Wall Street’s second quarter earnings season kicks into high gear in the coming weeks, with investors bracing for the worst reporting season in more than ten years amid the impact of the ongoing coronavirus crisis.

The hardest-hit sectors are expected to be Energy, with a decline of 154%, followed by Consumer Discretionary, forecast to fall 114%. In comparison, Tech company earnings are only anticipated to decrease by 8%.

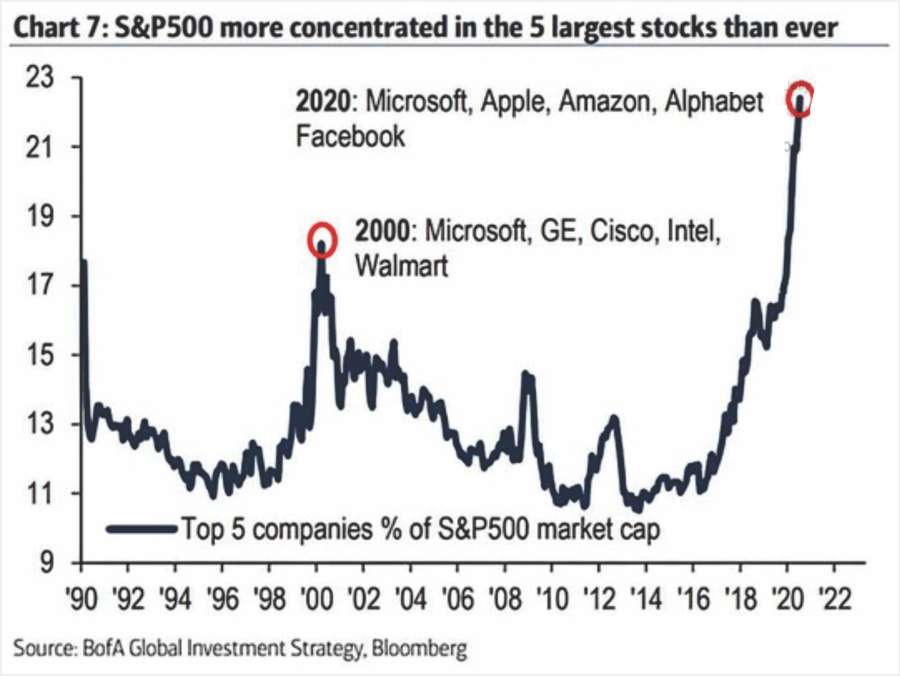

In an unprecedented development, just five companies—Apple, Microsoft, Amazon.com, Alphabet and Facebook—now account for more than 20% of the S&P 500's total market capitalization. That heightens the risk for the broader market, as it increases the importance of the earnings performance of a smaller set of companies.

Overall, 74% of global fund managers are long tech stocks, making it the most-crowded trade in the multi-decade history of the Bank of America Merrill Fund Manager survey.

The result: earnings from the five names below could either make or break the current market rally.

1. Microsoft Reports July 22 After Markets Close

- Q2 EPS Growth Estimate: +1.4% YoY

- Q2 Revenue Growth Estimate: +8% YoY

Microsoft (NASDAQ:MSFT) has thrived throughout the coronavirus crisis, jumping 51% over the last four months, easily outperforming the S&P's 38% gain over the same timeframe. Shares, which hit a record high of $216.35 on July 9, settled at $208.35 on Tuesday. With a market cap of $1.58 trillion, Microsoft is the world’s second-most valuable company.

The Redmond, Washington-based tech giant has enjoyed a surge in demand for its cloud-based services as more businesses spent heavily to upgrade their online services in response to the coronavirus pandemic and resulting shifts in consumer behavior away from in-store shopping.

Microsoft is scheduled to report results for its fiscal fourth quarter after the closing bell on Wednesday, July 22. Consensus estimates call for the software giant to post earnings of $1.39 per share, just above EPS of $1.37 in the year-ago period. Revenue is expected to total $36.42 billion, up 8% from sales of $33.72 billion in the same period a year earlier.

Another key metric investors will focus on will be growth in its Intelligent Cloud segment, which includes Azure, GitHub, SQL Server, Windows Server and other enterprise services. Microsoft’s commercial cloud revenue jumped 39% year-over-year to $13.3 billion in its most recent quarter, while revenue from its Azure services surged 59%.

2. Amazon Reports July 23 After Markets Close

- Q2 EPS Growth Estimate: -73.7% YoY

- Q2 Revenue Growth Estimate: +27.4% YoY

Amazon.com (NASDAQ:AMZN) has weathered the ongoing coronavirus-led stock market volatility much better than the broader market, surging nearly 65% since late March. Shares, which hit a record high of $3,344 on Monday, closed at $3,084.00 last night. With a valuation of $1.51 trillion, Amazon is the third most valuable company listed on the U.S. stock exchange.

The Seattle, Washington-based company has arguably been one of the most high-profile winners of the coronavirus crisis, benefitting from increased online shopping during the crisis.

Amazon next reports earnings after markets close on Thursday, July 23. Consensus calls for second quarter revenue of $80.8 billion, which would indicate a year-over-year growth rate of 27.4%, reflecting strength in both e-commerce and cloud computing. However, its earnings are forecast to plunge almost 74% from the year-ago period to $1.37 per share, as a result of heavy spending on employee safety measures amid the pandemic and upgrades to delivery logistics.

In addition to EPS and revenue, investors will also focus on the company’s booming cloud-computing business to see if it can maintain its torrid pace of expansion. Amazon Web Services’ revenue leaped to $10.22 billion in the first three months of the year, marking the first quarter AWS sales topped the $10 billion mark.

3. Facebook Reports July 29 After Markets Close

- Q2 EPS Growth Estimate: +50.5% YoY

- Q2 Revenue Growth Estimate: +1.3% YoY

Another mega-cap tech company which has flourished throughout the coronavirus crisis is Facebook (NASDAQ:FB), with its stock up about 60% in the last four months. Shares hit a record high of $250.05 on Monday and ended at $239.73 yesterday. At current levels, Facebook is valued at $681 billion, making it the smallest of the five big tech firms and the only one with a market cap below $1 trillion.

The Menlo Park, California-based social media giant is widely considered as one of the biggest winners of the COVID-19 crisis, as the government-mandated stay-at-home and social-distancing measures have made it more important than ever in terms of staying connected with friends and family virtually.

Not surprisingly, all three of its platforms, which in addition to Facebook also include Instagram and WhatsApp, have growing audiences, with the social network now counting 2.6 billion members.

Facebook, which is in the midst of a global boycott from 1,000 advertisers over its handling of hate speech and misinformation, next reports earnings after markets close on Wednesday, July 29. Consensus calls for second-quarter earnings per share to jump by more than 50% from the same period a year earlier to $1.37, while revenue is forecast to rise to $17.1 billion from $16.89 billion in the year-ago period.

Beyond the top-and-bottom line numbers, investors will be waiting to hear more about what type of impact the boycott is having on ad revenue for the rest of 2020 and beyond.

4. Apple Reports July 30 After Markets Close

- Q2 EPS Growth Estimate: -7.8% YoY

- Q2 Revenue Growth Estimate: -5.3% YoY

Anyone watching the stock market probably knows that Apple (NASDAQ:AAPL) shares have been on a tear in recent months. The tech and consumer conglomerate has seen its stock soar around 70% since late March, even as the broader market suffered intense bouts of volatility.

The stock, which hit an all-time high of $399.82 on Monday, ended at $388.23 on Tuesday. It has a market cap of $1.68 trillion, making it the most valuable company trading on the U.S. stock exchange.

The Cupertino, California-based tech behemoth next reports earnings after the market closes on Thursday, July 30. Consensus calls for earnings per share of $2.01 for its fiscal third quarter, down around 8% from EPS of $2.18 in the year-ago period.

Revenue is forecast to slip 5.3% from the same period a year earlier to $50.92 billion, with sales likely to have been heavily impacted by store closures and economic shutdowns across most of the U.S. and Europe.

Although Apple no longer reports individual unit sales of its product lineup, many will be eager to hear if the company will provide insight on the initial impact of the iPhone SE, which was announced in mid-April. Any updates on growth in its wearables segment, which include AirPods and Apple Watch will also be eyed.

5. Google Reports July 30 After Markets Close

- Q2 EPS Growth Estimate: -44.4% YoY

- Q2 Revenue Growth Estimate: -4.7% YoY

Google-parent Alphabet (NASDAQ:GOOGL) has benefited since the early days of the coronavirus pandemic, mostly due to a bump in demand for its cloud-related services. However, worries over reduced advertising spending have kept a lid on the search giant's gains.

Evidently, Google shares, which hit a record high of $1,576.16 on Monday and closed at $1,520.86 last night, have lagged those of the other four names mentioned above, with its stock up “just” 42% over the last four months. It has a market cap of $1.04 trillion, making it the fourth most valuable company listed on the U.S. stock exchange.

Google is expected to report second quarter financial results after the US market closes on Thursday, July 30. Consensus calls for earnings of $7.90 per share, down sharply from EPS of $14.21 in the year-ago period. Revenue is forecast to clock in at $37.11 billion, declining from sales of $38.94 billion in the same quarter a year earlier.

The main question on investors’ minds is just how bad the coronavirus crisis and economic shutdowns negatively impacted the company’s advertising revenue business. Google’s ad revenues rose to $33.76 billion in the preceding quarter, accounting for 82% of the company’s total quarterly revenue.

One segment that should be primed for blockbuster growth however is Alphabet's Google Cloud Platform, which saw sales rocket 52% in its most recent quarter to $2.78 billion.