Just like in 2016 and 2020, memetic warfare was a major contributor to US presidential elections in 2024. After it was fairly certain former President Trump secured his 2nd term, his son Donald Trump Jr. called for his 12.8 million followers to “Show me the memes!!!”.

But what happens to meme stocks in a new regulatory regime? Last Friday, the S&P 500 (SPX) index reached a new all-time-high, buoyed by Trump’s win on top of geopolitical factors. Following the enthusiasm spillover, many meme stocks have surged as well.

Where do they stand in November?

BlackBerry Limited

Over the last week, this penny stock unexpectedly surged by 7%, but returned flatlined performance over a 30-day period. Presently priced at $2.42, BlackBerry Ltd (NYSE:BB) stock is still under its 52-week average of $2.81 per share. As a cheap stock that had its 52-week highest point at $4.44, BlackBerry represents a moderate-risk, high-reward opportunity.

Having transitioned from a smartphone manufacturer to a software B2B model, the Canadian company focuses on secure comms for (IoT) devices. Last week, Hyundai (OTC:HYMTF) picked BlackBerry’s QNX platform, as the real-time operating system (RTOS) to handle Hyundai Mobis’ digital cockpits.

It is estimated that QNX is now present in 255 million vehicles, which BlackBerry acquired in April 2010 for $200 million. To date, BlackBerry’s largest acquisition was cybersecurity firm Cylance in 2018 for $1.4 billion. In mid-October’s Investor Day, the company outlined its future revenue growth expectations.

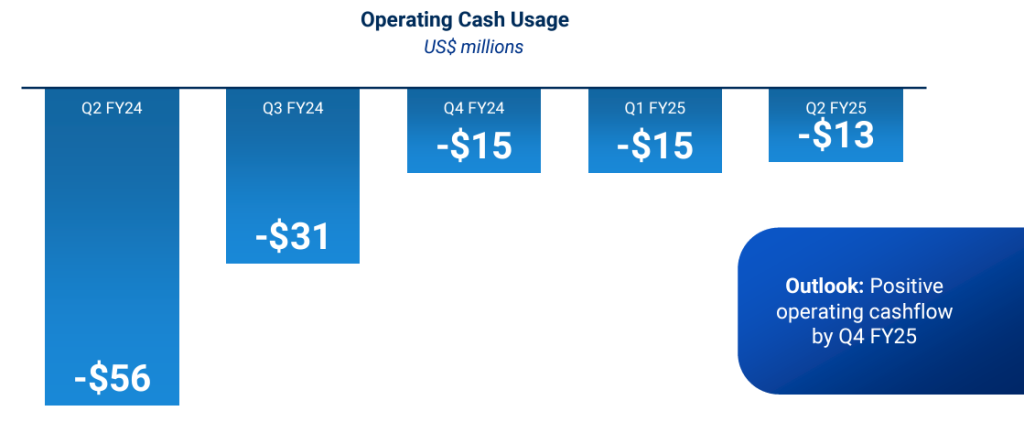

BlackBerry counts on more security contracts with governments for its AtHoc, UEM and secusmart solutions, while Cylance offers endpoint security solutions for AI/ML. From Q3 FY24, to Q2 FY25, the company plans to cut costs from $50 million to $10 million, saving up ~$135 in consolidation and streamlining efforts.

From Q4 FY22 to Q4 FY24, BlackBerry’s royalty backlog nearly doubled, from $460 million to $815 million. By 2033, the company expects to see even greater growth on account of the growing software developed vehicle (SDV) market.

Twelve months ahead, 7 analysts formed a $2.89 average price target for BB stock, with even the bottom outlook of $2.75 being higher than the present price. The ceiling estimate of $3 per BB share is still a significant profit potential for this penny stock.

Coinbase Global

This cryptocurrency exchange platform benefited greatly from Trump’s win, having gone up nearly 70% over the last week. The company started the year strong as the primary custodian for Bitcoin ETFs. With the expected removal of Gary Gensler as SEC Chair, and the end of Operation Choke Point 2.0, the next four years should see renewed capital inflows into the blockchain space.

Today’s new all-time high Bitcoin price of $84.3k is a testament to this expectation. At the present price of $317 per share, Coinbase Global Inc (NASDAQ:COIN) stock is steadily approaching its own all-time high of $357 in November 2021. However, we are likely to see a price correction after the sell the news effect wanes.

In Q3’s shareholder letter, Coinbase delivered $572.5 million in transaction revenue. While lower than during the strong Q1 at $1 billion, it nearly doubled from the year-ago quarter. Compared to $94.9 million net income in Q3 ‘23, the company generated $75 million, although pre-tax losses are obviously unrealized at the time of the filing.

Notably, Coinbase’s Base, an L2 scaling solution, also received a 55% quarterly transaction boost, now ranking first by total value locked (TVL). Compared to the closest second L2, Arbitrum One, Base holds $3 billion TVL vs $2.86 billion respectively.

According to 23 analysts, the average COIN price target is set for $243.47, while the high estimate could top the previous all-time high at $380 per share.

GameStop

The king of meme stocks should be viewed as the primary magnet that draws investor intention by notoriety alone. GameStop Corp (NYSE:GME) stock went up nearly 18% over the last week, delivering YTD returns of 57%.

Currently priced at $26.25 per share, GME stock is still above its 52-week average of $18.92, but farther from its high point of $64.83 for the same period. GameStop CEO Ryan Cohen capitalized greatly from this volatility, injecting the company with $4.19 billion in cash and cash equivalents throughout the year.

As noted back in September, this makes for a great baseline against $1.15 billion in total liabilities. By the same token, GameStop has gained much stamina for the upcoming meme trading cycles. This will largely depend on the social media influencers and their traction across major retail hubs like /r/WallStreetBets on Reddit (NYSE:RDDT).

GameStop’s next earnings call is yet to be officially announced but is expected to be between December 4th and December 9th. Given that the average S&P 500 enterprise value/EBITDA ratio is around 15, and GameStop’s is at 275.50, it would be fair to say the GME stock is overvalued even at this point.

As of mid-October, only 8.80% of outstanding GME shares were shorted, which was a 5.7% monthly drop. Despite the EV/EBITDA ratio, it is anyone’s guess where GME stock is heading next, making it a compelling memetic exposure nonetheless.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.