- Investors have plenty to be thankful for as we gather this year to celebrate Thanksgiving.

- Optimism that the Federal Reserve is all done raising interest rates has helped boost appetite for equities.

- As such, each of these five stocks offers a reason to be grateful, not just for their past performance, but for their potential in the future.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

- Year-To-Date Performance: +112.3%

- Market Cap: $26.9 Billion

- Year-To-Date Performance: +93.2%

- Market Cap: $19 Billion

- Year-To-Date Performance: +84.2%

- Market Cap: $282.2 Billion

- Year-To-Date Performance: +83%

- Market Cap: $130.2 Billion

- Year-To-Date Performance: +79.4%

- Market Cap: $67 Billion

With just 25 trading days left in 2023, U.S. stocks are on track to record one of their best annual performances in recent years, boosted by signs of cooling inflation which have fueled hopes that the Federal Reserve is done raising interest rates.

The benchmark S&P 500 index is up 18.7% year-to-date and now stands just 5% away from its January 2022 intraday record high.

The rally on Wall Street has been fueled by shares of the mega-cap tech companies, with Nvidia (NASDAQ:NVDA), and Meta Platforms (NASDAQ:META) both posting triple-digit gains, while Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), and Apple (NASDAQ:AAPL) are also up solidly on the year.

Besides the ‘Magnificent 7’ group of stocks, there are plenty of other thriving companies in the S&P 500 that investors should be extremely grateful for this Thanksgiving.

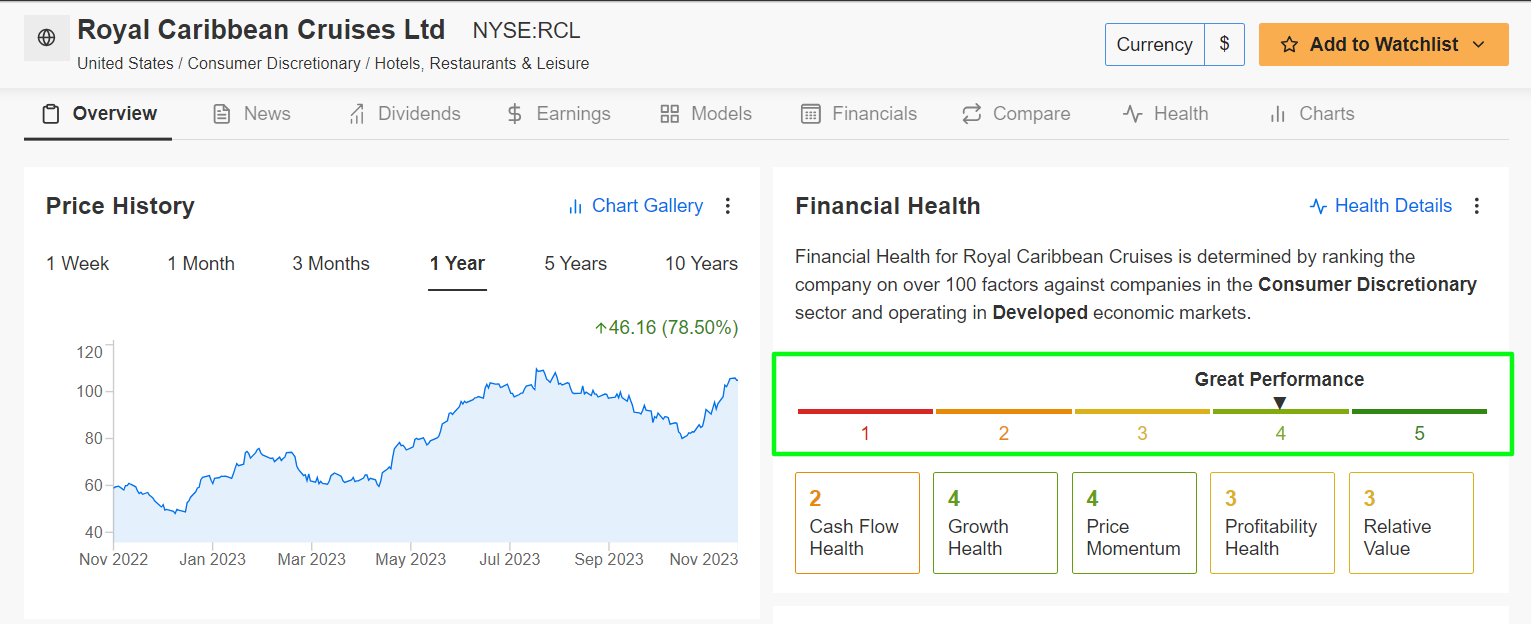

1. Royal Caribbean Cruises

In a testament to recovering travel and tourism trends, Royal Caribbean (NYSE:RCL) Cruises, which is the world’s largest cruise operator, has given shareholders plenty of reasons to be grateful this Thanksgiving.

The Miami-based cruise giant has seen a resurgence this year as the travel industry continues to rebound from the negative impact of the Covid pandemic.

Royal Caribbean's strategies to enhance safety measures, revamp the cruise experience, and capitalize on the ongoing improvement in travel demand have contributed to its robust year-to-date performance.

RCL stock - which began trading at $50.54 on January 3 and rose all the way to a 2023 peak of $112.95 on July 28 - has gained 112.3% in 2023, making it the third-best performer on the S&P 500 this year, trailing only Nvidia, and Meta Platforms.

Source: InvestingPro

All things considered, Royal Caribbean shares should continue appreciating as the travel company is poised to grow its earnings thanks to improving profitability trends.

It is worth mentioning that RCL currently has an above-average InvestingPro ‘Financial Health’ score of 3.2/5.0 due to strong earnings and sales growth prospects.

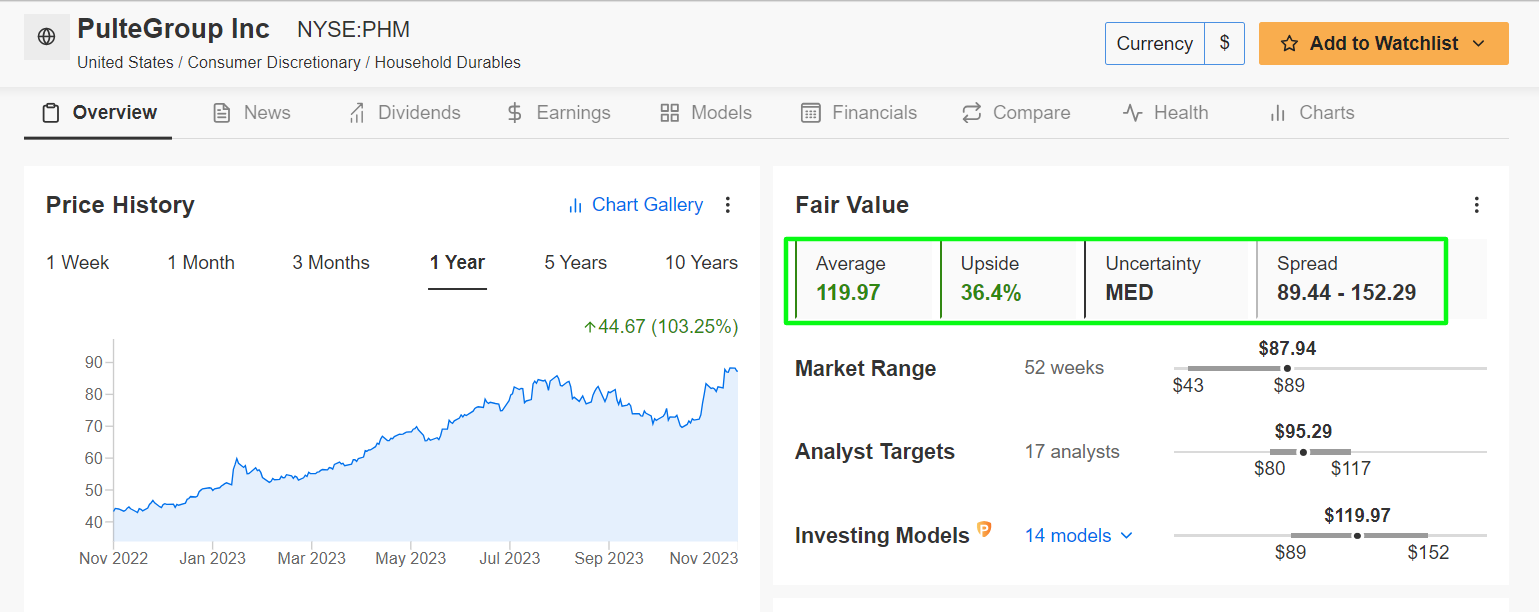

2. PulteGroup

PulteGroup (NYSE:PHM), the third largest home construction company in the United States, has been on a tear this year as it capitalizes on strong housing demand, largely driven by favorable supply and demand trends.

The Atlanta-based homebuilder, which mainly sells single-family homes, has demonstrated a higher backlog, healthy earnings, and robust sales growth thanks to thriving demand for new homes.

Its strategic land acquisition, aggressive share buybacks, and increasing annual dividend depict a strong outlook. Thus, this Thanksgiving, investors in PulteGroup have reasons to be optimistic.

PHM stock, which rose to a record high of $89.10 on Wednesday after starting the year at $46.40, is up 93.2% year-to-date, making it the fourth best performer on the S&P 500.

Source: InvestingPro

Looking ahead, PulteGroup looks set for further capital appreciation, as the homebuilding company's top and bottom lines are expected to grow considerably, courtesy of higher revenues and margin improvement.

It should be noted that even after the stock has nearly doubled since the start of the year, PHM remains undervalued at the moment according to InvestingPro, and could see an increase of 36.4% from the current market value.

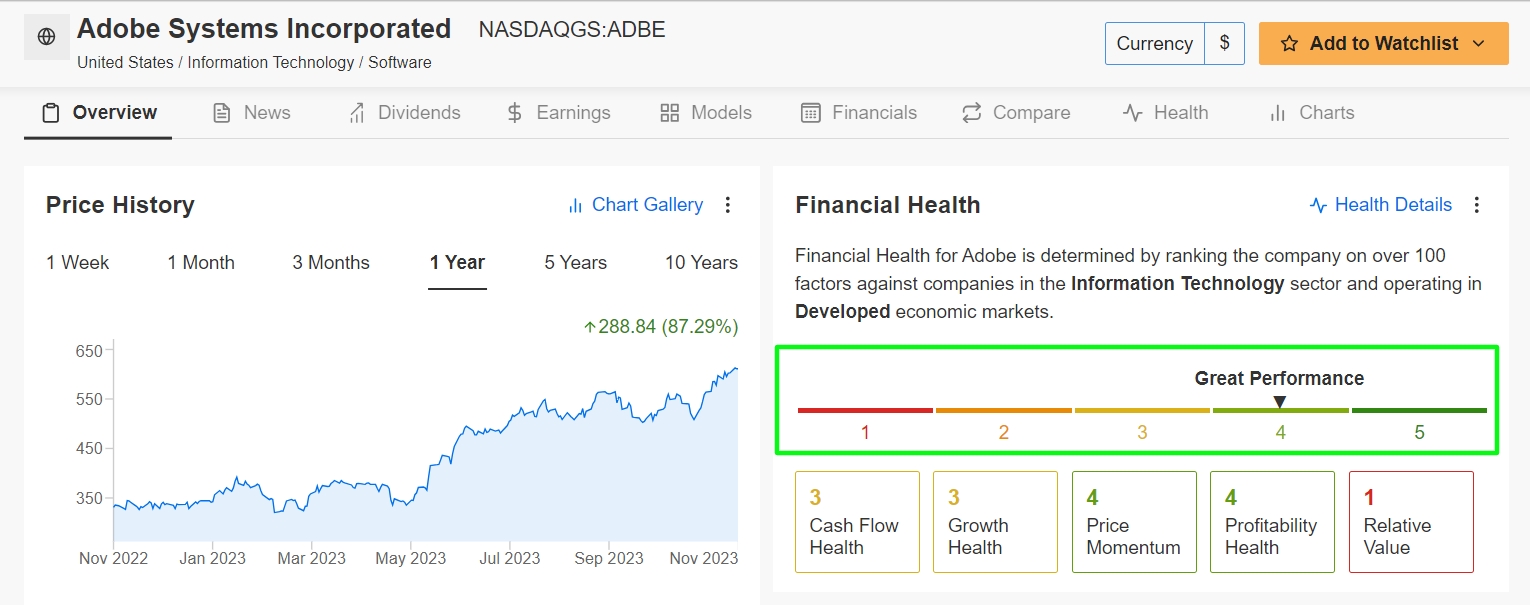

3. Adobe

Adobe (NASDAQ:ADBE)'s innovative software solutions and a strong foothold in creative and digital marketing tools have secured its position as one of the top performers in the S&P 500 this year.

The San Jose, California-based software-as-a-service powerhouse has continued to innovate and provide valuable tools in the digital space thanks to its growing involvement in artificial intelligence.

Adobe’s commitment to enhancing its suite of software, leveraging expanding digital transformation trends, and delivering consistent customer value makes it a stock for its holders to be thankful for this Thanksgiving.

Source: InvestingPro

ADBE began the year at $340.16 and closed at an all-time high of $619.73 last night, representing a year-to-date gain of 84.2%.

Adobe looks poised for further gains in 2024 as the current operating environment fuels demand for its wide array of subscription-based digital media and marketing software tools.

As Investing Pro points out, the tech titan currently enjoys a ‘Financial Health’ score of 4/5, thanks to strong earnings prospects, and a healthy profitability outlook.

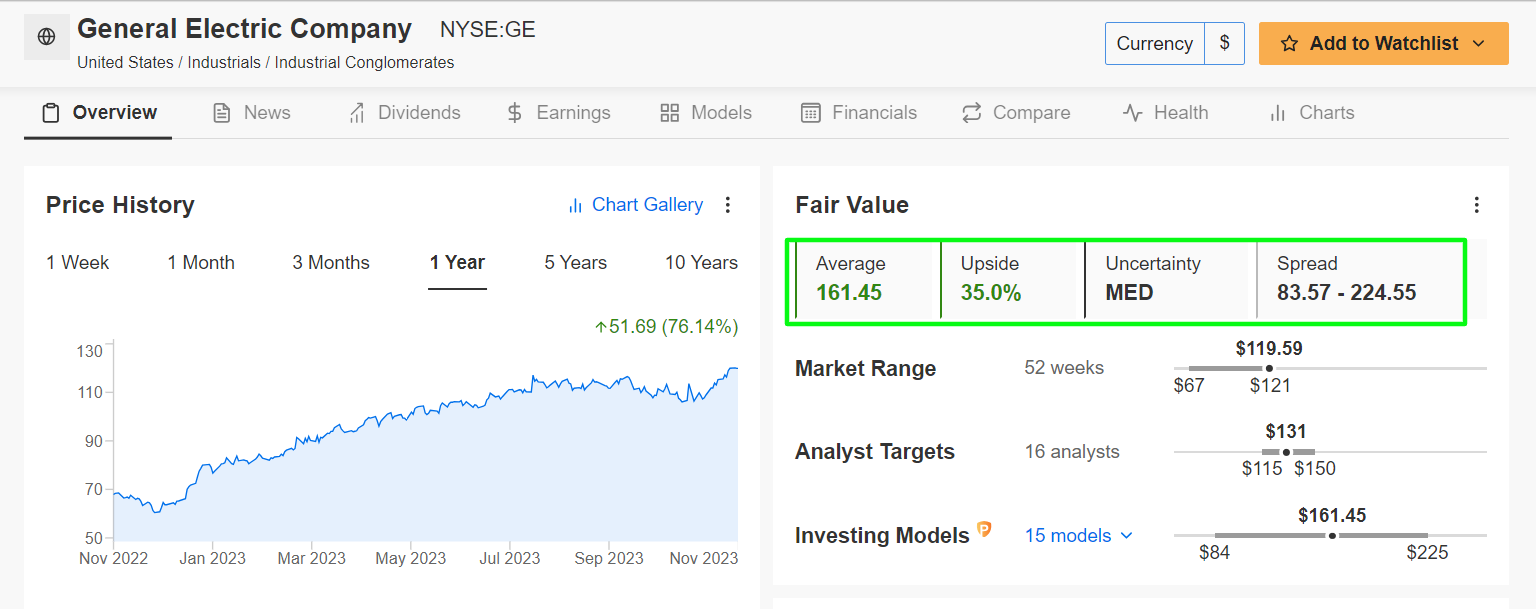

4. General Electric

General Electric (NYSE:GE) has emerged as one of the top performers in the S&P 500 this year, which makes GE a stock to be especially grateful for this Thanksgiving.

The multinational conglomerate has thrived due to its diversification across various sectors like aviation, healthcare, and renewable energy. The Boston-based company, which was founded in 1892, beat Wall Street’s profit and sales estimates in every quarter this year as it reaps the benefits of its diversified portfolio, strategic initiatives, as well as cost-cutting measures.

Source: InvestingPro

General Electric has been on a major uptrend throughout most of the year, with shares soaring 83% in 2023. The stock - which began trading at $65.59 on January 3 - ended at $119.66 yesterday, the highest closing price since November 2017.

Even with the recent upswing, GE remains undervalued and could see an increase of 35%, according to InvestingPro, bringing shares closer to their ‘Fair Value’ of $161.45.

Demonstrating the strength and resilience of its business, General Electric sports a near-perfect Investing Pro ‘Financial Health’ score of 4 out of 5.

5. Arista Networks

Arista Networks (NYSE:ANET), a key player in the networking technology sector, has carved a niche with its innovative solutions and has been successful in grabbing market share from chief rivals Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR).

The Santa Clara, California-based networking-infrastructure company's focus on cloud networking, data center solutions, and its role in advancing network infrastructure has made it a standout performer, earning plenty of gratitude from stockholders this year.

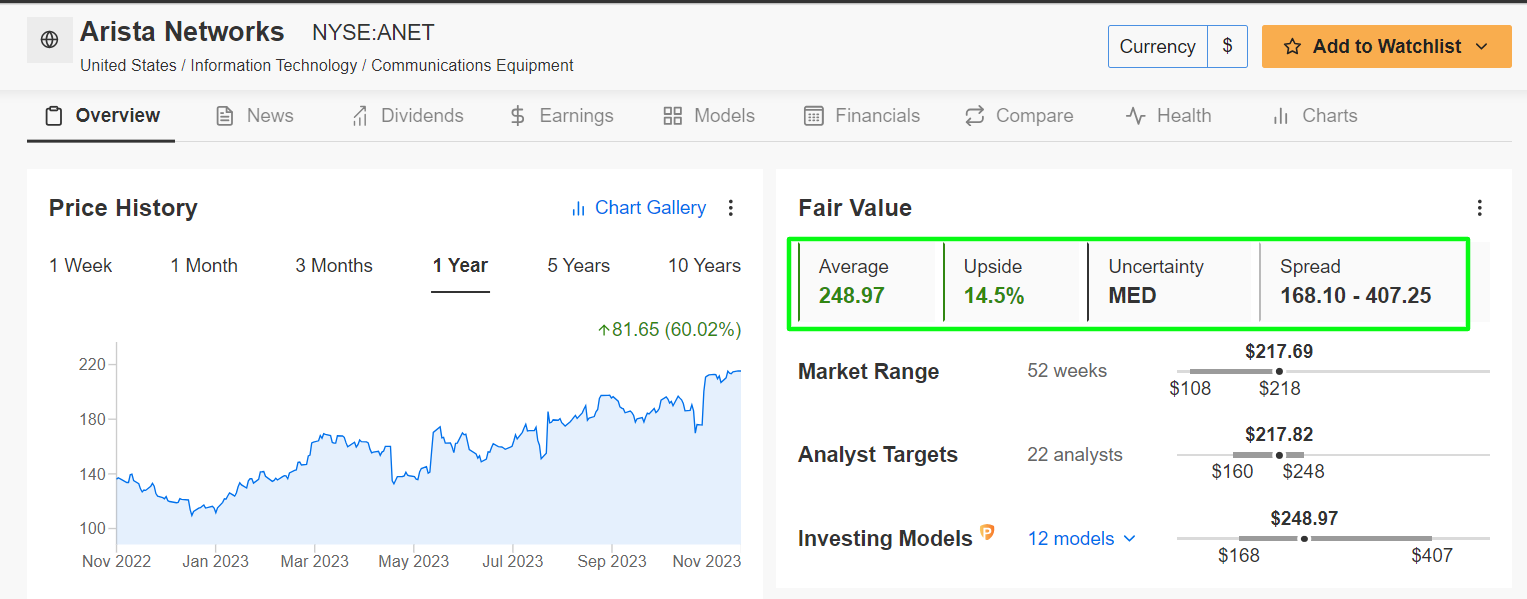

Source: InvestingPro

ANET stock closed at a new record peak of $217.69 on Wednesday, earning the company a valuation of $67 billion.

Shares have scored a gain of almost 80% in 2023, making it the 11th best performer on the S&P 500 this year.

Not surprisingly, Arista Network’s stock is substantially undervalued according to the quantitative models in Investing Pro: with a ‘Fair Value’ price target of around $249, ANET shares could see an upside of 14.4% from current levels.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.