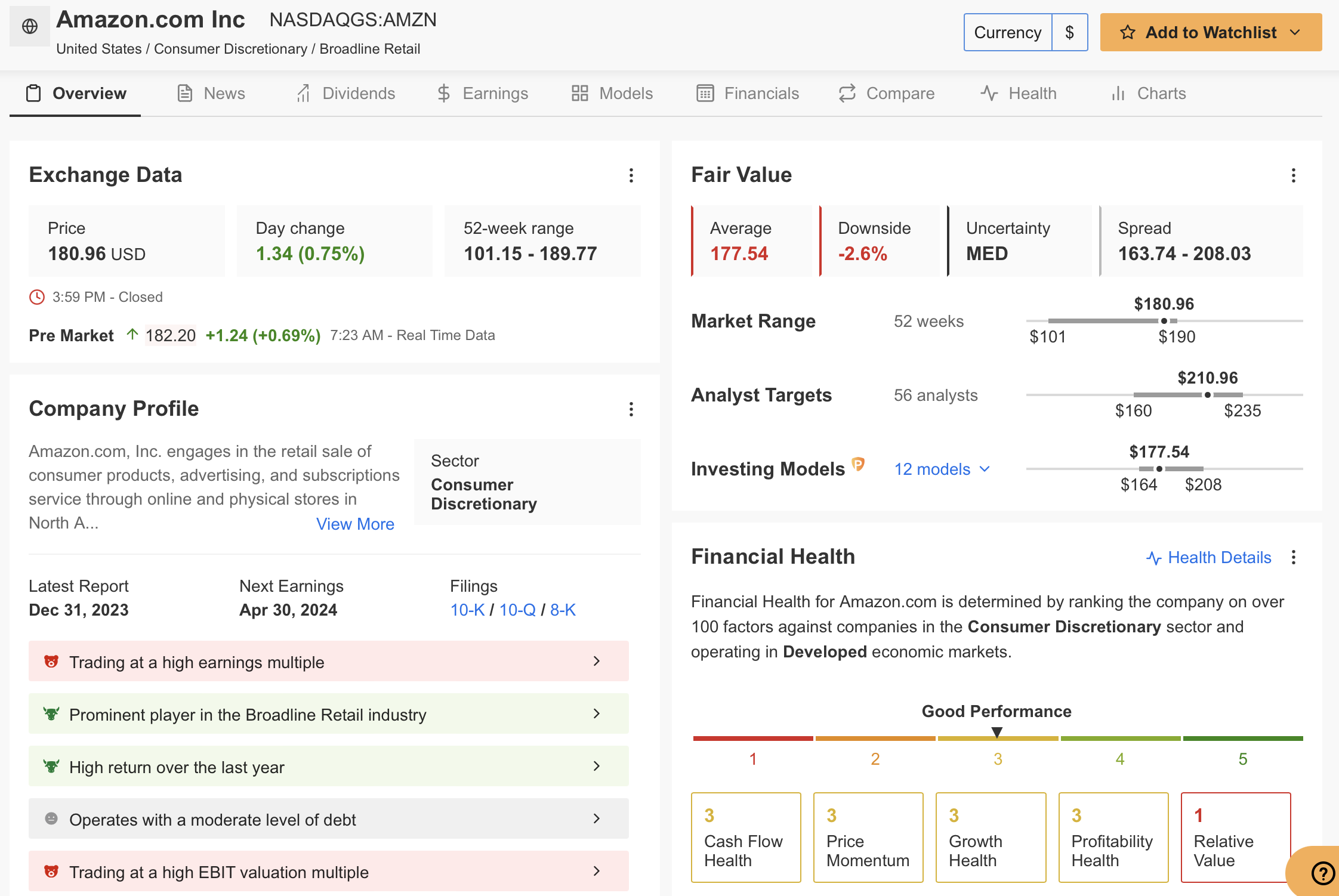

Examining Amazon's overall report card via InvestingPro reveals a 'good performance' rating for its financial health, with a score of 3 out of 5 based on 12 financial models and moderate uncertainty.

The calculated fair value for AMZN is $177.50, suggesting the stock is currently trading around its fair value level. However, it's crucial to monitor potential changes in fair value following the earnings report.

Analyzing Amazon's Strengths and Weaknesses with InvestingPro

InvestingPro provides valuable insights into Amazon's strengths and weaknesses:

Strengths:

Weaknesses:

Despite these weaknesses, Amazon's growth-oriented initiatives and cost-cutting efforts are viewed positively by the market. Analysts generally expect solid revenue and profit growth for the first quarter, leading to a potential pre-session stock price increase towards $182.

Technical View

Amazon's stock has maintained a clear uptrend since last year, confined within an ascending channel. This month, AMZN bounced off the channel's lower boundary and turned upward again, suggesting potential bullish momentum.

Last week, buyers emerged at the support level, pushing the stock above the channel's midline with significant volume.

If Amazon's earnings report is positive, a further surge towards the $190 band is likely. Additionally, the Stochastic RSI and CCI indicators on the daily chart hint at potential bullishness.

However, tomorrow's Fed interest rate decision and subsequent messaging could significantly impact the broader market, potentially causing volatility in AMZN's price.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This content, which is prepared purely for educational purposes, cannot be considered as investment advice. We also do not provide investment advisory services.