By Benjamin Schroeder

Overall, we think the bearish sentiment can keep going in the near term. For markets, the main focus remains on the assessment of the US macro backdrop, with plenty of data this week to watch. Looking further forward, the ECB's operational review will likely include a structural bond supply, as hinted by those close to the discussion

Bearish Sentiment Can Continue on US Macro Backdrop

Following Friday’s strong rally, a rebound in rates on Monday had been on the cards. More notable was how uniform it was across the curve, seeing rates up by around 7-8bp. With it, the 10Y Bund yield rose back to 2.44% – although leaving the 2s10s curve at an inverted -49bp.

Overall, we think there are factors that can keep the bearish sentiment ongoing in the near term. Supply may be one explainer, given the busy slate lined up this week, especially after the announced mandates by France and Slovakia. We also had a number of European Central Bank speakers sharing hawkish comments, which nudged the front end in such a way that for the first time a full cut in June is no longer priced in.

The main focus remains on the assessment of the US macro backdrop. The items we watch today include the Conference Board’s consumer confidence reading, which has worked its way up to 115 over the past months and speaks to the resilient consumption in keeping growth momentum. The durable goods orders are expected to show a big drop in the headline on the back of volatile aircraft orders. Stripping these out we should remain with a picture of basically flatlining, which we have seen over the past 12 months.

Sneak Peek Into ECB Operational Review Positive for EGBs

According to Bloomberg, people familiar with the ECB’s review of the monetary framework officials are honing in a new setup that provides liquidity to the banking system via a combination of a structural bond portfolio and regular market operations. In the report that was published over the weekend they also hinted at a transition period of two years, a time frame which in our view could be beneficial to EGBs and periphery spreads in particular.

The bond portfolio of the ECB currently stands at €4.6 tn and would fall to around €3.5tn in two years according to our projections. The run-off could extend, but to stabilise the balance sheet after two years we think the ECB will introduce a structural bond portfolio to off-set further declines in the QE portfolios. Crucially, though, the news story did not mention anything about the balance between a bond portfolio and market operations. Previously ECB's Isabel Schnabel has expressed concerns about resurrecting the interbank market, not least given a changed regulatory backdrop for banks. As such we would expect the ECB to run regular market operations as an alternative to interbank funding in parallel to the structural bond portfolio.

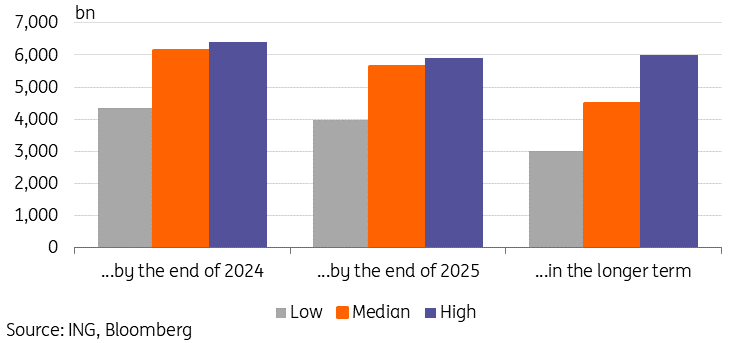

Nevertheless, the uncertainty about the final balance sheet size remains high as evidenced by the divergence in opinions of economists. The survey outcomes in the figure below show that the upper bound estimate of the long-term ECB balance sheet size is double that of the lower bound.

In our view the ECB will aim for ample bank reserves in the new operational framework, and a target excess liquidity of at least € 1.75 tn – close to the pre-pandemic levels – would align with a two-year transition phase. And over time, to maintain a fixed level of liquidity, the balance sheet of the ECB will have to increase gradually as the economy grows. A structural bond portfolio would likely grow alongside with the ECB thus remaining a constant buyer of EGBs.

Survey: “How Big Do You Expect the ECB’s Balance Sheet to Be”

Today’s Events and Market View

The focus remains on the US data with durable goods and the conference board’s consumer confidence as the main releases to watch. The eurozone calendar is relatively quiet, with the ECB publishing money supply data.

In supply, the focus is on longer-dated eurozone bonds. On top of the 20Y Dutch (€1.5-2bn) and 26Y German (€1bn) green bond taps, France yesterday mandated a new 30Y bond which should also be today’s business. Slovakia mandated a new 10Y benchmark. In the US the Treasury will sell US $42bn new 7-year notes today. Yesterday's 2-year and 5-year auctions were seen as adding to markets retracing Friday's rally with especially the 5y auction metrics on the softer side.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more