Why consider AAIF?

Offering the prospects of both capital and income growth, AAIF could be considered a core offering for investors seeking diversification through Asian equity exposure. The company’s managers follow Abrdn (LON:ABDN)’s quality and value approach. They seek businesses across the market cap spectrum that are attractively valued and can tick three boxes to support the company’s growing dividend: quality firms with strong balance sheets, operating in a structural growth area, which can deliver reliable earnings and sustainable dividends.

ESG is an integral part of the research process as the managers believe that companies ranking favourably in these areas deliver superior returns for shareholders. Using MSCI ratings, AAIF ranks higher than its reference index on environmental, social and governance factors.

Although investment company discounts are generally wider than normal in an uncertain macroeconomic environment, AAIF’s valuation appears to be somewhat anomalous. Despite a respectable performance record versus its four peers in the AIC Asia Pacific Equity Income sector, AAIF currently has the second-widest discount. The company has also outperformed its reference index over the last one, three and five years and offers a very attractive 5.5% dividend yield. Its 15-year dividend growth record means that AAIF qualifies as one of the AIC’s next-generation dividend heroes and is just five years away from becoming a full dividend hero.

NOT INTENDED FOR PERSONS IN THE EEA

AAIF: Diversified, high-quality Asian equity exposure

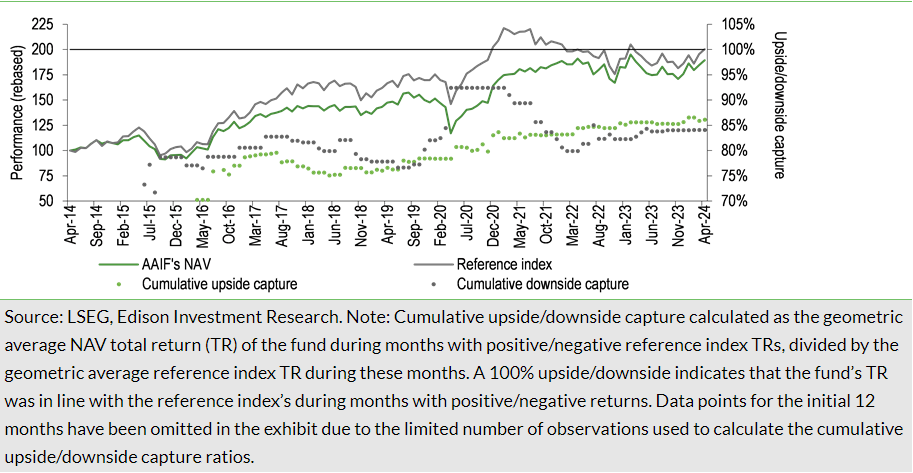

abrdn has had a local presence in Asia for more than 30 years, so AAIF’s managers have deep knowledge of the region and have built strong relationships with companies and relevant organisations. The managers employ a low-beta strategy focusing on quality businesses that can grow earnings and dividends over the long term. This means that the company’s performance is likely to lag during periods of market strength, but it should perform better on a relative basis when share prices are under pressure, which is borne out by AAIF’s upside/downside analysis, shown below in the Performance section. The managers believe that Asian dividend growth is sustainable, with strong corporate balance sheets providing flexibility when interest rates change, and options for cash redeployment, either for future growth or returning cash to shareholders. AAIF’s dividend yield is around double that of the reference index; the fund also has a higher operating margin and return on equity than the index.

ESG is an integral part of AAIF’s investment process

abrdn believes that ESG factors are financially material and affect corporate performance. MSCI has awarded AAIF an ‘A’ ESG score, and it has higher ratings in all three areas compared with its reference index: environmental score of 5.6 versus 5.3 (at end January 2024), social 5.2 versus 5.0 and governance 5.8 versus 5.3; the fund’s 6.8 ESG quality score compares with 6.2 for the reference index.

AAIF provides exposure to several growth themes

- Aspiration: increasing middle-class wealth is driving higher demand for premium products and services (portfolio examples include AIA and TISCO Financial Group).

- Building Asia: BHP and Power Grid Corporation of India, whose regulated cash flow supports its dividend, plus the company is a beneficiary of the goal of providing electricity across the whole of India by the end of the decade.

- Digital future: Accton Technology and Sunonwealth Electric Machine Industry Company are smaller-cap companies that are growing their dividends on the back of robust fundamentals.

- Going green: Asia is well positioned to benefit from the growth in renewable energy, batteries and electric vehicles (portfolio examples include LG Chem and Keppel Infrastructure Trust).

- Technology enablers: Samsung Electronics (LON:0593xq) and Taiwan Semiconductor Manufacturing Company (TSMC) are both industry leaders and are AAIF’s largest holdings.

The investment backdrop

Yoojeong Oh, one of AAIF’s managers, provides some observations about the current investment backdrop. She believes that quality companies with solid balance sheets and sustainable earnings growth will emerge stronger from tough times. The manager suggests that lower interest rates and an anticipated weaker US dollar mean that investors should look more favourably at the prospects for Asian companies, especially given the important growth themes that are available in the region.

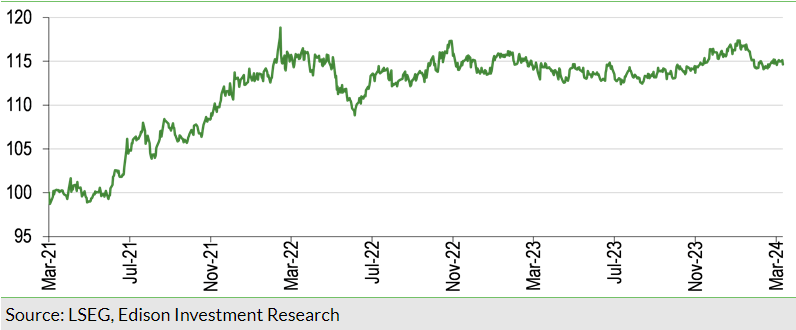

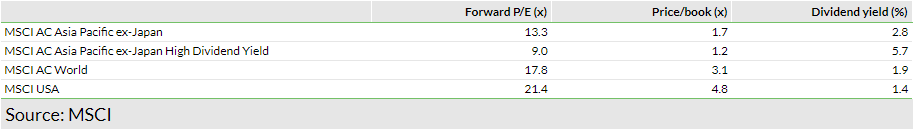

Also, Asia ex-Japan looks attractively valued compared with the world market (Exhibit 1), which is dominated by the US (64% at end March 2024). Oh highlights that Asia is home to some of the largest and fastest-growing companies in the world, many of which are established global brands or have dominant positions in growing sectors. The manager remains cautious about growth in China due to muted consumption growth and persistent challenges for policymakers to stimulate spending and growth. However, she is mindful that the significant sell-off in Chinese stocks has led to some interesting investment opportunities in the country.

Current portfolio positioning and activity

Geographic breakdown

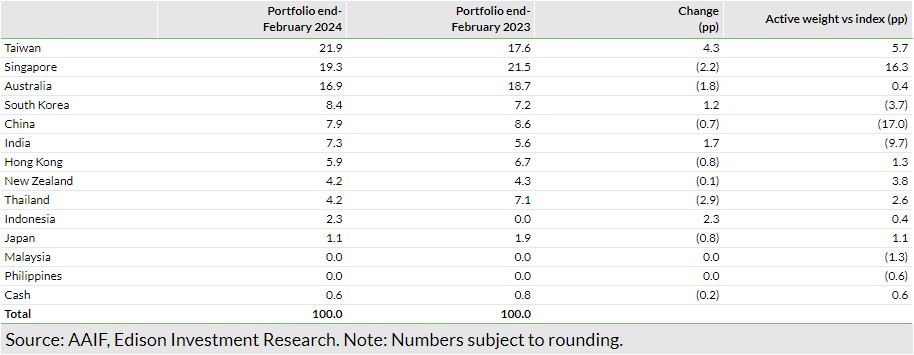

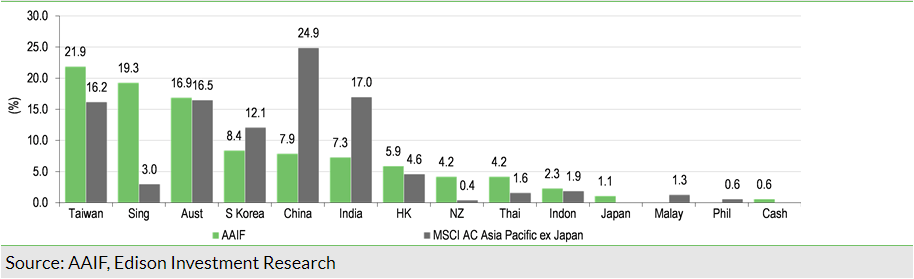

Over the 12 months to the end of February 2024, there were modest changes in AAIF’s geographic exposure, with the most notable being a higher weighting to Taiwan (+4.3pp) and a lower allocation to Thailand (-2.9pp). Versus the reference index, the largest divergences remain China (-17.0pp), which has a large weighting in growth stocks that do not pay dividends, and Singapore (+16.3pp), which is the second highest-yielding market in the region. Taiwan offers the highest yield (AAIF is overweight), while Australia offers the third-highest yield (AAIF is broadly in line). The fund has a 9.7pp underweight exposure to India, which has performed very strongly, and company valuations are generally looking stretched.

Sector breakdown

AAIF’s largest sector allocation at around 30% is technology, which is greater than the MSCI AC Asia Pacific ex Japan Index’s c 22% weighting. This sector includes AAIF’s two largest positions, TSMC and Samsung Electronics, which together make up around 16% of the fund. The next largest sector in the portfolio is 20%+ in financials, which is not dissimilar to the index’s sector weighting. Notable differences versus the index are a higher real estate weighting, which is understandable for an income-focused fund, as is AAIF’s below-index allocation to consumer discretionary stocks. There are no healthcare stocks in the fund (around 5% of the index) as in Asia these tend to be nascent rather than mature businesses.

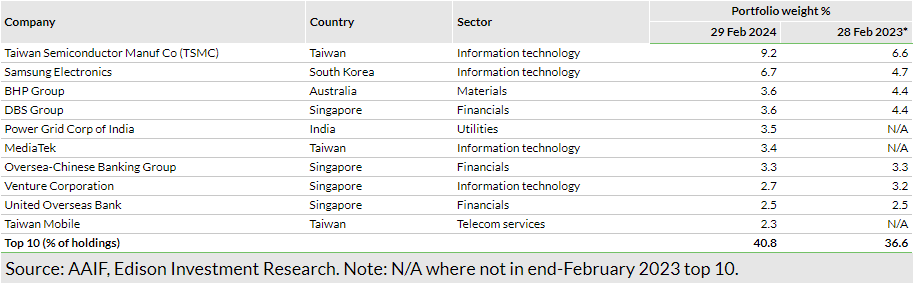

Top 10 holdings

At the end of February 2024, AAIF’s top 10 holdings made up 40.8% of the portfolio, which was a higher concentration compared with 36.6% 12 months earlier; seven names were common to both periods. The top 10 is a mixture of higher-yielding stocks; for example, utility and financial companies and dividend growth names such as technology businesses. Large positions are resized depending on the stage of their business cycles and the managers add to positions ahead of special dividends being paid. AAIF had 58 holdings at the end of February 2024, which was six less than a year before.

FY23 new positions and complete disposals

Here is a brief summary of the initiations and sales in the portfolio in 2023, most of which will have been covered in our prior notes. Historically, portfolio turnover was around 15–20% per year; however, 2023 saw a step-up to a still modest 35%. The manager suggests this level is likely to continue, to take advantage of available opportunities as they arise.

New holdings: Telstra Group (the leading Australian telecom carrier); Autohome (the main Chinese online auto retailer); Tencent (HK:0700) (a major Chinese internet platform, which now pays a dividend); SITC International Holdings (a Hong Kong-listed shipping company); AKR Corporindo (a major Indonesian industrial fuel distributor); and Bank Mandiri (one of the largest Indonesian banks).

Sales: Bank Rakyat Indonesia (disposal of a residual holding); Macquarie Group and Medibank (reduced the fund’s Australian financial exposure in the wake of turmoil in the US and European banking sectors in early 2023); Astra International (sale following receipt of a special dividend); China Vanke and China Merchants Bank (disposal due to a deteriorating Chinese macroeconomic backdrop); and Kasikornbank, KMC KUEI Meng International and Okinawa Cellular Telephone (lower-conviction positions, with the proceeds used to fund companies with more attractive dividend growth and yields).

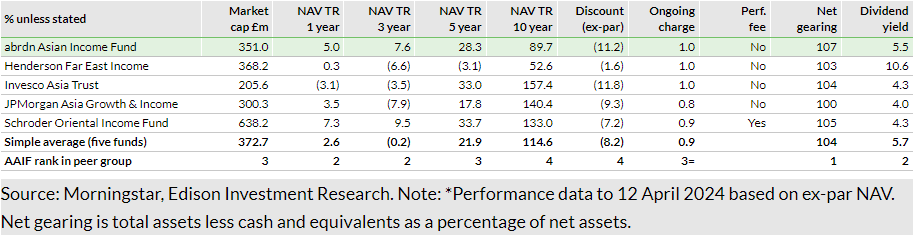

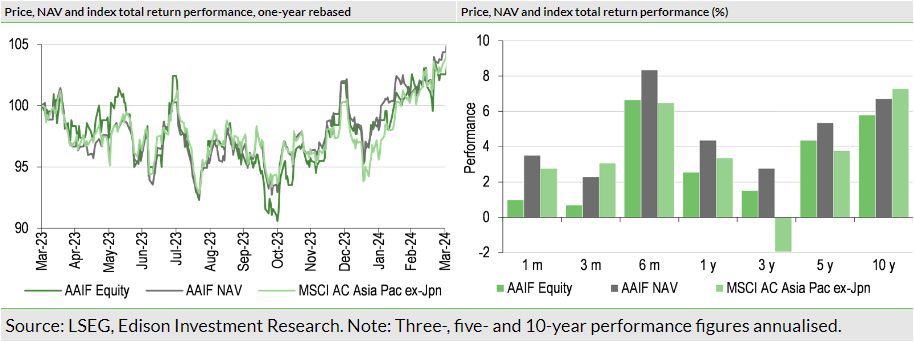

Performance: NAV ahead over one, three and five years

AAIF is one of five funds in the AIC Asia Pacific Equity Income sector (Exhibit 5). Its NAV total returns are above average over the last one, three and five years, ranking second, second and third respectively. It has the second-widest discount in the sector, which seems somewhat unwarranted given the company’s performance record and consistent quality and value approach. AAIF currently has one of the highest ongoing charges in the sector. However, given an announced fee reduction, the company’s ranking is likely to improve to the second lowest. AAIF currently has the highest level of gearing. Its dividend yield is second only to Henderson Far East Income, which is changing its strategy towards more balanced growth between capital and income.

An analysis using Morningstar data shows that most of the funds in the sector employ a large-cap value approach, with only JPMorgan (NYSE:JPM) Asia Growth & Income having more of a balance between growth and income stocks. AAIF has a greater percentage of its portfolio made up of smaller-cap stocks (c 25% versus less than 10%). Along with Schroder Oriental Income Fund, the company has around 80% invested in developed rather than emerging markets, which is a higher percentage compared with the rest of its peers. Unlike managers that take a barbell approach of investing in some businesses with a high yield and others that do not pay a dividend, all of AAIF’s portfolio companies contribute to the fund’s overall dividend yield, although exceptions are made for an IPO or a spin-off company that has committed to a future dividend payment.

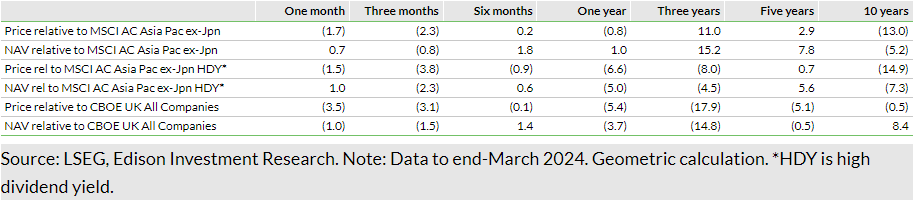

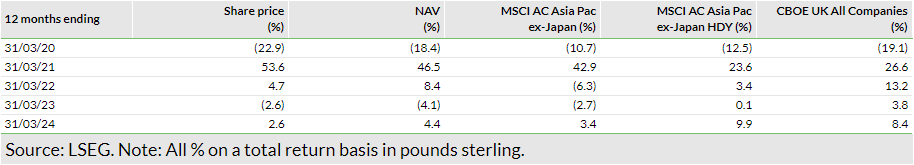

AAIF’s relative returns are shown in Exhibit 6. Its NAV has outperformed the MSCI AC Asia Pacific ex Japan Index over the last one, three and five years. It is ahead of the MSCI AC Asia Pacific ex Japan High Dividend Yield Index over the last five years in NAV and share price terms.

In FY23, AAIF’s NAV and share price total returns of +2.5% and +1.9% respectively were ahead of the MSCI AC Asia Pacific ex Japan Index’s +1.6% total return (currency adjusted). Outperformance was due to the strategy of investing in Asian companies with high dividend yields and strong fundamentals. An underweight exposure to China was of particular benefit to the company’s performance. Technology holdings were positive contributors, including mega-cap TSMC (semiconductors), along with smaller Taiwanese companies such as Sunonwealth Electric Machine Industry (precision motors and thermal solutions) and Accton Technology (network communication equipment). Another strong performer was Power Grid Corporation of India (electricity transmission), which is benefiting from the shift to renewable energy.

AAIF’s upside/downside analysis

The low beta nature of AAIF’s portfolio is highlighted by its upside/downside analysis. Over the last decade, its cumulative upside capture of 86% is not unlike its downside capture of 84%. As these numbers are below 100%, it implies that the fund will move around 15% less than the MSCI AC Asia Pacific ex-Japan Index during both rising and falling markets.

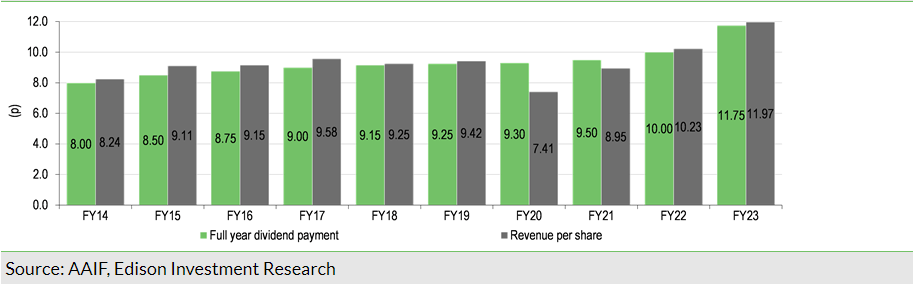

Dividends: Significant step-up in FY23

AAIF pays quarterly dividends in May, August, November and February. The FY23 total distribution of 11.75p per share (1.0x covered) was a significant 17.5% increase versus 10.00p per share in FY22. The company has now increased the annual dividend for 15 consecutive years, making it well on the way for a 20-year record required to be classed as an AIC dividend hero. Over the last five years, AAIF’s dividend has compounded at an annual rate of 5.1%. Following the payment of the FY23 fourth quarterly dividend, revenue reserves will be c 4.6p per share, which is equivalent to around 0.4x the annual payment; the company can also pay dividends out of capital when required.

Revenue earnings per share were 11.97p in FY23, which was a 17.0% increase year-on-year. This was due to higher dividend receipts from portfolio companies, but also as a result of lower rates of overseas withholding tax, following AAIF’s move to a UK tax residence in 2022.

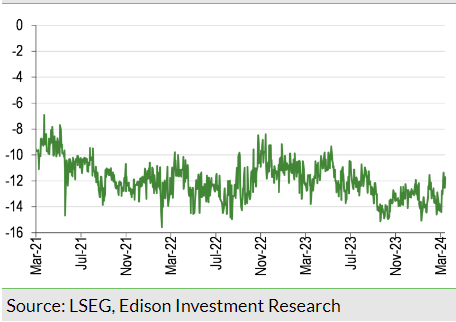

Valuation: Towards the wider end of three-year range

AAIF’s discount to NAV remains wider than most of those of its peers, despite the fund’s performance record and attractive dividend yield. Its latest 11.7% share price discount to cum-income NAV compares with the 6.9% to 15.6% range over the last three years and is occurring during a period when in general investment company discounts are wider than average. Over the last one, three, five and 10 years, AAIF’s average discounts are 12.6%, 11.9%, 11.0% and 8.4% respectively.

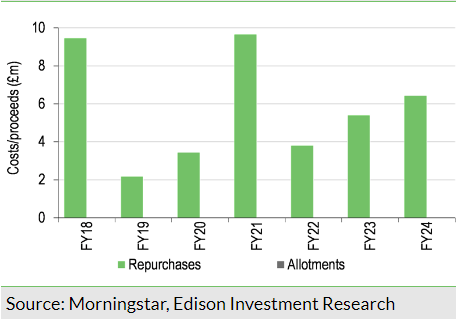

The board’s policy is to repurchase shares when the share price discount to cum-income NAV exceeds 5% (in normal market conditions). In FY23, c 2.7m shares (c 1.6% of the share base) were bought back and held in treasury. Due to the persistent discount, share repurchases have continued selectively at the discretion of the board in FY24 (Exhibit 12).

Fund profile: Above-average income

AAIF is a Jersey-registered, closed-end investment company that launched in December 2005. It is managed by abrdn’s Asian equity team, which aims to generate an attractive total return from a diversified portfolio of Asia-Pacific equities, including those with above-average dividend yields. AAIF invests across the market-cap spectrum and is unconstrained in terms of geographic and sector exposures. Its board follows a progressive dividend policy, and the annual dividend has increased in each of the last 15 years. The fund’s performance is measured against the MSCI AC Asia Pacific ex-Japan Index. Relative performance versus the MSCI AC Asia Pacific ex-Japan High Dividend Yield Index is provided for reference. AAIF can invest in preference shares, debt, convertible securities, warrants and equity-related securities, as well as off-reference index stocks (including Japan). A maximum 20% of total assets is permitted in a single issuer. Gearing of up to 25% of NAV (up to 15% in normal market conditions) is permitted. The managers may write covered put and call options, and undertake stock lending to generate additional revenue, although these features are used sparingly.

Investment process: Focus on quality and value

abrdn’s disciplined investment approach is based on three core beliefs: fundamental research can highlight market inefficiencies; over the long term, company fundamentals drive share prices, but in the shorter term, share prices can be mispriced; and ESG analysis and corporate engagement can enhance returns. Portfolio turnover is relatively low, running around 35% per year, implying around a three-year holding period.

abrdn’s preference for quality companies is because they are more profitable and generate a more stable performance, have the financial resources to invest for the long term, are better placed to weather uncertain environments and can potentially reduce risk and enhance returns. Quality companies are likely to have sustainable competitive advantages, operating in attractive industries, with robust balance sheets, well regarded management teams and favourable ESG attributes.

There is a five-step investment process:

- Idea generation: the broad investible universe is around 1,000 stocks, so quantitative tools are used to refine the opportunity set. Given its size and local presence, abrdn enjoys extensive corporate access.

- Research: there is active coverage/review of c 300 stocks, with ESG fully embedded in the process.

- Peer review: around 200 stocks are given a ‘buy’ rating, and these and companies rated ‘hold’ may be included in the portfolio. There is a team-based approach that includes rigorous debating of ideas.

- Portfolio construction: the fund holds 40–70 stocks, selected on a bottom-up basis, which is subject to quantitative and risk analysis.

- Engagement: active engagement with companies involves voting and regular dialogues with investee businesses.

abrdn has a proprietary research platform used by all its equity, credit and ESG teams. Research is focused on four areas: ‘foundations’ – business fundamentals and evaluation of ESG risks and opportunities; ‘dynamics’ – the important drivers of business change that influence company valuations; ‘financials and valuation’ – financial analysis and assessment of market expectations; and ‘investment insight and risk’ – the investment thesis and non-consensus insight, risk factors and downside scenarios.

AAIF’s approach to ESG

abrdn has been actively integrating ESG into its investment process for 30 years and believes that ESG factors are financially material and can meaningfully affect a company’s performance. The managers cite evidence that shows shares in higher-quality companies can perform better than inferior peers, investing in companies with better ESG scores can add to fund performance, and ESG analysis can help deliver a similar portfolio return while reducing investment risk.

AAIF’s portfolio has an ‘A’ ESG rating by MSCI, a leading external ratings agency. Environmental factors relate to how a company conducts itself regarding environmental conservation and sustainability. Social factors pertain to a company’s relationship with its employees and vendors. Governance factors include the corporate decision-making structure, the independence of board members, the treatment of minority shareholders and executive compensation. An ESG focus enables AAIF’s managers to glean additional insights from company visits and obtain an ESG information advantage. These meetings are important as Asian companies’ ESG disclosure can be poor, especially in certain markets such as China.

abrdn’s Asia-Pacific equity team has around 40 people, three of whom are ESG specialists. The company is an active investor that votes at shareholder meetings, works with companies to drive positive change and engages with policymakers on ESG and stewardship matters. abrdn does not invest in tobacco companies or firms directly exposed to controversial weapons. Following extensive due diligence and research, abrdn’s research analysts assign an ESG score of 1 to 5 to each company under coverage. The company has aligned its approach with that advocated by the investor agenda of the Principles for Responsible Investment, which is a United Nations-supported initiative to promote responsible investment to enhance returns and better manage risk.

Gearing

During FY23, AAIF had a £10m, 1.53% fixed-rate term loan and a £40m multi-currency revolving credit facility (RCF) with Bank of Nova Scotia, London Branch; at the end of FY23, a sterling equivalent of £32.1m was drawn down. Both facilities matured on 1 March 2024. The £10m loan was repaid in full and AAIF renewed its £40m RCF with a £50m, one-year loan with Bank of Nova Scotia, London Branch. Under the terms of this loan, there is an option to increase the £50m commitment to £70m at any time, subject to the lender’s approval.

At 5 April 2024, AAIF’s net gearing was 6.5%.

Fees and charges

Following discussions with abrdn, the board announced a reduced AAIF fee structure, which is based on the lower of market cap or net assets. This is a c 23% decrease versus the previous fee and is equivalent to an estimated £664k saving based on the company’s year-end assets. A shift to a market cap-based fee aligns AAIF more closely with its shareholders given the company’s shares are trading at a discount to NAV. abrdn will also invest six months of AAIF’s management fees in the company’s shares.

The FY23 management fee was 0.80% of AAIF’s rolling monthly average NAV over the previous 12 months, up to £350m, and 0.60% per year above £350m. It was reduced with effect from 1 January 2024 to 0.75% of the lower of market cap and net assets up to £300m and 0.60% over £300m. Fees are charged 40:60 to the revenue and capital accounts respectively, in line with the expected split of returns between income and capital. No performance fee is payable.

In FY23, AAIF’s ongoing charges were 1.00%, which was 1bp lower year-on-year. All other things being equal, the FY24 ongoing charges should decline to 0.83%, which is a not insignificant reduction of 17bp.

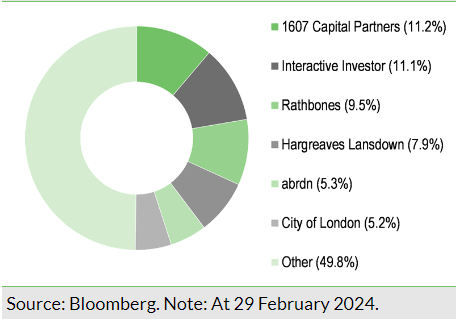

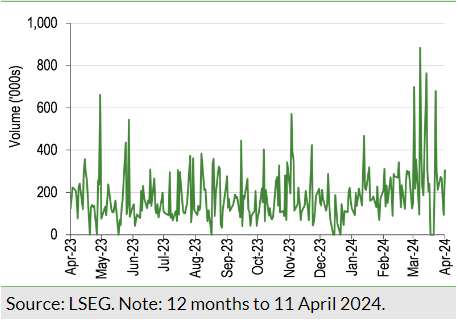

Capital structure

AAIF is an investment company with one class of share; there are 163.8m ordinary shares in issue, with a further 31.1m shares held in treasury. Its average daily trading volume over the last 12 months is c 190k shares.

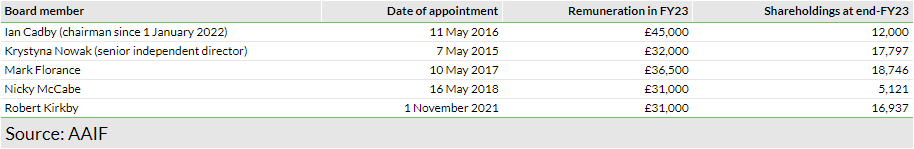

The board

On 12 April 2024, AAIF’s board announced the appointment of Jane Routledge as an independent non-executive director with effect from the conclusion of the 8 May 2024 AGM. She has significant marketing experience with a long career in the investment management sector, including senior marketing positions at Schroders (LON:SDR), Invesco, Hermes and Seven Investment Management. Routledge is currently a non-executive director of M&G (LON:MNG) Credit Income Investment Trust and Brown Advisory US Smaller Companies.

Having served as one of AAIF’s directors for nine years, Krystyna Nowak is planning to retire from the board at or before the May 2025 AGM.

_____________________________________________________

General disclaimer and copyright

This report has been commissioned by abrdn Asian Income Fund and prepared and issued by Edison, in consideration of a fee payable by abrdn Asian Income Fund. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom