-

3M's recent spin-off of its healthcare subsidiary, Solventum Corporation, signals a strategic shift aimed at streamlining its operations and unlocking potential value for shareholders.

-

Despite initial market enthusiasm, concerns persist regarding 3M's financial health and profitability outlook for 2024.

-

Analysts remain divided on 3M's prospects, with some highlighting its recovery potential based on recent financial data, while others express caution amid conservative forecasts for the upcoming quarters.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

3M Company (NYSE:MMM) successfully spun off its healthcare subsidiary, Solventum Corporation, which began trading on the New York Stock Exchange under the ticker SOLV.

As part of the spinoff, 3M shareholders received 1 share of SOLV for every 4 shares of MMM they owned. 3M retains a 19.9% stake in Solventum, which will be bought back within five years after the spin-off.

The decision to spin off its healthcare business was announced by 3M two years ago. After completing the necessary preparations, Solventum Corp. debuted on the NYSE this week. Following the spinoff, Solventum replaced V.F. Corp. (NYSE:VFC) in the S&P 500.

On the same day Solventum began trading, 3M reached a new settlement in a drinking water lawsuit. The company obtained final approval from the US District Court for its settlement agreement with public water suppliers in the US.

This settlement follows accusations against 3M for water contamination with harmful chemicals. The agreement involves a payment of $10.3 billion spread over 13 years, with the first installment expected in the third quarter of this year, pending any objections.

Investors React Positively

The spinoff garnered a positive reception from the street, leading to a 6% increase in 3M's stock price, closing at $94 from an opening of $90.85 after the spin-off announcement.

However, initial trading for SOLV saw a price drop from $80 to $68.4, a 14% decrease, prompting some investors to wait for stabilization before purchasing.

3M's healthcare sales had been declining before the spinoff, with 2023 sales totaling $8.2 billion, down 2.8% from the previous year.

In its latest SEC filing, 3M projected stable financial performance for Solventum, with estimated organic sales growth ranging from -1.5% to 1.5% for the coming year.

The spin-off of Solventum is part of 3M's strategy to streamline its healthcare operations, following the sale of its drug distribution venture for $650 million to a private equity firm in 2020.

While we wait to see how this spinoff would fare for 3M in the long run, let's take a look at the company's current financial state and how this spinoff might change things.

3M Company: Key Financial Metrics

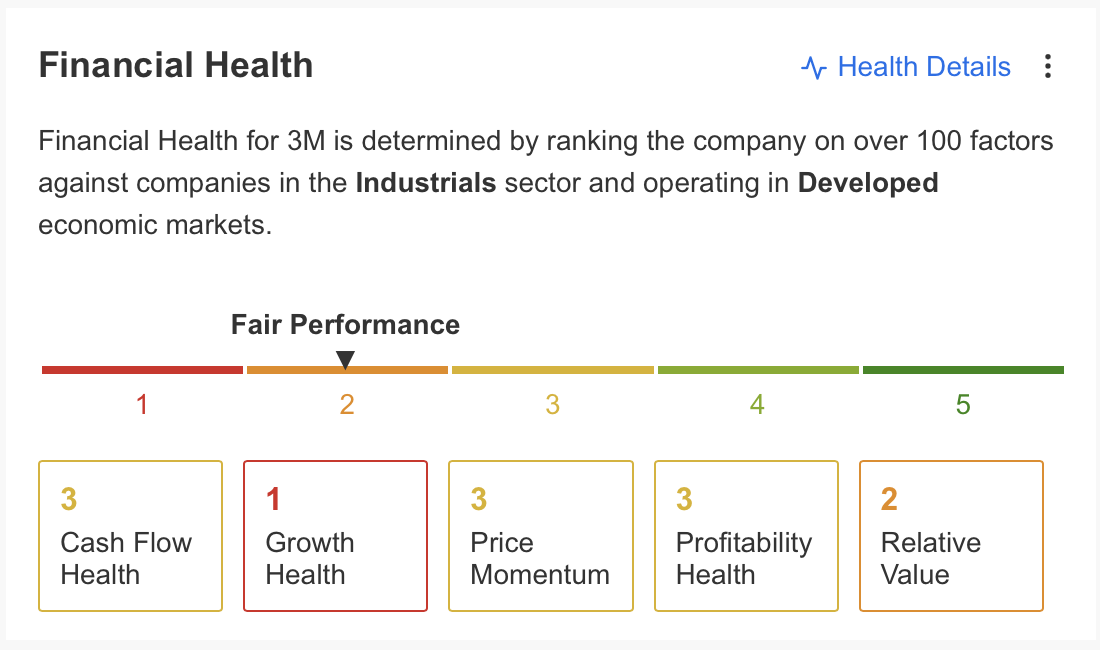

3M financials show that the company's financial health remains below average. The InvestingPro Financial Health report shows that 3M's biggest problem is in growth items.

Source: InvestingPro

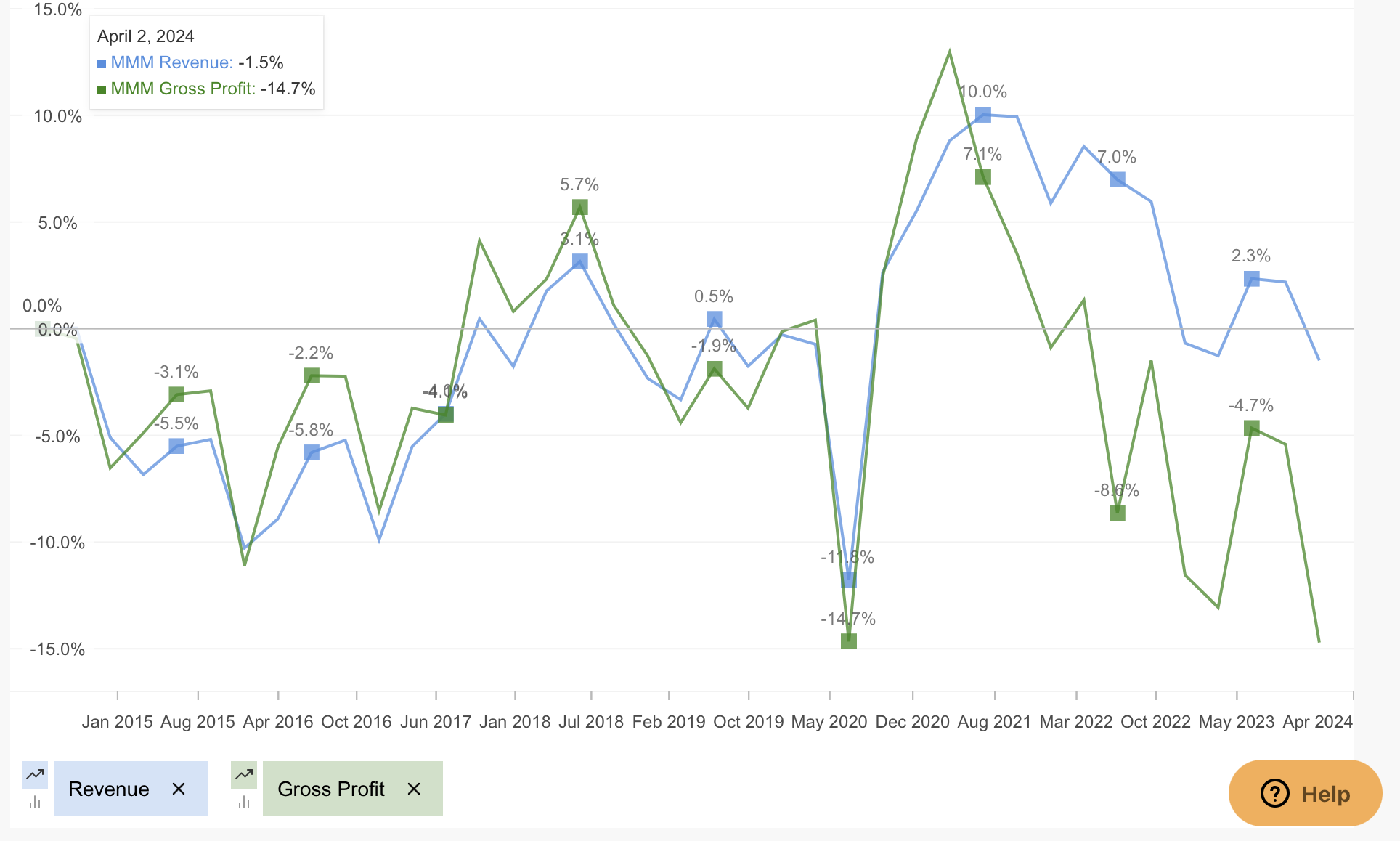

The company's profitability and cash flow are average. When we visualize revenue and gross profit in InvestingPro, it is seen that 3M has had problems in revenue growth, especially since 2021, while this trend has seen some recovery by 2023.

Source: InvestingPro

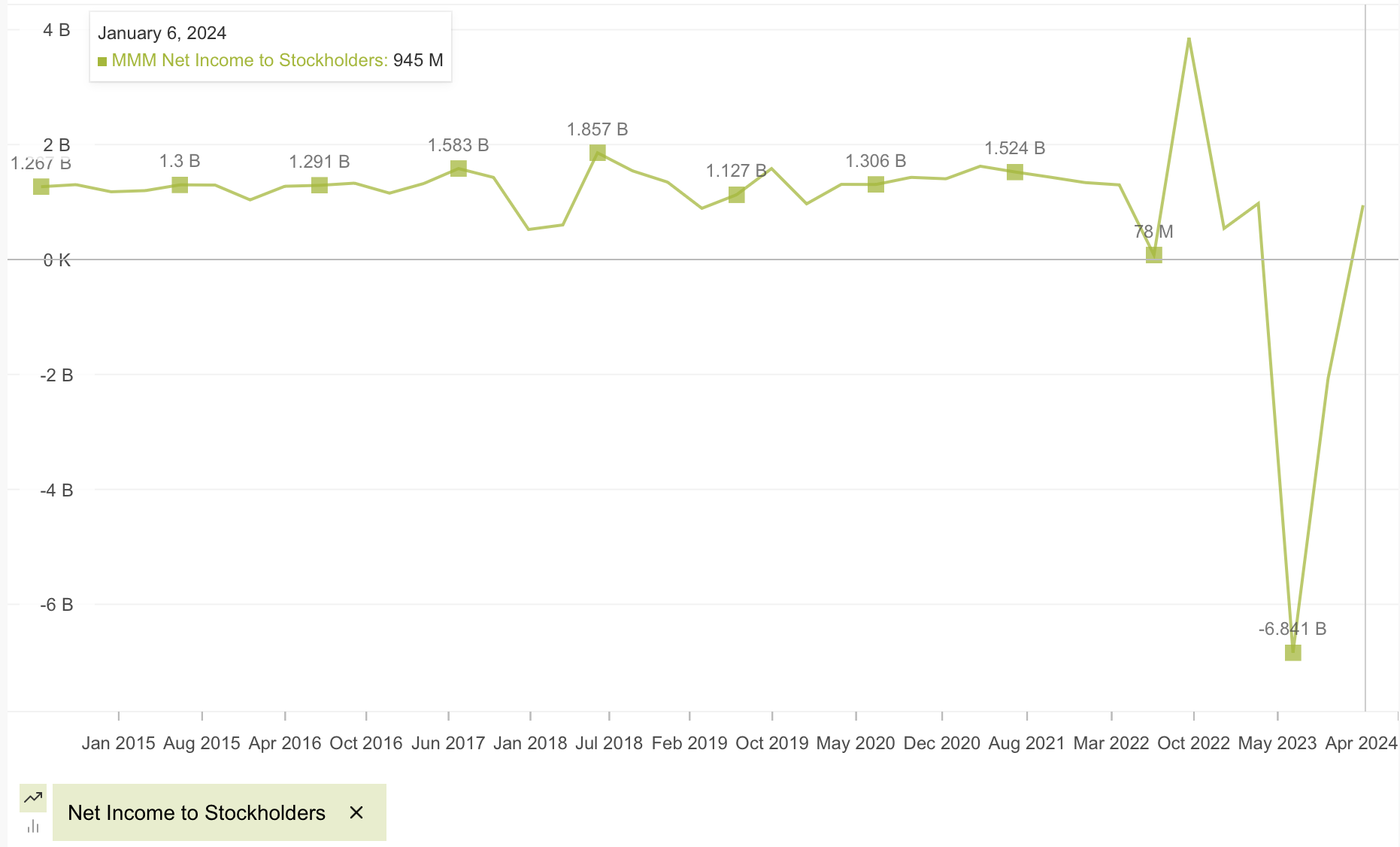

While the weakness in sales also affected profit margins, the company managed to achieve profitability in the last quarter of 2023 after posting losses in the 2nd and 3rd quarters, when its operational costs increased.

Source: InvestingPro

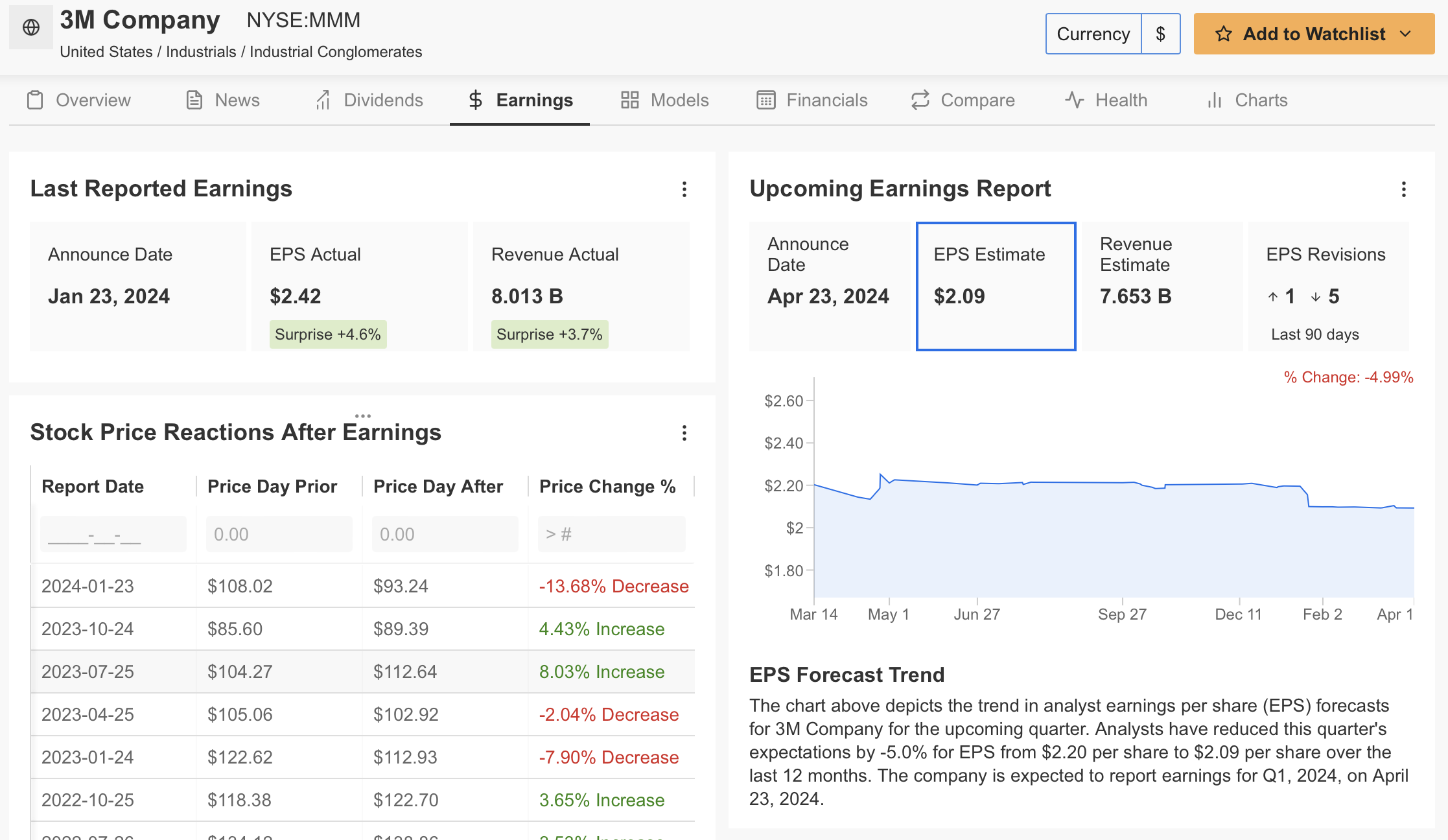

However, the company, which announced its Q4 results on January 23, revealed strong financials and gave hope to its investors by announcing higher-than-expected revenue and earnings per share.

Despite this, the share price fell by nearly 14% after the results were announced and fell from $108 to $93 at that time. This was the biggest negative reaction after the earnings report in the last 5 years.

Despite the financials that gave a recovery message in the last quarter, the company's low-profit outlook for 2024 was seen as the biggest factor that caused the selloff.

Moreover, the weak profit expectations during the period when the spin-off that took place this week came to the agenda made investors uneasy.

Source: InvestingPro

Although 3M's 2024 projection is seen as conservative by the market, some analysts think that the forecasts are consistent and reflect the current conditions in 2024.

Accordingly, we can see that the share price will be positively affected by the fact that 3M presents figures exceeding expectations in its quarterly reports.

However, if we take a look at the forecasts in the last 3-month period, 5 analysts revised their opinion downwards.

Analysts' consensus is that 3M will announce revenues of $ 7.65 billion with a profit per share of $ 2.09, down 5%, in the first quarter results of 2024, which will be announced on April 23.

Source: InvestingPro

One of the most important features of 3M is that it has a significant long-term investor base with 53 years of uninterrupted dividend payments.

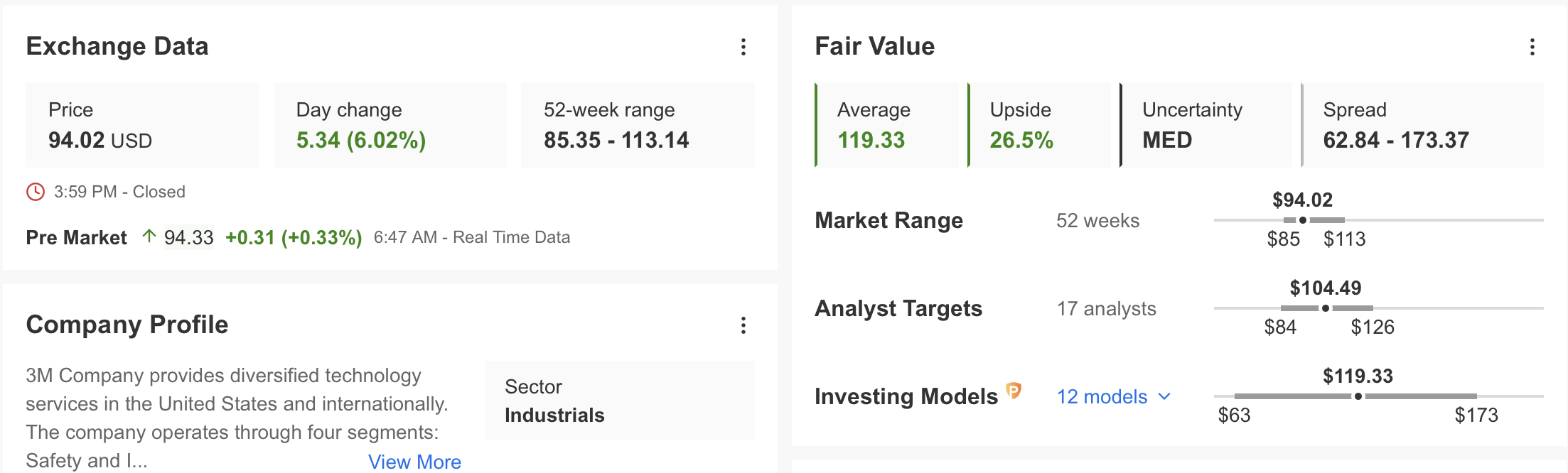

Excluding 2024 expectations, the available data reflects the recovery in the company's financial structure, and we can confirm this with InvestingPro's fair value analysis.

Based on 12 financial models, MMM's fair value price is currently 119 dollars. This DA can be interpreted as a 26% discount to MMM's current price of 94 dollars. In addition, 17 analysts believe that 3M stock could move towards $105 within the year.

Technical View

Since 2021, MMM, which has been moving in a long-term falling channel, attracted attention with its tendency to break the pre-split channel upwards.

In case the stock reaches the pre-split price, the movement to violate the channel at $ 105 will follow. A weekly close above $115 on average can confirm that the long-term decline has been broken.

The uptrend that may occur in a possible upside breakout may carry the MMM price up to the $160 region. On the other hand, as long as the share price remains within the channel on the weekly chart, it will continue its downward trend.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.