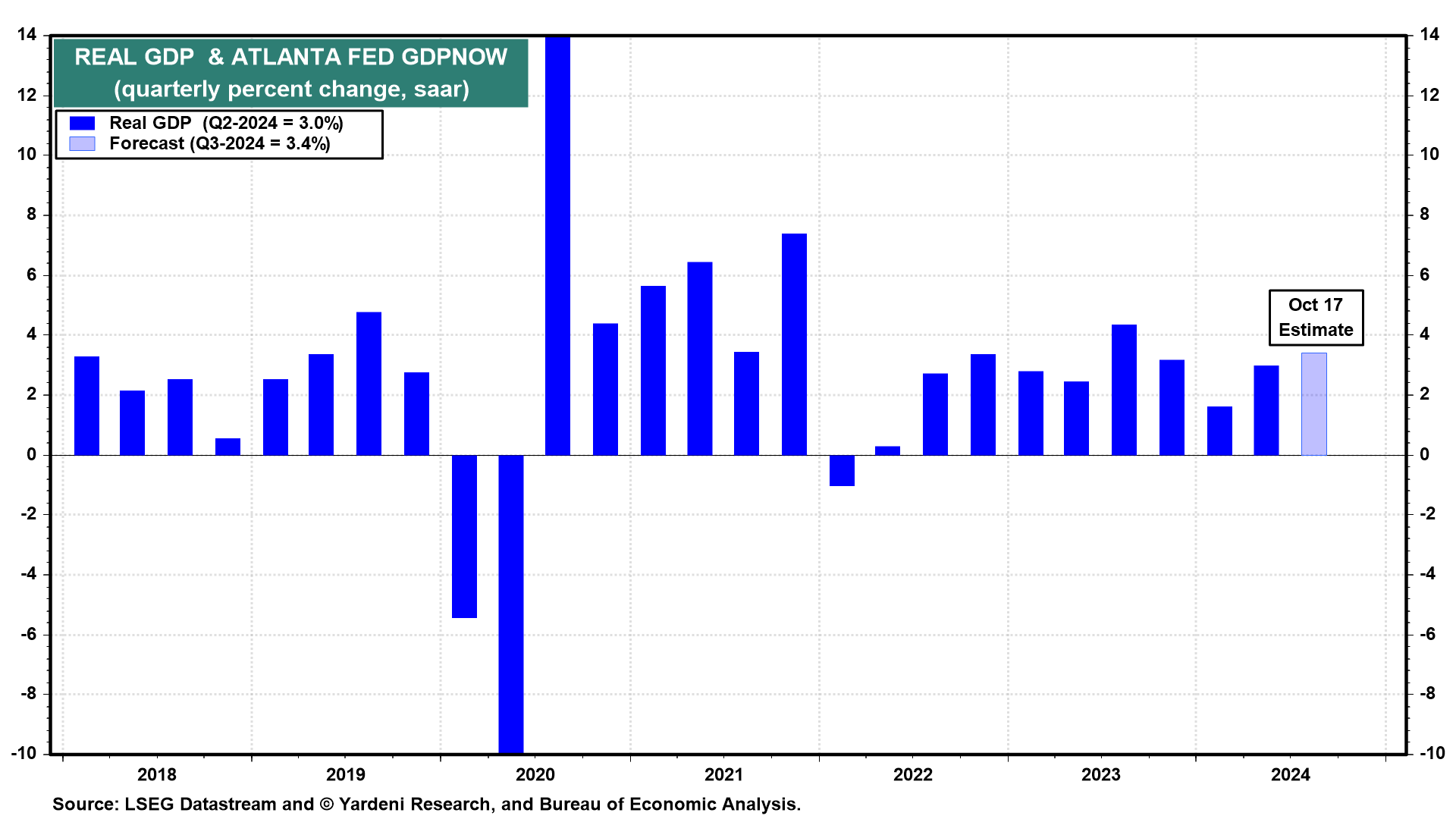

Yesterday, the Atlanta Fed's GDPNow tracking model raised Q3's real GDP growth rate from 3.2% to 3.4% following a roaring September retail sales report (chart).

Real consumer spending was revised up from 3.3% to 3.6%. Jobless claims fell despite worker strikes and hurricanes. Manufacturing also held up well notwithstanding Boeing (NYSE:BA) layoffs and bad weather.

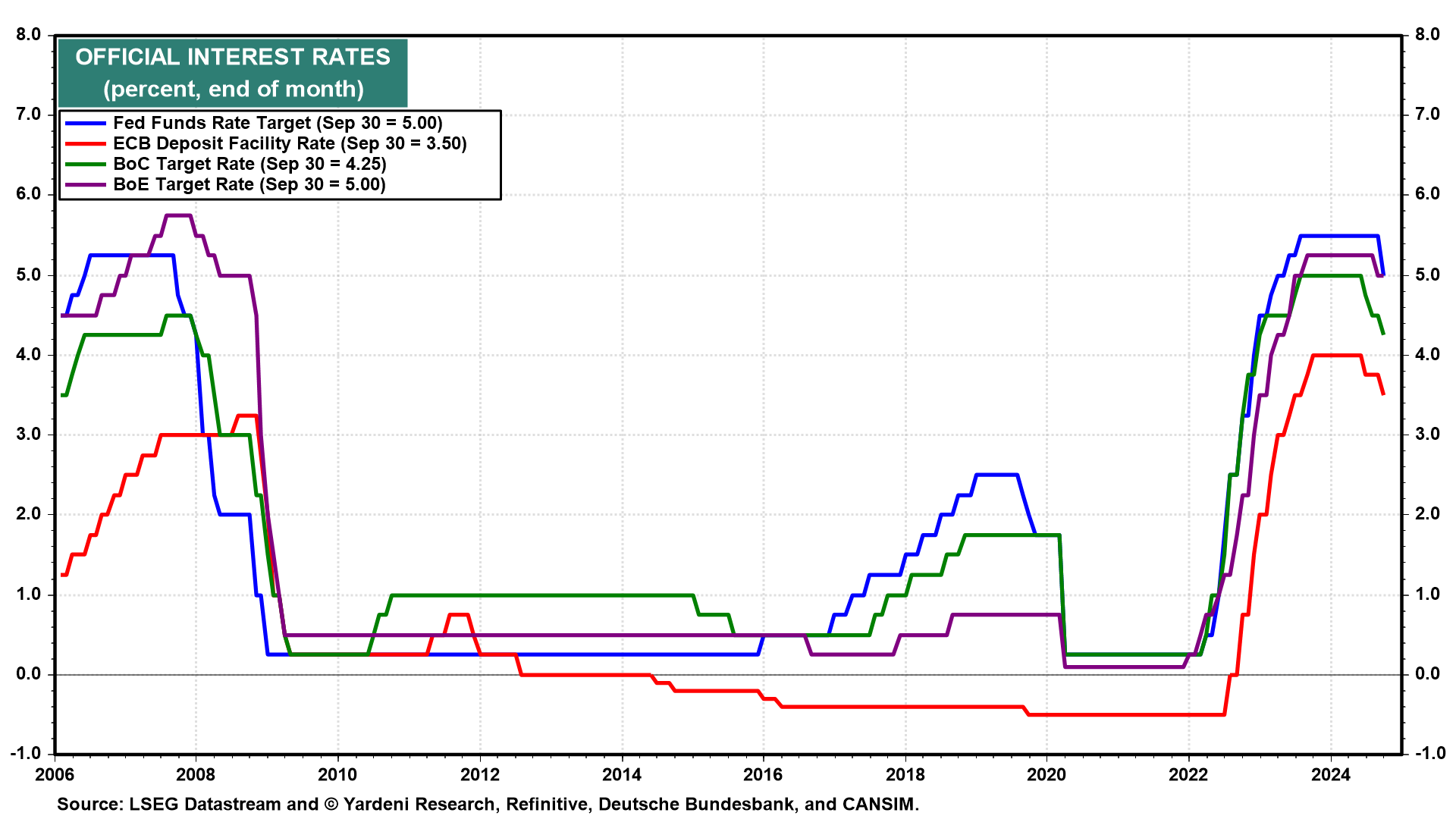

Yesterday's data further confirm our assessment that the Fed was too dovish when it cut the federal funds rate by 50bps on September 18.

We immediately responded by raising the odds of a stock market meltup and forecasting a counterintuitive backup in bond yields.

Sure enough: Stocks are climbing to new record highs and the 10-year US Treasury yield is up almost 50bps to 4.10% since September 18.

Here's more on yesterday's economic indicators and developments:

(1) Retail sales

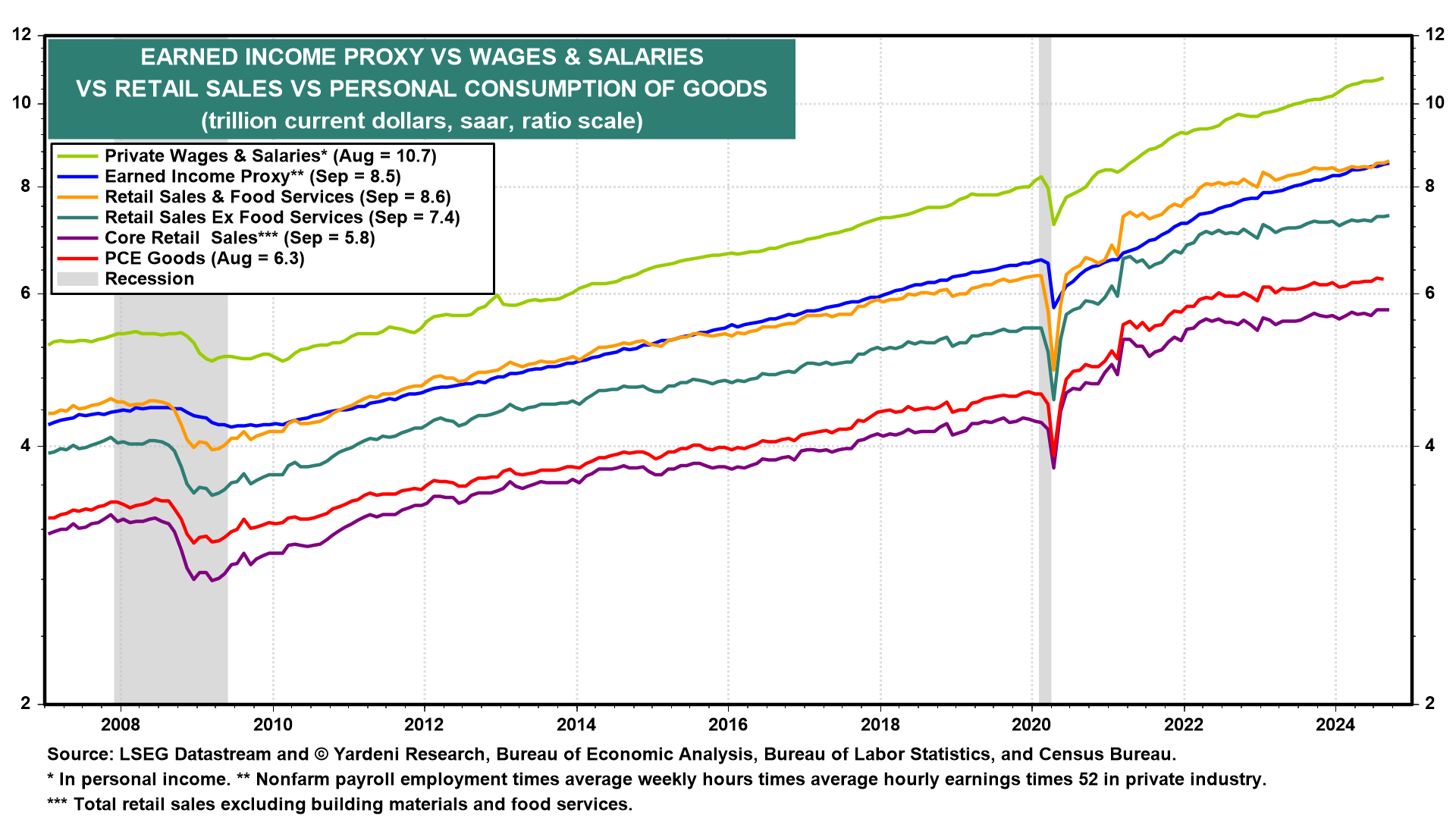

Consumer spending was strong again in September, as real retail sales rose 0.5% m/m to another record high.

That was right in line with our expectation based on the 0.3% m/m increase in our Earned Income Proxy for private-industry wages and salaries in personal income and the 0.2% drop in CPI goods (chart).

(2) Unemployment claims

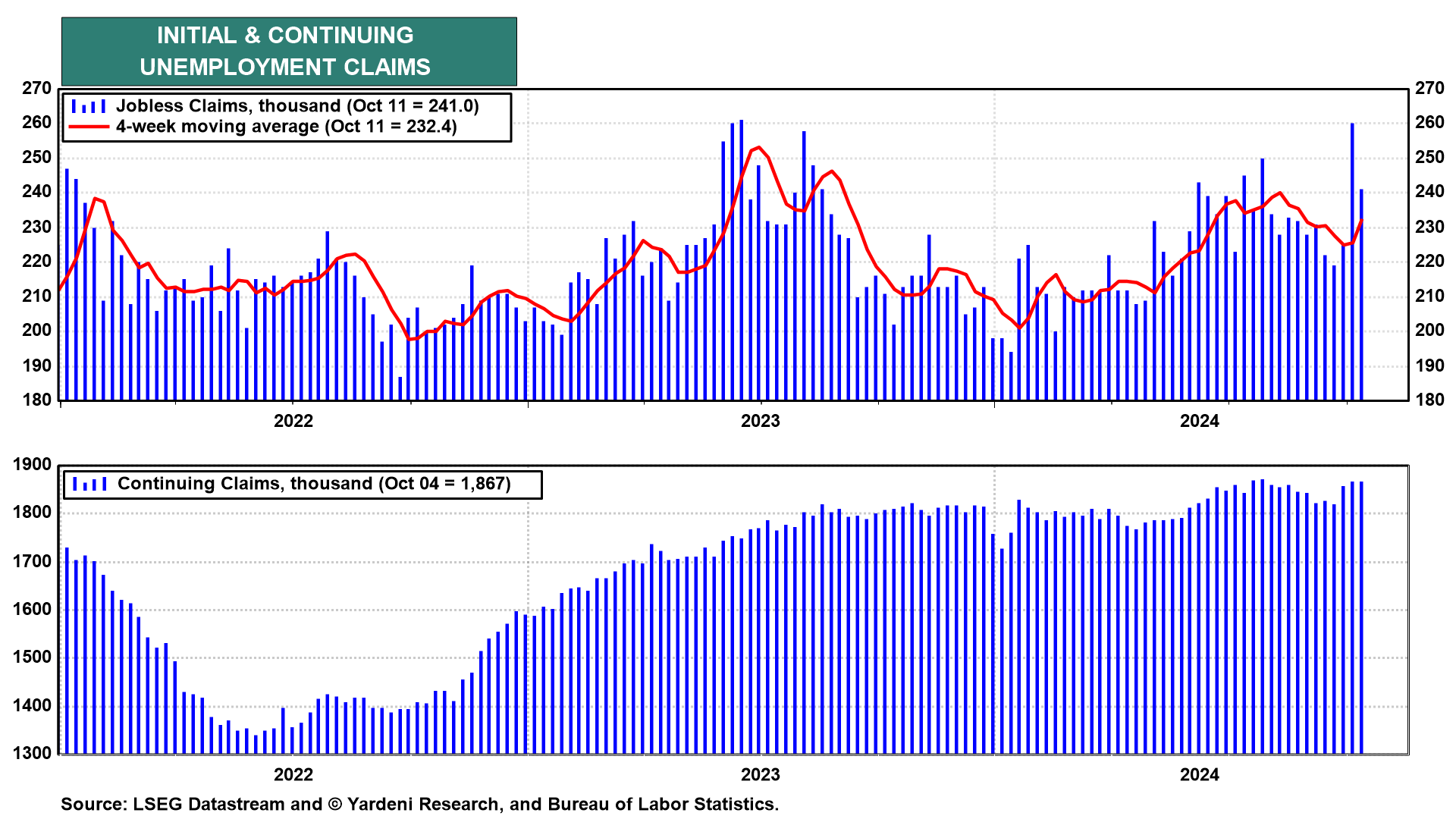

The good news on consumer spending was paired with good labor market news. Initial jobless claims fell from 17,000 in the week ended October 12 to 241,000 (sa) (chart). The impact of hurricanes and manufacturing layoffs amid strikes were expected to spur more jobless claims.

Indeed, the largest increases on a state-by-state basis were in rust-belt states and those hit by Hurricane Helene (i.e., Michigan, North Carolina, Ohio, and Florida). yesterday's report shows that the jobs market broadly remains on solid footing.

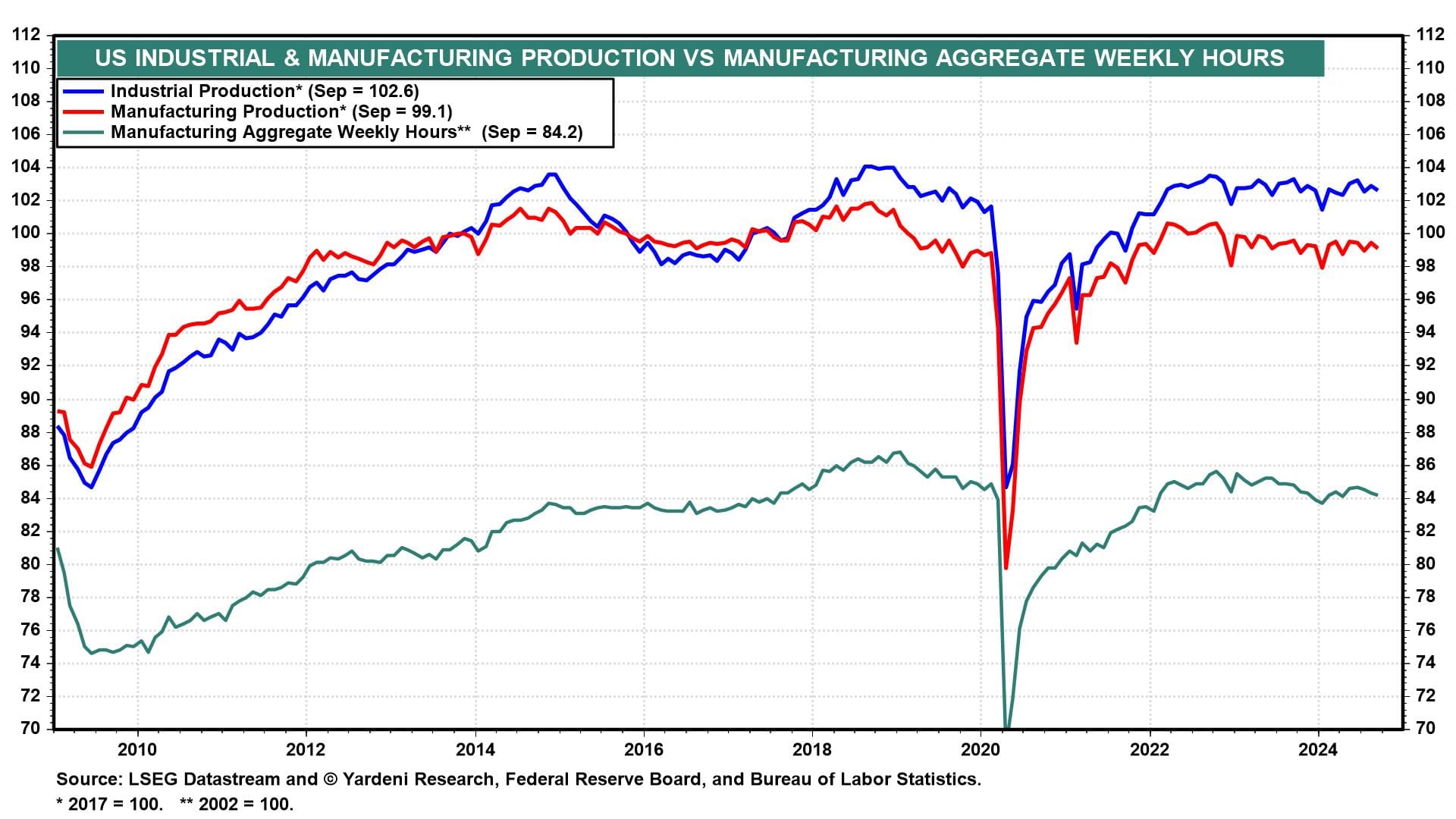

(3) Industrial production

September's industrial production (IP) fell 0.3% after rising 0.3% the prior month. We expected IP to edge lower after manufacturing weekly hours dipped 0.1% in September (chart).

The Federal Reserve estimated that the Boeing strike reduced IP growth by 0.3% in September, while Hurricanes Helene and Milton subtracted an additional 0.3%. In other words, IP held up relatively well last month.

(4) ECB

The European Central Bank (ECB) cut rates for the third time this year yesterday, lowering the Eurozone's benchmark rate by 25bps to 3.25% (chart). The move was widely expected as headline inflation in the Eurozone is below 2.0% while growth is flagging.

We expect economic growth to remain stronger in the US than in the Eurozone. There is also a higher likelihood that inflation gets stuck above 2.0% in the US. In that scenario, the euro is likely to fall as the ECB cuts rates more than the Fed.