- While markets have taken a breather, we remain in a bull market.

- Despite recent data not being favorable, we are yet to see a deep correction.

- In this scenario, we will discuss three stocks that have lagged the broader market slightly and could catch up soon.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>> (CODE INWESTUJPRO1)

Since the start of the year, the S&P 500 has hit new record highs, gaining 8.3% in the process.

Despite recent data showing slightly worse-than-expected inflation and unemployment rates, there hasn't been a correction yet, indicating that buyers are in control.

Given this scenario, one interesting strategy is to look for undervalued companies with bullish potential as market optimism persists.

In this regard, three stocks stand out, and in this piece, we will discuss them individually.

1. Chevron

Chevron (NYSE:CVX) experienced sharp declines last October following news that it had acquired Hess (NYSE:HES). However, it has been gradually recovering since the beginning of the year, gaining over 3%.

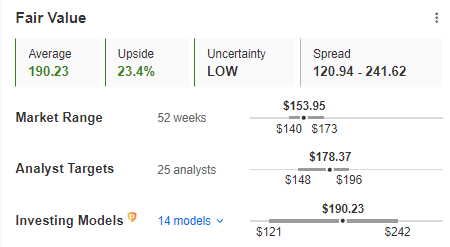

With the stock still about $36 below its historical highs, there's room for further gains. The fair value index suggests a potential move of more than 23%, indicating bullish prospects.

Source: InvestingPro

It's important to highlight that Waren Buffett's Berkshire Hathaway (NYSE:BRKb), has boosted its investment in the company.

As per the latest f13 report, which mandates large investment funds to disclose current holdings, Berkshire Hathaway has purchased 16 million shares, raising its stake in the portfolio to 5.3%. This move positions it as the fifth largest holding.

The company maintains strong growth fundamentals and the potential to enhance free cash flow, allowing for successive sharing of growing profits with shareholders.

2. STMicroelectronics

STMicroelectronics (NYSE:STM), a French-Italian company, makes electronic circuits. In recent years, these circuits have become crucial in the global semiconductor landscape.

Despite entering a consolidation phase, the company's stock price remains in an overall uptrend.

The demand side needs to surpass the recent peak price of $51 per share. Breaking through this level will pave the way for challenging the all-time high prices.

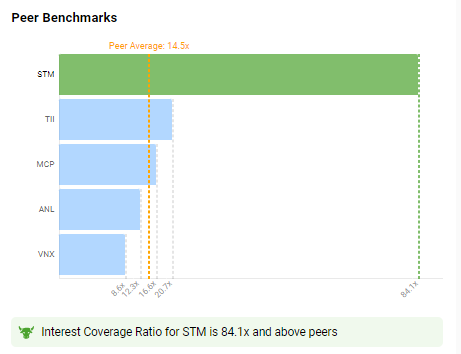

Fundamentally, it's crucial to note the strong cash flow. It comfortably covers the debt, with cash fully covering the current debt.

Source: InvestingPro

3. Haemonetics (NYSE:HAE) Corporation

Haemonetics Corporation, a prominent player in the medical industry, specializes in providing blood and plasma services.

Following a challenging period during the pandemic, the company experienced a sales recovery in 2023, with forecasts indicating continued growth in the current year, ranging from 4% to 7%.

A significant recent development announced earlier this month was the acquisition of Chicago-based Attune Medical for $160 million. This acquisition is expected to drive earnings growth in the years to come.

Recently, the company's stock price has seen a rebound, supported by strong defense near $72 per share. Currently, it is trading in the range of $72 to $80 per share.

The breakout of the upper limit of the aforementioned range remains crucial and could potentially pave the path toward $90 area.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year Invest ingPro subscriptions.

Do you only use the Investing app? This offer is also for you! InvestingPro for the app now also 10% off with INWESTUJPRO1. Enter discount code TU.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.