In our latest insight piece, we examine what’s in store for the oil market after OPEC’s surprise October output cut.

On 5 October OPEC+ announced that it would cut oil quotas by 2.0 million barrels per day (mbpd) from November. The cut will be the largest since 2020, representing around 2% of global oil output.

The OPEC+ cut signals to the rest of the market that the cartel intends to put a floor under crude prices—halting the bear market that had overtaken crude since June. The cut also comes just as crude releases from the U.S’ Strategic Petroleum Reserve are to end in October, and as the EU’s ban on seaborne imports of Russian crude is to take effect from 5 December.

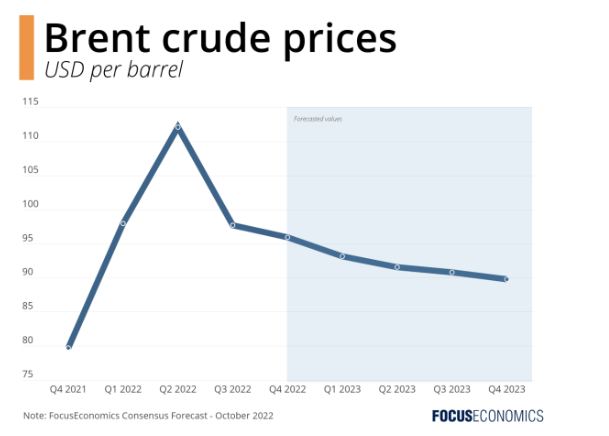

The move will keep oil prices higher for longer. That said, the quota cut is unlikely to lead to a prolonged rebound in prices from their current level of slightly below USD 100 per barrel. To begin with, OPEC+ members have been consistently undershooting their quotas in recent months. As such, the actual hit to production will likely be around 0.9 mbpd, mainly affecting the production of Kuwait, Saudi Arabia and the UAE. In addition, the global economy continues to slow, dragging on crude demand, with the heads of the IMF and World Bank recently warning about the rising risk of a global recession.

Analysts at Fitch Solutions commented on risks to the now more bullish outlook:

“Brent’s [recent] breakout from its multi-month downtrend is a positive sign for the group and, from a fundamental perspective, there are reasons for optimism. However, oil market sentiment remains fragile and, should prices relapse below USD 90 per barrel after such a sizeable cut, the group’s credibility could be damaged. Any loss of faith in the OPEC+ ‘put’ would be extremely bearish for prices and poses a downside risk to our current forecast for Brent crude to average USD 100 per barrel next year.”

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinion of FocusEconomics S.L.U. Views, forecasts or estimates are as of the date of the publication and are subject to change without notice. This report may provide addresses of, or contain hyperlinks to, other internet websites. FocusEconomics S.L.U. takes no responsibility for the contents of third party internet websites.

Author: Matthew Cunningham, Associate Economist