All eyes are on Nvidia (NASDAQ:NVDA) upcoming results, which will be released tonight European time. The results are more than just an insight into Nvidia, but a macro event on par with a Fed rate meeting or an important macro key figure. Besides being a 'temperature gauge' for the overall AI rollout that directly impacts stocks in this part of the market, Nvidia is also the third largest company in the S&P 500, representing over 5% of the index value, and the results could have a significant impact in the broader market.

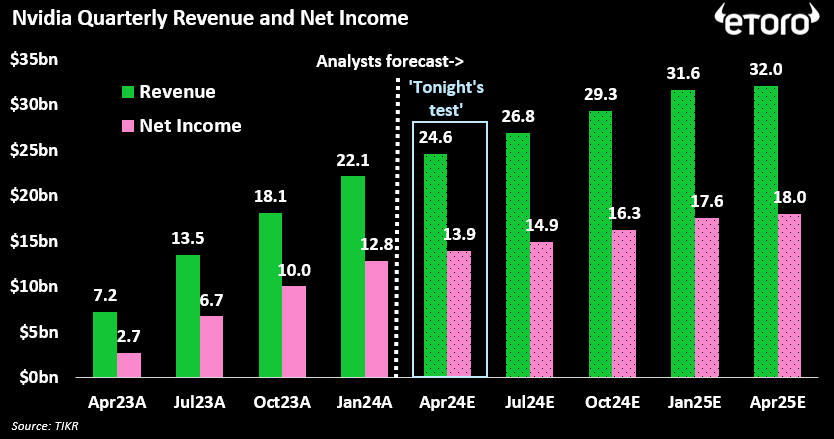

Investors are keen to see if Nvidia's impressive momentum from 2023 has continued into 2024. The chipmaker has led the AI wave, with its share price rising by an insane 200% in the past year. Investors expect Nvidia to deliver a whopping $24.6 billion in quarterly revenue, which would be an astounding 240% increase over the same quarter last year.

It wouldn't surprise the market if the company again beats analysts' expectations slightly. Not least because Nvidia has outperformed its earnings in the previous four quarters. Analysts expect Nvidia to post quarterly earnings of $5.58 per share, which would be another increase of over 400% from a year ago. But the bar is set pretty high, and another double-digit over-delivery and guidance increase may prove to be too big a task.

But let's not forget that this excellence is largely already priced into the stock and its high valuation. The company trades at a price/earnings multiple of 38 times. This means that while analysts expect earnings per share over the next 12 months to be around $25, this should be seen in light of a share price of $950.

With Nvidia as the frontrunner in the AI race, today's result will also resonate in the broader tech sector and have a major impact on companies where large 'AI premiums' are already priced in. Other chip stocks with high valuations, from Arm Holdings (NASDAQ:ARM) to Super Micro could be hit hard if Nvidia disappoints with signs that AI adoption is slower than investors had hoped.

Jakob Westh Christensen, eToro Market Analyst

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

All Eyes Are on Nvidia Upcoming Results

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.