- Q2 earnings season begins next week and is a major test for markets

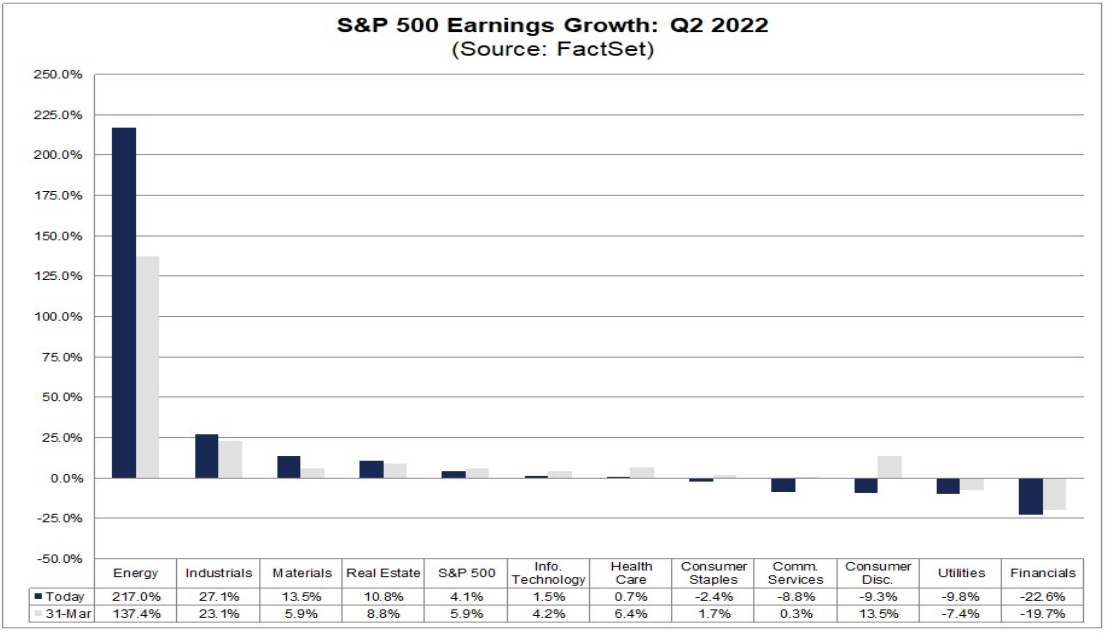

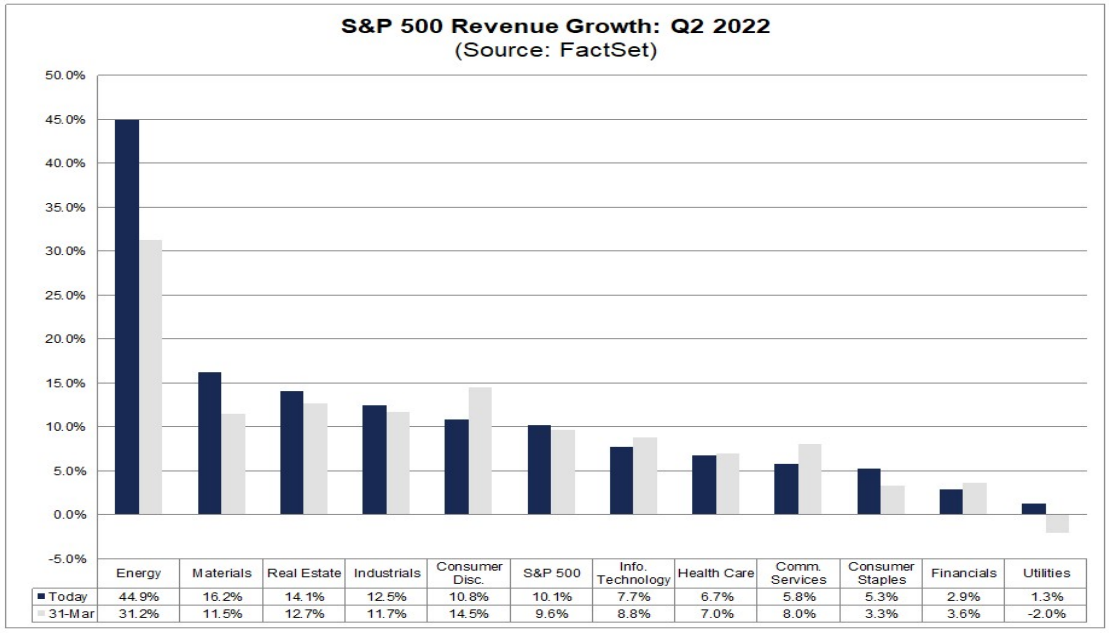

- S&P 500 expected to post Q2 sales growth of 10.1% and 4.1% earnings growth

- Consider buying energy, industrials, and materials sectors shares

- Projected Q2 EPS Growth: +217.0% yoy

- Projected Q2 Revenue Growth: +44.9% yoy

- Projected Q2 EPS Growth: +27.1% yoy

- Projected Q2 Revenue Growth: +12.5% yoy

- Projected Q2 EPS Growth: +13.5% yoy

- Projected Q2 Revenue Growth: +16.2% yoy

The highly anticipated second-quarter earnings season is set to begin and investors are bracing for what may be the worst reporting season in two years. A potent combination of macroeconomic headwinds, including higher costs, supply chain disruptions, labor shortages, and the military conflict in Ukraine is expected to take its toll on numbers.

FactSet is forecasting year-over-year (yoy) EPS growth of 4.1% which—if confirmed—would mark the slowest yoy increase since Q4 2020.

US banks kick off the earnings bonanza with JP Morgan (NYSE:JPM) and Morgan Stanley (NYSE:MS) reporting on Thursday, July 14.

At the sector level, six of the eleven sectors are projected to report yoy earnings growth, led by Energy, Industrials, and Materials.

Five sectors are expected to report a yoy decline in earnings, led by the Financials, Utilities, and Consumer Discretionary sectors.

Sector EPS Expectations

Revenue expectations are slightly more promising, with sales growth expected to climb 10.1% yoy, which will mark the sixth straight quarter of revenue growth above 10%.

Sector Revenue Expectations

All eleven sectors are expected to report yoy growth in revenues. In fact, five sectors are predicted to report double-digit sales growth, led by Energy, and Materials.

Despite mounting worries that the Federal Reserve’s plan to aggressively hike rates to combat the highest inflation in decades will cause a recession, we highlight three sectors whose financial results are projected to show significant improvement amid the current market conditions.

Energy: Soaring Oil & Gas Prices Set To Boost Results

The Energy sector is expected to report the biggest yoy gain in earnings of all eleven sectors, with a whopping 217% surge in second-quarter EPS, according to FactSet.

With higher oil and natural gas prices benefitting the sector—the average price of WTI crude in Q2 2022 was $108.52, 64% higher than a year earlier—it is also projected to record the highest yoy increase in revenue of all eleven sectors at 44.9%.

ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) are expected to be the largest contributors to the sector's spike in earnings, with the two energy giants forecast to report triple-digit profit growth and double-digit sales growth.

Two other notable names likely to enjoy significant improvements in Q2 results are Valero Energy (NYSE:VLO), which is projected to post EPS of $6.48, up 1,250% yoy, and Marathon Petroleum (NYSE:MPC), which is anticipated to record a 747% yoy increase in EPS.

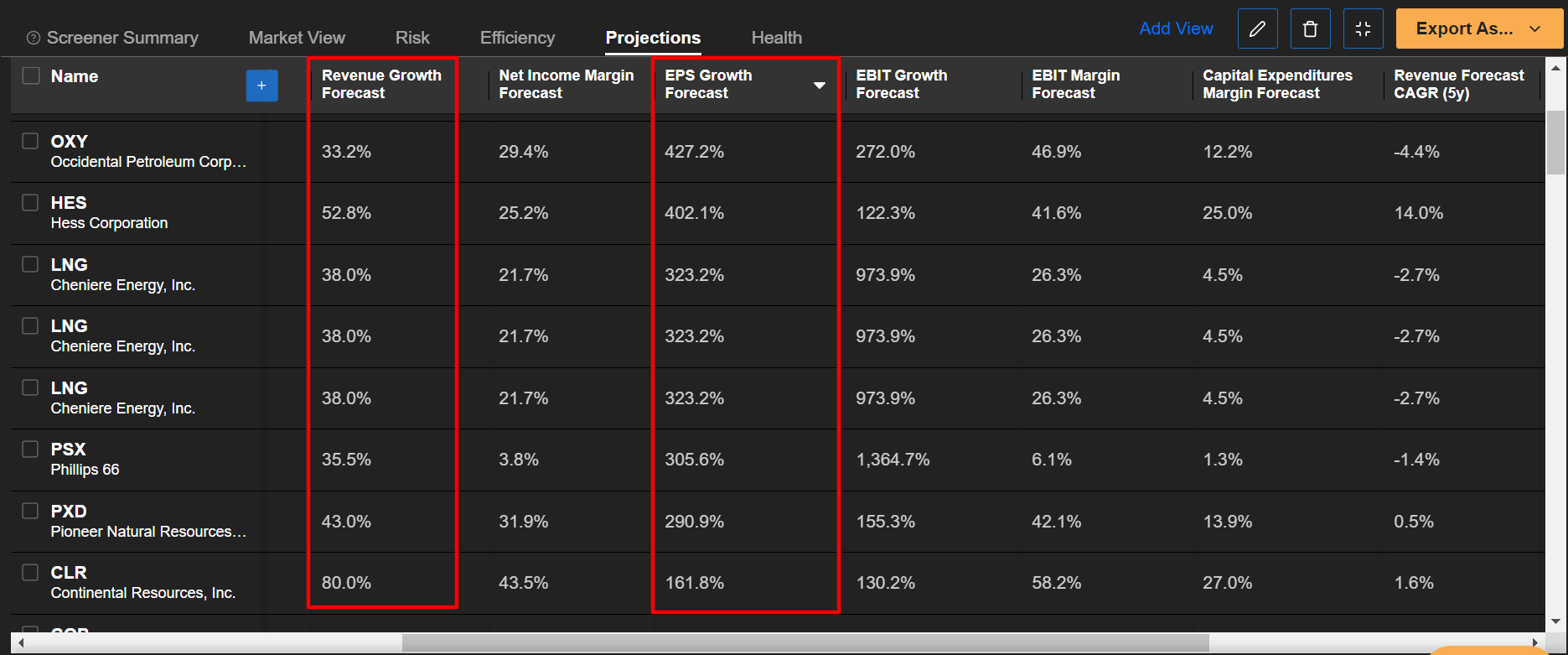

According to the InvestingPro+ Energy Stock Screener, other names set to enjoy robust Q2 profit and sales growth are Occidental Petroleum (NYSE:OXY), Hess (NYSE:HES), Cheniere Energy (NYSE:LNG), Phillips 66 (NYSE:PSX), and Pioneer Natural Resources (NYSE:PXD).

Source: InvestingPro

The Energy Select Sector SPDR Fund (NYSE:XLE)—which tracks a market-cap-weighted index of US energy companies in the S&P 500—is up 25.6% year-to-date, making it the top-performing sector of 2022 by a wide margin. In comparison, the S&P 500 is down 19.6% over the same timeframe.

XLE’s ten biggest holdings include Exxon, Chevron, ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), Occidental Petroleum, Pioneer Natural Resources, Schlumberger (NYSE:SLB), Marathon Petroleum, Valero Energy, and Phillips 66.

Industrials: Airlines Expected To Lead Growth

Industrials are expected to report a 27.1% yoy jump in Q2 EPS, the second-highest gain of all eleven sectors according to FactSet.

In fact, ten of the twelve industries in the sector are expected to report a yoy increase in profit, led by the Airlines, Construction & Engineering, and the Air Freight & Logistics groups.

The sector—which is perhaps the most sensitive to economic conditions—is also expected to report Q2 sales growth of 12.5% yoy, the fourth largest growth in revenue.

At the company level, Delta Air Lines (NYSE:DAL), and United Airlines Holdings (NASDAQ:UAL) are two to watch. Delta is forecast to post Q2 EPS of $1.66, improving substantially from a loss of $1.07 per share last year, while United is expected to report a 118% yoy increase in revenue to $12 billion

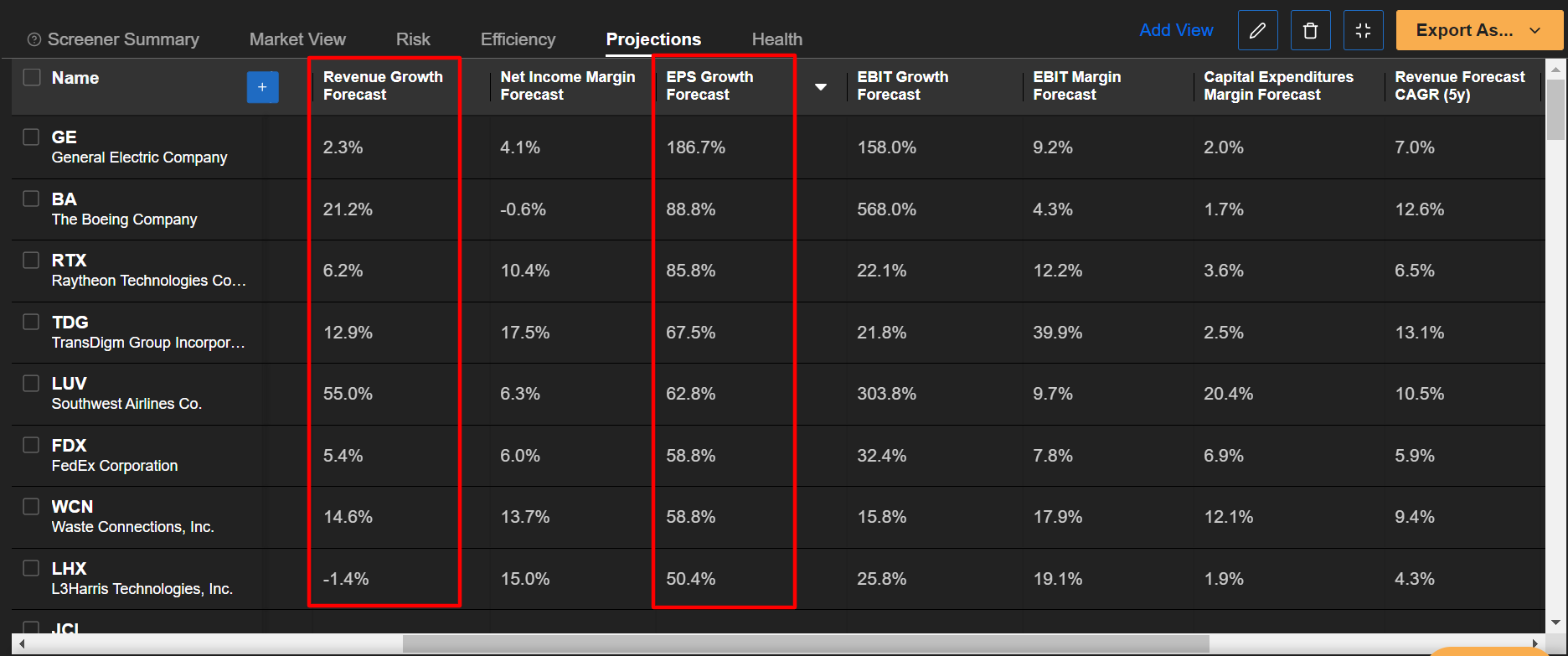

Southwest Airlines (NYSE:LUV), which is projected to report yoy earnings and sales growth of 62.8% and 55% respectively, is another prominent name to keep on your radar.

The InvestingPro+ Industrials Stock Screener shows that General Electric (NYSE:GE), Boeing (NYSE:BA), Raytheon (NYSE:RTN) Technologies (NYSE:RTX), Transdigm (NYSE:TDG), and FedEx (NYSE:FDX) are some of the other notable companies anticipated to report solid Q2 results.

Source: InvestingPro

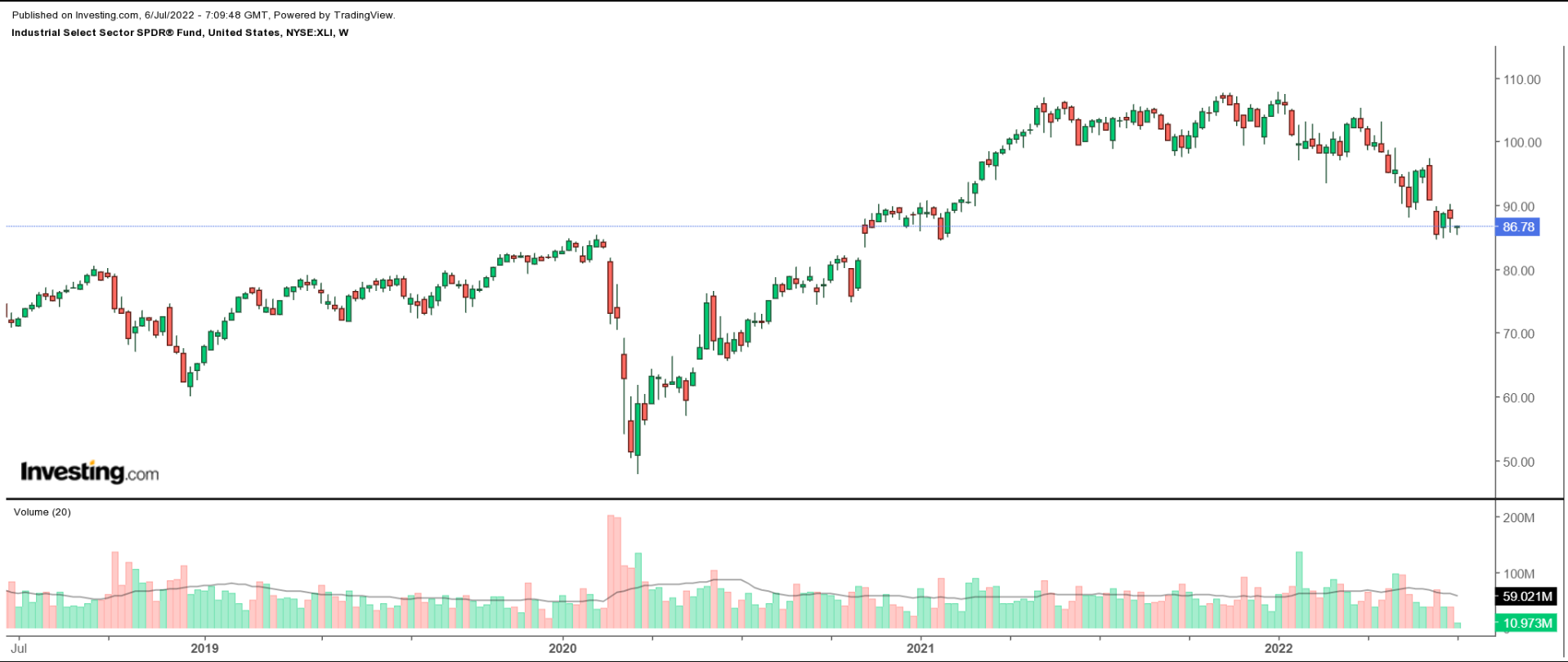

The Industrial Select Sector SPDR Fund (NYSE:XLI)—which tracks a market-cap-weighted index of industrial sector stocks drawn from the S&P 500—is down 18% year-to-date.

XLI’s top ten holdings include Raytheon, United Parcel Service (NYSE:UPS), Union Pacific (NYSE:UNP), Honeywell International (NASDAQ:HON), Lockheed Martin (NYSE:LMT), Caterpillar (NYSE:CAT), Deere (NYSE:DE), Boeing, 3M (NYSE:MMM), and Northrop Grumman (NYSE:NOC).

Materials: Metals & Mining Rally Set to Power Profit, Sales Growth

The Materials sector—which includes companies in the metals and mining, chemicals, construction materials, and containers and packaging industry—is forecast to print the third-highest yoy earnings growth of all eleven sectors, with second-quarter EPS anticipated to increase 13.5% yoy, according to FactSet.

With stronger prices of metals—such as gold, copper, nickel, platinum, palladium, and aluminum—helping the sector, it is also expected to report the second largest yoy increase in revenue, with sales forecast to grow 16.2%.

Not surprisingly, all four of the industries in the sector are anticipated to enjoy double-digit Q2 EPS and revenue growth, with the Metals & Mining group set to see profit and sales surge 25% and 21% respectively from the year-ago period.

The Materials Select Sector SPDR Fund (NYSE:XLB)—which tracks a market-cap-weighted index of US basic materials companies in the S&P 500—is down 19.8% in 2022.

XLB’s ten largest stock holdings include Linde (NYSE:LIN), Sherwin-Williams (NYSE:SHW), Air Products (NYSE:APD), Newmont (NYSE:NEM), Freeport-McMoRan (NYSE:FCX), Ecolab (NYSE:ECL), Corteva (NYSE:CTVA), Dow Inc (NYSE:DOW), International Flavors & Fragrances (NYSE:IFF), and Nucor (NYSE:NUE).

According to the Pro+ Materials Stock Screener, several companies from the group stand out for their potential to record impressive results.

First is specialty-chemicals manufacturer Albemarle (NYSE:ALB), which is expected to report earnings growth of 225% yoy. The second is Nucor (NYSE:NUE), which is predicted to post Q2 EPS of $8.01, significantly improving from EPS of $5.15 a year earlier.

International Flavors, Newmont, and Ball Corporation (NYSE:BALL) are a few more to watch as all three companies have seen their business thrive amid the current environment.

Source: InvestingPro