- The financial sector has bounced back after facing turmoil in March

- And large U.S. banks have passed their stress tests with flying colors

- Does that mean it's a good time to buy these banks' stocks now?

- InvestingPro Summer Sale is back on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Investors were understandably nervous ahead of one of the most controversial stress tests in recent years as volatility in the sector escalated since the collapse of Silicon Valley and Signature Bank in March.

However, the 23 largest U.S. banks successfully passed the Federal Reserve's annual stress tests with flying colors, remaining above capital requirements during a hypothetical global recession, despite projections indicating a loss of over $500 billion.

This achievement highlights the resilience of large banks, demonstrating their ability to continue lending to households and businesses even during a hypothetical recession. Essentially, the current level of capitalization of U.S. banks positions them favorably in the worst-case scenario envisioned by the Fed.

The Fed's hypothetical scenario for this year's stress tests included a new component called "preliminary market impact." It featured inflation that was less severe than the adverse baseline scenario but still subject to increased inflationary pressures due to public expectations, as reported by EFE.

This additional component was only applied to banks listed as 'globally systematically important' institutions (G-SIBs), which include Wells Fargo & Company (NYSE:WFC), Bank of America Corp (NYSE:BAC), and Morgan Stanley (NYSE:MS).

The positive outcome of the stress tests has had a significant impact on the stock market, leading to sector-wide gains on Wall Street. In fact, the KBW Bank rose by 5% in June, marking its first positive monthly closure since last January.

Source: Investing.com

Investors had anticipated that the large U.S. banks would enhance their shareholder remuneration policies following the positive stress test results. According to the Federal Reserve's regulations, banks are required to wait two days after releasing the stress test results before making any related announcements.

As expected, last Friday, after the market closed, JPMorgan (NYSE:JPM), Wells Fargo, Goldman Sachs (NYSE:GS), Morgan Stanley, and Citigroup (NYSE:C) revealed an increase in their dividends for the third quarter.

So, are these stocks worth buying at current levels?

Using InvestingPro, we will analyze the 4 largest U.S. banks by assets, according to Fed data: JPMorgan, Bank of America, Citigroup, and Wells Fargo.

1. JP Morgan

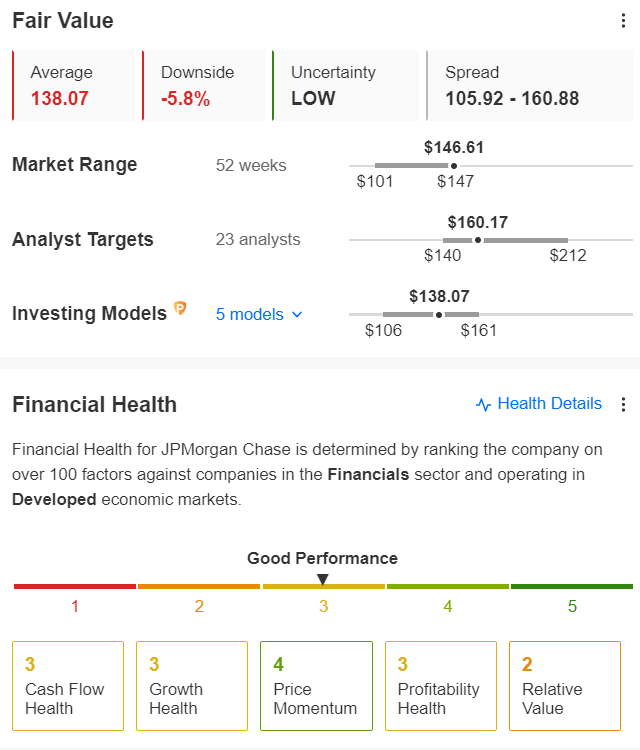

Headquartered in New York, JPMorgan is the largest bank in the United States. According to InvestingPro, it has a fair value of $138.07, its risk is low, and its financial health is good.

Source: InvestingPro

With an impressive track record, the bank has consistently increased its dividend for 12 consecutive years, offering shareholders a high return on stockholders' equity. Additionally, industry analysts have expressed confidence in the bank's profitability for the current year, backed by its strong performance over the past decade.

However, InvestingPro highlights certain factors to keep an eye on, including operations with a high price-to-earnings ratio (P/E) in relation to near-term earnings growth and weak gross profit margins.

Anticipation is building for JPMorgan's upcoming Q2 2023 earnings call scheduled for July 14th. Over the past 12 months, analysts have raised their earnings per share (EPS) expectations for this quarter by 14.1%, projecting an increase from $3.29 to $3.75 per share.

Source: InvestingPro

2. Bank of America

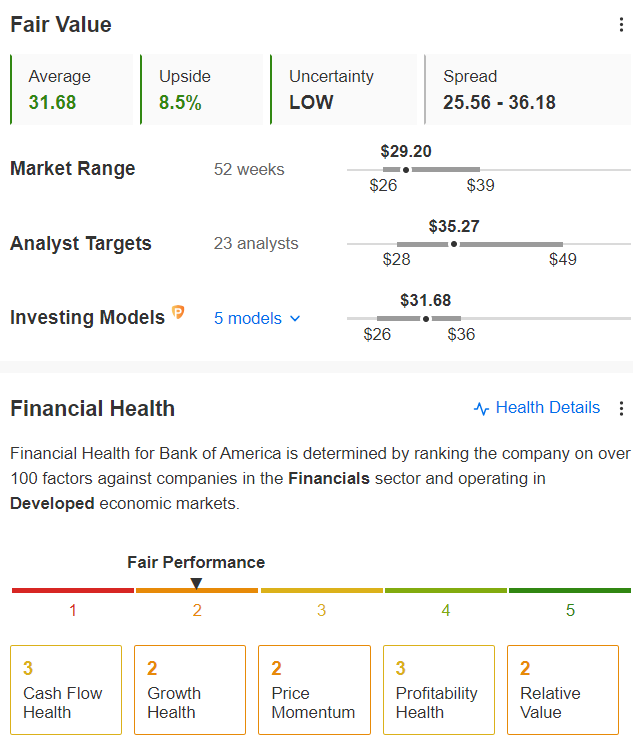

Bank of America, as assessed by InvestingPro, is reported to have a fair value of $31.68. The evaluation suggests that the bank carries a low level of risk, and its financial health remains satisfactory.

Source: InvestingPro

Bank of America's notable strength, as highlighted by InvestingPro, is its consistent increase in dividends for nine consecutive years. However, there are certain factors that warrant attention. Weak gross profit margins, a year-over-year increase in total debt, and downgrades in earnings forecasts by five analysts are among the areas to monitor.

Over the past 12 months, analysts have revised their earnings per share (EPS) expectations for this quarter, with a downward adjustment of -16.8% from $1.02 per share to $0.85 per share. The company is scheduled to announce its second-quarter 2023 results on July 18th.

Source: InvestingPro

3. Citigroup

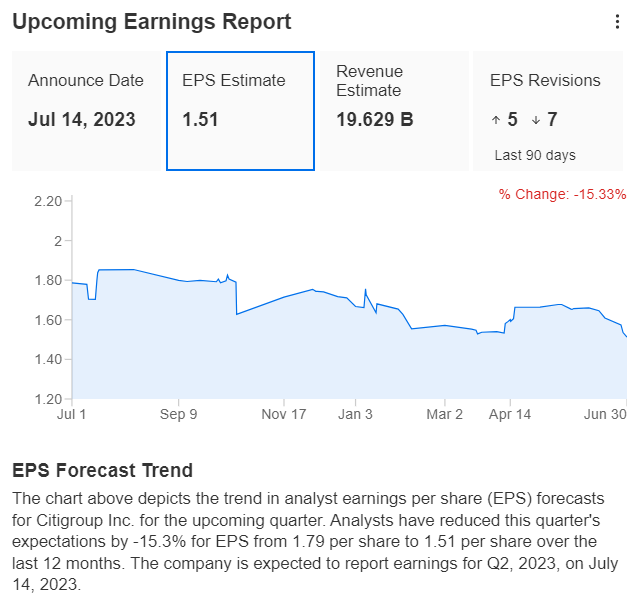

InvestingPro reports that Citigroup holds a fair value of $58.59, exhibits a medium level of risk, and demonstrates acceptable performance in terms of its financial health.

Source: InvestingPro

InvestingPro highlights some strengths of Citigroup, including its low earnings multiple and a track record of consistent dividend payments over 12 consecutive years.

However, there are factors that warrant attention, such as weak gross profit margins, high share price volatility, and downward revisions in earnings forecasts by five analysts.

Over the past 12 months, analysts have revised their earnings per share (EPS) expectations for this quarter, with a decrease of -15.3% from $1.79 to $1.51 per share. Citigroup is scheduled to announce its second-quarter 2023 results on July 14th.

Source: InvestingPro

4. Wells Fargo

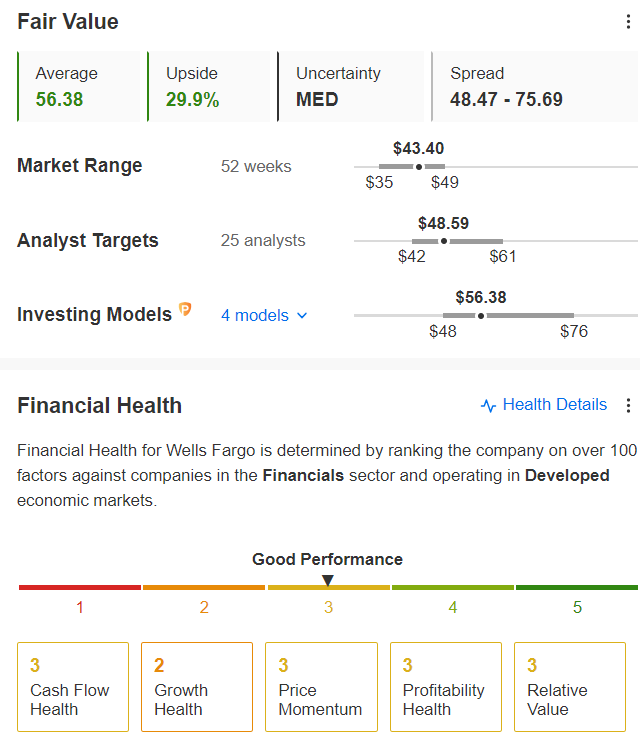

Wells Fargo operates in 35 countries and serves more than 70 million customers. According to InvestingPro, the bank's fair value stands at $56.38, with a medium level of risk and decent financial health.

Source: InvestingPro

The bank has consistently maintained dividend payments for an impressive 52 consecutive years.

However, there are certain factors that warrant attention, including downward revisions in earnings forecasts by six analysts and weak gross profit margins.

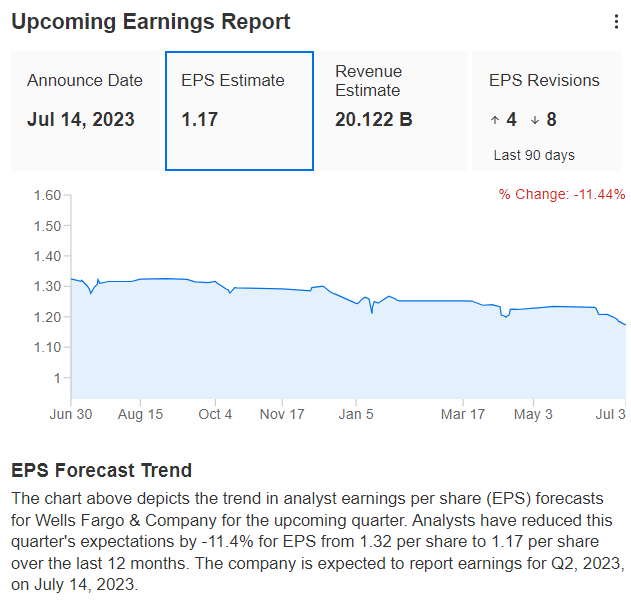

Over the past 12 months, analysts have adjusted their expectations for earnings per share (EPS) this quarter, with a decrease of -11.4% from $1.32 to $1.17 per share. Wells Fargo is scheduled to announce its second-quarter 2023 results on July 14th.

Source: InvestingPro

Are you considering new stock additions to your portfolio or divesting from underperforming stocks? If you seek access to the finest market insights to optimize your investments, we recommend trying the InvestingPro professional tool for free for seven days.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest nor is it intended to encourage the purchase of assets in any way.