- Worries over soaring inflation, slowing economic growth, and rising interest rates have been the primary driver of market sentiment in recent months.

- In this article, we highlight three companies that are relatively safe amid the looming threat of stagflation, thanks to their strong fundamentals, reasonable valuations, and growing dividend payouts.

- Taking that into consideration, Kellogg, Duke Energy, and Dollar General should be on your radar.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

- P/E Ratio: 16.6

- Market Cap: $24.6 Billion

- Year-To-Date Performance: +13.2%

- P/E Ratio: 22.4

- Market Cap: $83.8 Billion

- Year-To-Date Performance: +3.8%

- P/E Ratio: 22.7

- Market Cap: $52.04 Billion

- Year-To-Date Performance: -3.5%

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

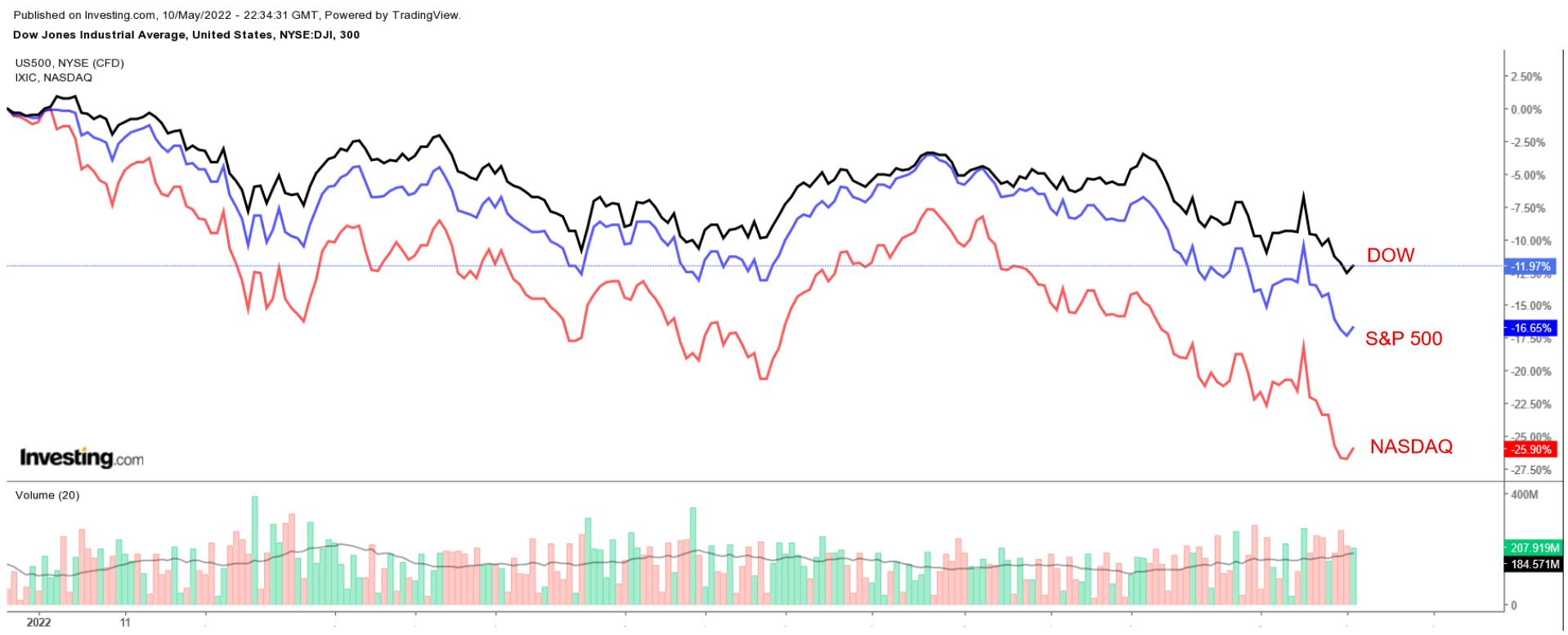

Stocks on Wall Street have endured one of their worst starts to the year in history due to the growing risk of stagflation—widely defined as persistently high inflation coupled with stagnant economic growth.

The Dow Jones Industrial Average is down 11.4% year-to-date, while the benchmark S&P 500 and the tech-heavy NASDAQ Composite are off by 16% and 24.4%, respectively.

As Wall Street continues its wild rollercoaster ride, the three stocks below are well-positioned to ride out the ongoing market turmoil as investors rush to protect themselves against the prospect of a weakening economy.

1. Kellogg

The Kellogg Company (NYSE:K) is one of the world’s biggest food manufacturing companies, best known for producing cereals and convenience foods, such as potato chips, crackers, and toaster pastries.

Some its most recognizable brands include Corn Flakes, Froot Loops, Rice Krispies, Frosted Flakes, Pringles, Cheez-It, and Eggo waffles.

While steep declines have walloped non-profitable high-growth technology companies since the start of the year, defensive areas of the consumer staples sector are seeing impressive gains as investors pile into stocks that tend to do well in a stagflationary setting.

With a P/E ratio of 16.6, Kellogg—whose shares are up about 13% year-to-date—comes at an extreme discount when compared to its notable peers, such as Kraft Heinz (NASDAQ:KHC), General Mills (NYSE:GIS), and Hormel Foods (NYSE:HRL).

The packaged-food manufacturer is also a quality dividend stock. K currently offers a quarterly payout of $0.58 per share, which implies an annualized dividend of $2.32 at a yield of 3.11%, one of the highest in the sector.

Shares of K rose to $75.52 on Tuesday, their best level since February 2017, before ending the session at $72.93, earning the Battle Creek, Michigan-based company a valuation of $24.6 billion.

In a sign of how well its business has performed amid the current environment, Kellogg reported first quarter profit and sales which blew past consensus expectations on May 6, thanks to robust demand for its wide variety of snacks.

It also raised its 2022 full-year organic sales outlook and said it plans on accelerating the pace of price hikes it pushes to consumers amid soaring costs and supply shortages.

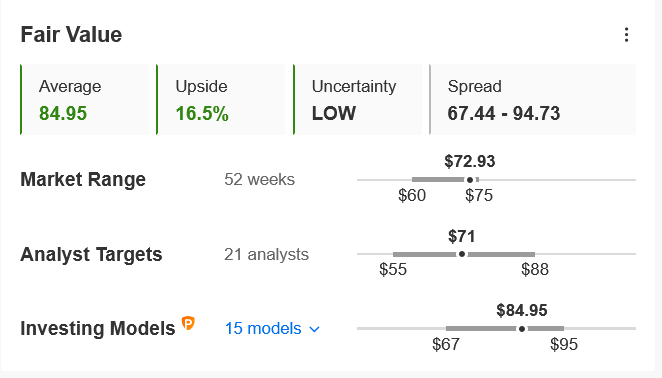

Not surprisingly, K could see an increase of around 16.5% in the next 12 months, according to the InvestingPro model, bringing it closer to its fair value of $84.95 per share.

Source: InvestingPro

2. Duke Energy

As investors fret about the toxic cocktail of accelerating inflation, slowing economic growth, and rising interest rates, Duke Energy (NYSE:DUK), one of the largest electric and natural gas utilities in the U.S., has potential to deliver strong returns in the months ahead.

Stocks of defensive companies whose products and services are essential to people’s everyday lives, such as utility providers, tend to outperform in environments of lower economic growth and soaring inflation.

In addition, Duke currently offers a relatively high quarterly dividend of $0.9850 per share. This represents an annualized dividend of $3.94 and a yield of 3.56%, making it an extremely attractive play in the current environment.

For comparison, the yield on the benchmark U.S. 10-year Treasury is hovering at around 3%, while the implied yield for the S&P 500 is currently at 1.55%.

DUK ended Tuesday’s session at $108.91, within sight of its recent all-time high of $116.33 touched on Apr. 21. At current levels, the Charlotte, North Carolina-based corporation—which is up about 4% year-to-date—has a market cap of $83.8 billion.

Duke Energy reported first quarter adjusted earnings of $1.30 per share on May 9, which came in a tad below consensus estimates for earnings per share of $1.34.

Revenue rose roughly 16% year-over-year to $7.1 billion, thanks to strong sales from its gas and electric transmission segment and renewable-energy business. Analysts expected Q1 sales of $5.7 billion.

The utility provider also reaffirmed its full-year adjusted earnings guidance range of $5.30 to $5.60 a share, as well as its long-term earnings per share growth rate of between 5% to 7% through 2026.

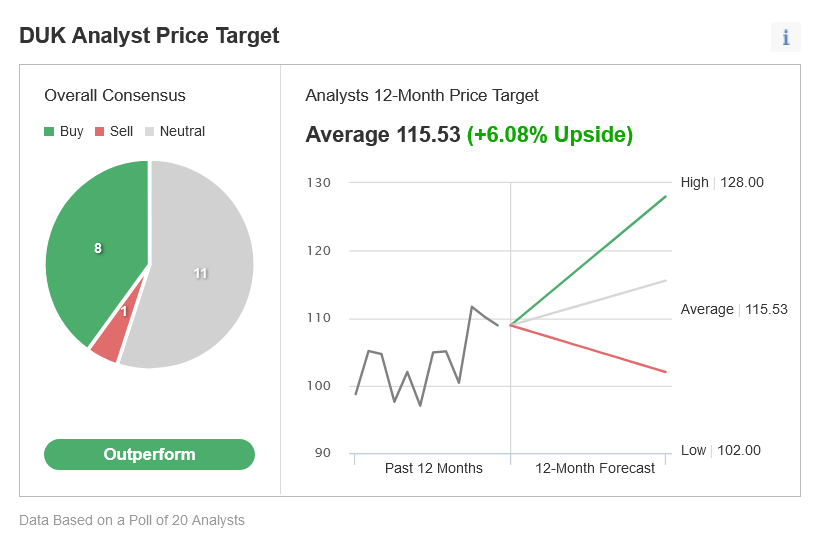

At a price point under $110, DUK comes at a moderate discount according to analysts surveyed by Investing.com, which points to over 6% upside in Duke shares from current levels over the next 12 months.

Source: Investing.com

3. Dollar General

As fears begin to mount that the U.S. economy will hit a rough patch in the months ahead, Dollar General (NYSE:DG), which operates more than 18,000 stores in 44 states, appears as an excellent value pick for investors looking to hedge in the face of further volatility.

The largest discount retailer in the U.S. mostly sells groceries, household supplies, and personal care products at rock-bottom prices. It has publicly described their core customers as households earning less than $35,000, underlining the company's recession-proof status.

Shares of DG, which are down 3.5% year-to-date, rose to an all-time high of $262.20 on Apr. 21. At session's close last night, DG reached $227.50, giving the Goodlettsville, Tennessee-based discount retailer a market cap of $52.04 billion.

Dollar General’s continuous efforts to return more cash to shareholders in the form of higher dividend payouts and stock buybacks make it an even likelier candidate to outperform in the months ahead.

The company recently increased its quarterly cash dividend by 31% to $0.55 per share. This represents an annualized dividend of $2.20 and a yield of around 1%.

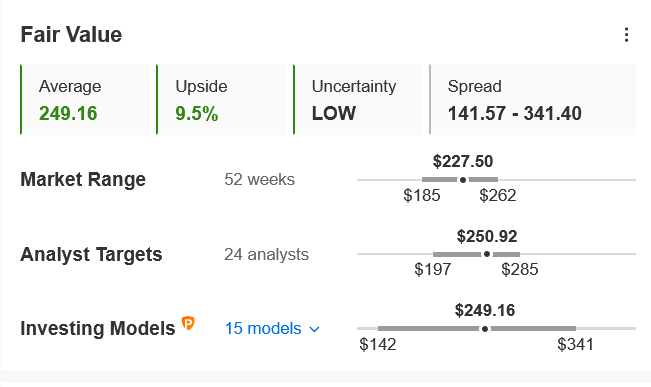

Indeed, DG is undervalued at the moment according to InvestingPro models and could see an upside of 9.5% over the next 12 months to its fair value of $249.16.

Source: InvestingPro

Dollar General, which reported mixed earnings and revenue in the previous quarter, but forecast better-than-expected full-year sales, next reports financial results ahead of the opening bell on Thursday, May 26. Consensus calls for first quarter earnings per share of $2.35 on revenue of $8.7 billion.

Perhaps of greater importance, Dollar General’s outlook for the rest of 2022 will be in focus as it deals with the ongoing impact of an accelerating inflationary environment, lingering supply chain issues, rising raw material costs, labor shortages, as well as potential changes in consumer behavior.

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »