- These vital lessons from Brian Feroldi can transform your investment journey

- I have handpicked 5 lessons to share with you today

- Let's take a look at each of them, one by one

In the hustle and bustle of our daily lives, it's all too easy to lose sight of what truly matters. Unfortunately, this oversight often leads many investors to disappointing performances or, in the worst cases, substantial losses.

Thanks to Brian Feroldi, an author, investor, and financial educator, I've gathered some images that give simple but essential lessons that every investor should always remember. Today, I'd like to discuss five key lessons from his investment philosophy that stand out:

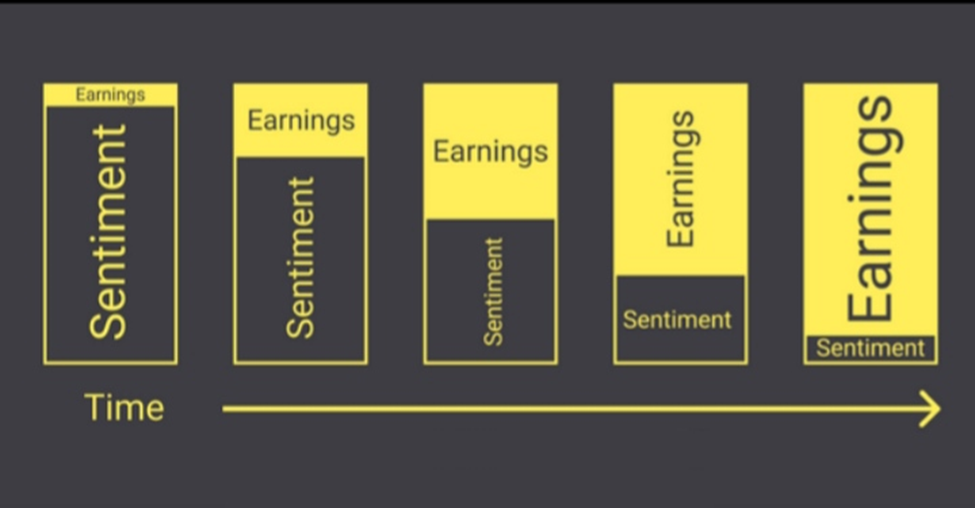

1. What Truly Drives Markets

John Bogle always emphasized that there are two genuine drivers behind our market performances: earnings and dividends, period. A third factor comes into play (mainly in the short term): speculative factors like valuations represented by metrics such as the P/E ratio.

Source: Brian Feroldi

2. Focus on the Controllable

Regrettably, some investors still build their strategies and their entire financial lives around predictions of when the Fed might cut interest rates (projections that changed 10 times in the last 9 months). Really?

Source: Brian Feroldi

Observe the image above. What can you truly control? Certainly not interest rates, inflation, or the markets themselves. You can control your ability to save monthly, the portion allocated to investments, your asset allocation, rebalancing, and accumulation plans.

These things are within your control. Redirect your time and energy away from what's beyond your influence and focus on what truly matters.

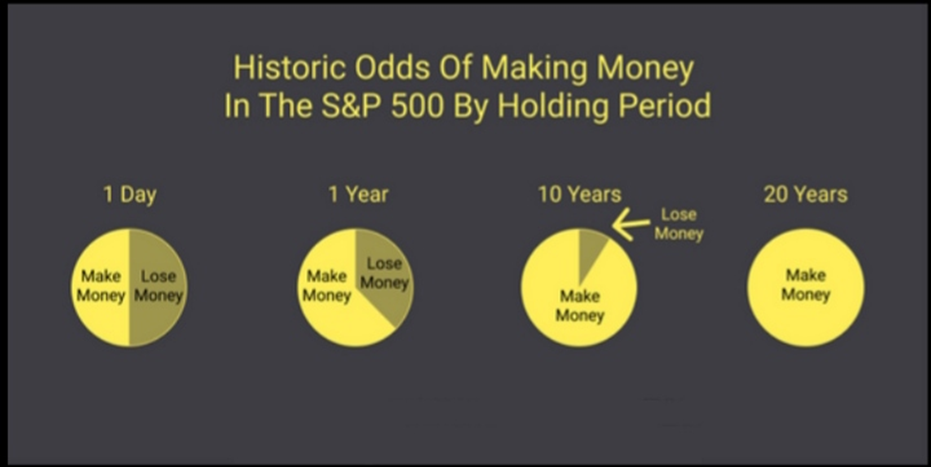

3. Invest with Favorable Odds

Throughout history, ever since stock markets were born, purchasing a simple ETF tracking the S&P 500 index and holding it for a minimum of 17 years has always yielded positive returns through pandemics, wars, financial crises, and banking failures alike.

Source: Brian Feroldi

As seen in the image above, time is your friend, provided you have enough of it. "But 17 years is too long!" you might say (not necessarily given today's life expectancy).

However, having an investment horizon of at least 8-10 years should be the bare minimum. It's no coincidence that Warren Buffett, the greatest investor of all time, has held onto stocks for over 20 years (He held Coca-Cola Co (NYSE:KO) for 34 years).

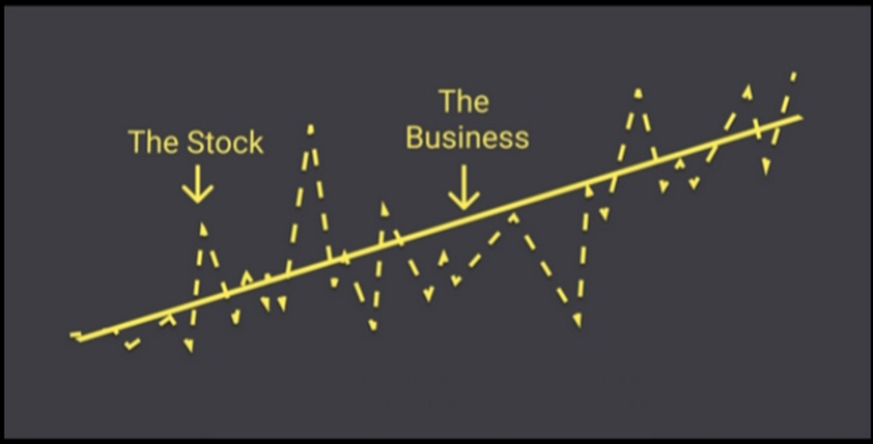

4. Invest in Businesses, Not Stocks

I hate to mention Buffett again, but he's consistently right. You're not buying a piece of paper at a certain price, hoping it'll rise.

You're buying a company comprising people, buildings, services, patents, and clients that daily produces and sells goods or services. And this business generates cash flows - both current and future.

Source: Brian Feroldi

So, you're investing in a business that generates cash flows, ideally at a good price. This understanding improves your initial evaluations when selecting individual stocks.

A stock's price can fluctuate significantly, especially in the short term, but if you comprehend the business and it continues to grow, your results will eventually be in your favor.

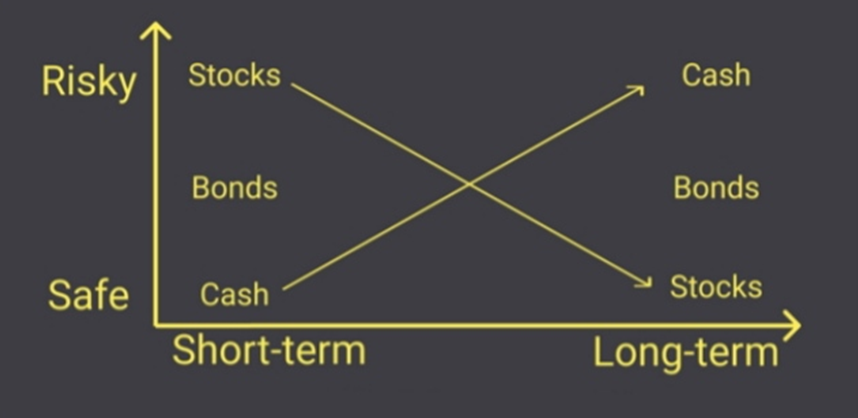

5. Short-Term Risks ≠ Long-Term Risks (and Vice Versa)

Stocks are risky- better to buy government bonds!

Are you absolutely sure?

Perhaps we should redefine the concept of risk for a moment.

What risk is not: fluctuations between highs and lows over time. What risk is: failing to achieve your financial goals, not outpacing inflation.

Source: Brian Feroldi

Seen this way, stocks are the only asset class capable of covering not just inflation but also generating significant returns over medium-to-long periods.

We could cite another hundred lessons like these, but grasping these initial five will propel you one step closer to success in this seemingly simple yet still misunderstood world.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.