- Fed's expected aggressive tightening to contain soaring inflation, has many worrying about a possible recession.

- Three companies to protect your portfolio due to strong fundamentals, attractive valuations, and dividend payouts.

- Merck, Northrop Grumman, and NRG Energy to add to your watchlist.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

- Year-To-Date Performance: +23.5%

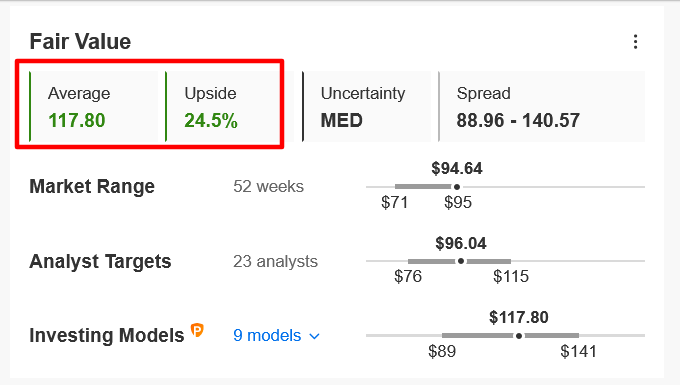

- Pro+ Fair Value Upside: +24.5%

- P/E Ratio: 17.2

- Dividend Yield: 3.53%

- Market Cap: $239.3 Billion

- Year-To-Date Performance: +21.7%

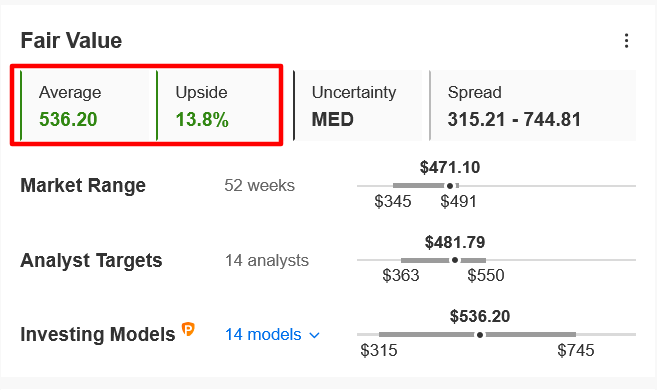

- Pro+ Fair Value Upside: +13.8%

- P/E Ratio: 13.0

- Dividend Yield: 1.47%

- Market Cap: $73.2 Billion

- Year-To-Date Performance: +6.3%

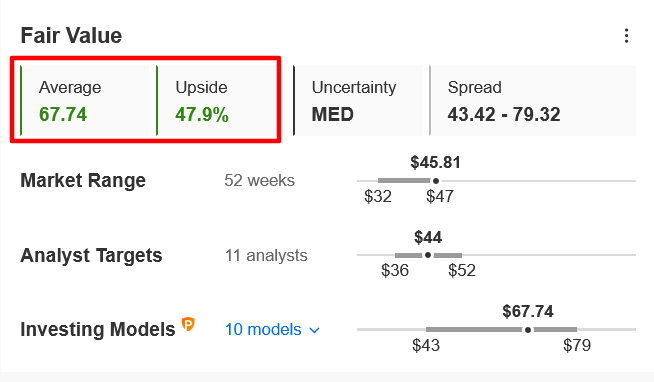

- Pro+ Fair Value Upside: +47.9%

- P/E Ratio: 2.8

- Dividend Yield: 3.77%

- Market Cap: $10.9 Billion

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

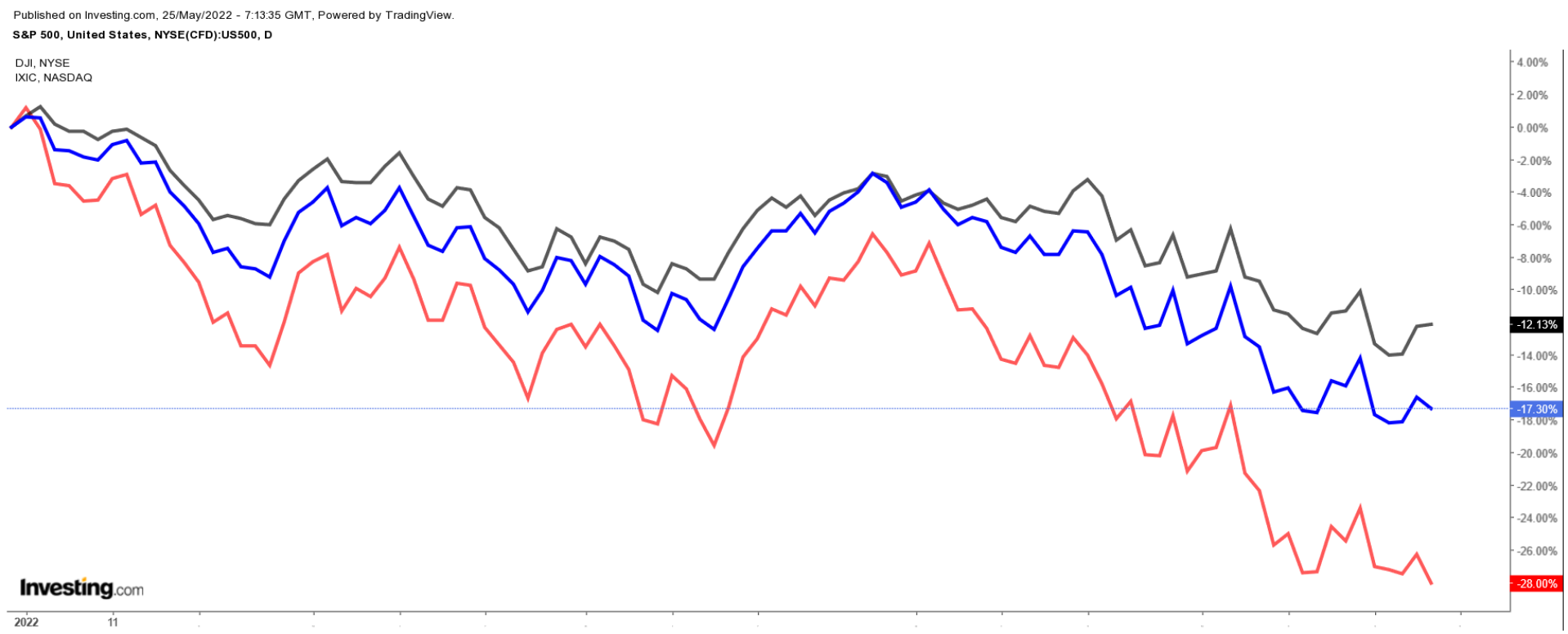

Stocks on Wall Street have suffered one of their worst starts to the year in history, raising investor concerns over the Federal Reserve’s plans to hike interest rates in its battle against persistently high inflation.

The blue-chip Dow Jones Industrial Average is down 12.1% year-to-date, while the benchmark S&P 500 and the tech-heavy NASDAQ Composite are off by 17% and 27.8%, respectively.

The market expects the Fed to hike rates multiple times by year’s end, putting the federal funds rate in a range between 2.75% and 3.0% at the end of 2022.

In addition to raising rates, the central bank will also start reducing its $9 trillion balance sheet in June, adding to policy tightening against a market backdrop that is much more volatile now than the last time the Fed shrank its bond portfolio.

As Wall Street continues its rollercoaster ride, the three companies below are well-positioned to ride out ongoing market turbulence as investors rush to protect themselves against the prospect of a weakening economy.

1. Merck

Merck & Company (NYSE:MRK) is a leading multinational pharmaceutical giant, involved in developing and producing a wide variety of medicines, vaccines, biologic therapies, and animal health products.

The Rahway, New Jersey-based company currently owns six blockbuster drugs or products, each with over $1 billion in revenue, including cancer immunotherapy, anti-diabetes medication, and vaccines against HPV and chickenpox.

With a price-to-earnings ratio of 17.2, and an annualized dividend of $2.76 per share at a relatively elevated yield of 3.53%, Merck seems a good option for investors looking to shield themselves from further market volatility in the months ahead.

High quality blue-chip dividend stocks tend to outperform in a roiling environment as market players seek defensive-minded companies with down-to-earth valuations instead of non-profitable high-growth technology stocks.

MRK closed Tuesday’s session at $94.64, just below its all-time high of $94.92 touched on Monday. At current levels, the pharmaceutical firm has a market cap of $239.3 billion.

Year-to-date, Merck shares have gained 23.5%, easily outpacing the comparable returns of the broader market as well as other notable names in the healthcare sector, including Johnson & Johnson (NYSE:JNJ), Pfizer (NYSE:PFE), Eli Lilly (NYSE:LLY), AbbVie (NYSE:ABBV), and AstraZeneca (NASDAQ:AZN).

At a price point under $100, MRK comes at a significant discount according to the quantitative models in InvestingPro, which point to 24.5% upside in Merck shares from current levels over the next 12 months to a fair value of $117.80.

Source: InvestingPro+

2. Northrop Grumman

As one of the world’s largest weapons manufacturers and military technology providers, West Falls Church, Virginia-based Northrop Grumman (NYSE:NOC) is also a leading producer of highly sophisticated drones, best known for its B-2 stealth bomber line.

Northrop’s stock stands out as a solid choice to hedge against further market uncertainty as investors pile into defensive areas of the industrials sector. The arms company is also well-positioned to benefit from growing global government and military defense budgets amid the current geopolitical environment.

Shares of NOC—which are up 21.7% year-to-date—ended at $471.10 yesterday, within sight of its all-time high of $490.82 touched on Mar. 7. At current valuations, the aerospace and defense technology company has a market cap of $73.2 billion.

With a P/E ratio of 13.0, Northrop comes at an extreme discount when compared to other notable defense contractors, such as Raytheon (NYSE:RTN) Technologies (NYSE:RTX), Lockheed Martin (NYSE:LMT), and General Dynamics (NYSE:GD), which have P/E ratios of 33.2, 19.5, and 18.8, respectively.

In addition, Northrop’s continuous efforts to return more cash to shareholders in the form of higher dividend payouts make it an even likelier candidate to outperform in the months ahead.

The weapons maker recently boosted its quarterly cash dividend by 10% to $1.73 per share, marking the 19th consecutive annual payout increase. This represents an annualized dividend of $6.92 and a yield of 1.47%.

Not surprisingly, NOC could see an upswing of around 14% in the next 12 months, according to the Investing Pro+ model, bringing it closer to its fair value average of $536.20 per share.

.

.

Source: InvestingPro+

3. NRG Energy

Houston, Texas-based NRG Energy (NYSE:NRG) is one of the biggest electric utility companies in the U.S. Its core operations include producing, selling, and delivering electricity and related products to approximately six million residential, commercial, industrial, and wholesale customers in ten states across the Northeast and Midwest regions.

NRG fits the bill as a solid name to own as inflation fears and the Federal Reserve’s aggressive rate hike plans fuel concerns about a potential recession in the months ahead.

Stocks of defensive companies whose products and services are essential to people’s everyday lives, such as utility providers, tend to outperform in environments of lower economic growth and accelerating inflation.

NRG’s ultra-low valuation, as well as ongoing efforts to return more capital to investors, make it an even more attractive pick amid the current market conditions.

With a reasonable price-to-earnings ratio of just 2.8, NRG is significantly cheaper than some its notable peers, including NextEra Energy (NYSE:NEE), Sempra Energy (NYSE:SRE), and PG&E (NYSE:PCG)

The integrated power firm is also a quality dividend stock, currently offering an annualized payout of $1.40 per share at a yield of 3.77%.

Shares of NRG are up 6.3% so far in 2022, closing at $45.81 yesterday, earning the company a valuation of nearly $11 billion. The stock rose to $46.86 late last week, a level not seen since October 2007.

Despite its strong year-to-date performance, NRG is substantially undervalued at the moment according to InvestingPro models and could see an upside of close to 48% over the next 12 months to its fair value average of $67.74/share.

Source: InvestingPro+

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI