- In this article, we will focus on finding new value-themed stocks poised to outperform as inflation fears rattle markets and the Fed tightens monetary policy.

- Using the Investing Pro+ stock screener, we highlight three companies that are relatively safe thanks to their strong fundamentals, low valuations, and growing dividend yields.

- Taking that into consideration, ZIM Integrated Shipping Services, Macy’s, and NRG Energy fit the bill.

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools and data. Learn More »

- P/E Ratio: 1.7

- Dividend Yield: 77.2%

- Market Cap: $7.4 Billion

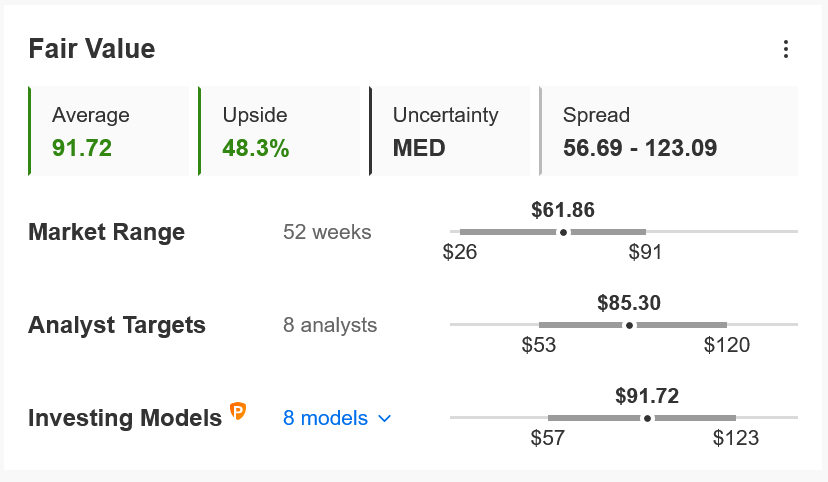

- Pro+ Fair Value Upside: +48.3%

- P/E Ratio: 5.3

- Dividend Yield: 2.66%

- Market Cap: $7.0 Billion

- Pro+ Fair Value Upside: +54.3%

- P/E Ratio: 4.2

- Dividend Yield: 3.51%

- Market Cap: $9.1 Billion

- Pro+ Fair Value Upside: +64.0%

Value stocks have been some of the market’s top performers in recent months, as investors pile into cheap companies offering substantial opportunity for upside amid the current volatility on Wall Street.

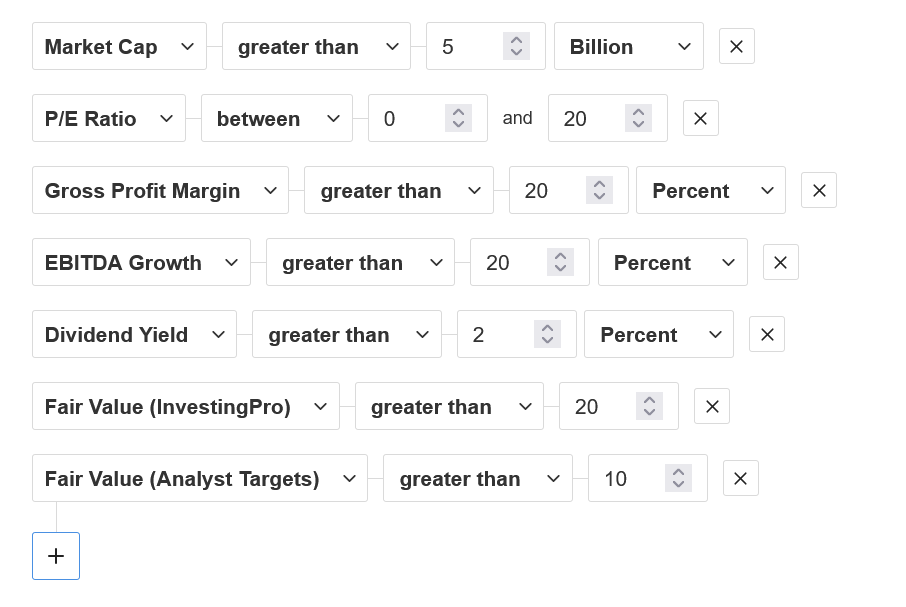

As such, using the Investing Pro+ stock screener, we ran a methodical approach to filter down the 7,500-plus stocks that are listed on U.S. exchanges into a small watchlist of established dividend-paying companies with attractive valuations.

Our focus was on stocks with a market cap of $5 billion and above, a price-to-earnings (P/E) ratio between 0 and 20, and a dividend yield greater than 2%. We then scanned for companies that enjoy both gross profit margins and EBIDTA growth of more than 20%. And those names with InvestingPro Fair Value upsides of at least 20% and analysts’ price targets greater than 10% made our watchlist.

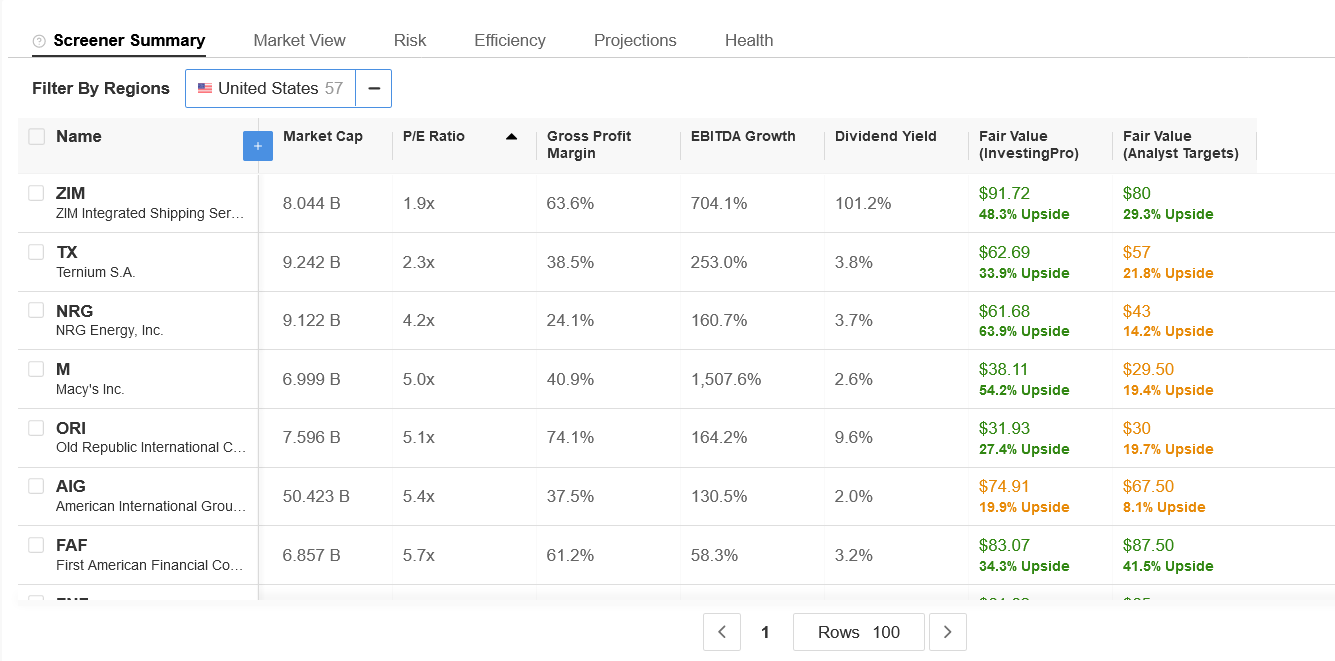

Source: InvestingPro

Digging deeper, we will break down three of the most promising names which are expected to provide the highest return in the months ahead based on the InvestingPro models.

Source: InvestingPro

1. ZIM Integrated Shipping Services

ZIM Integrated Shipping Services (NYSE:ZIM), commonly known as ZIM, is an international cargo shipping company. It owns and operates a fleet of 118 vessels, which includes 110 container vessels and 8 vehicle transport vessels, making it one of the world’s top 20 carriers.

The Israel-based company, which made its debut on the New York Stock Exchange in January 2021 at $15 per share, has benefited from a potent combination of surging freight rates and a favorable demand environment amid ongoing global supply chain issues.

ZIM stock closed at $61.86 on Tuesday. At current levels, the integrated shipping company—which is up about 134% over the last 12 months—has a market cap of $7.4 billion.

Source: Investing.com

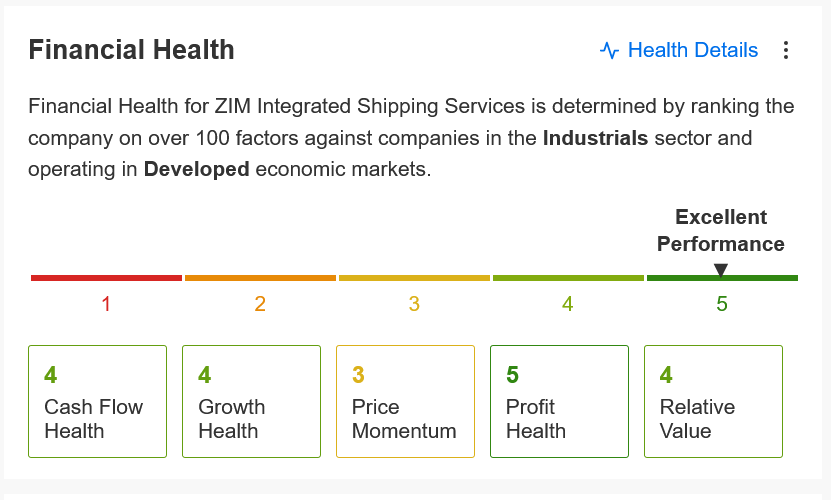

With a perfect Pro+ financial health score of 5/5 and an extremely attractive valuation, ZIM stock fits the bill as a solid name to own amid the current inflationary environment.

Source: InvestingPro

The shipping giant trades at a P/E ratio of just 1.7, which according to InvestingPro, is cheaper by 82% than the sector median of 11.0. In addition, ZIM leads the sector for some of its profitability metrics, enjoying gross profit margins of nearly 64%, and whopping year-over-year EBIDTA growth of more than 700%.

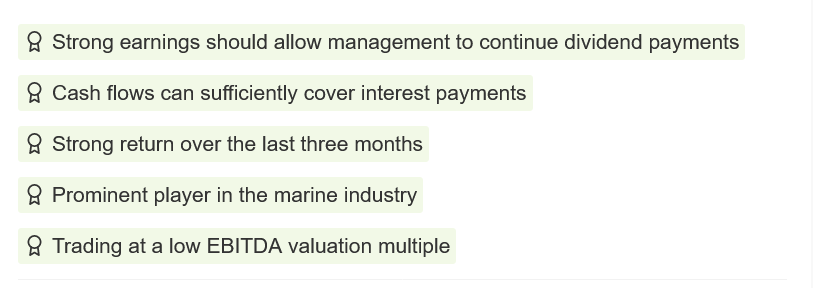

Pro+ also highlights a number of additional tailwinds the company currently has going for it, such as strong earnings and cash flow growth, as well as a low EBIDTA valuation multiple.

Source: InvestingPro

Taking that into account, ZIM is a strong buy to add to a portfolio, especially when you consider its solid earnings outlook and sky-high dividend yield. Indeed, ZIM stock could see an increase of around 48% in the next 12 months, according to the InvestingPro model, bringing it closer to its fair value of $91.72 per share.

Source: InvestingPro

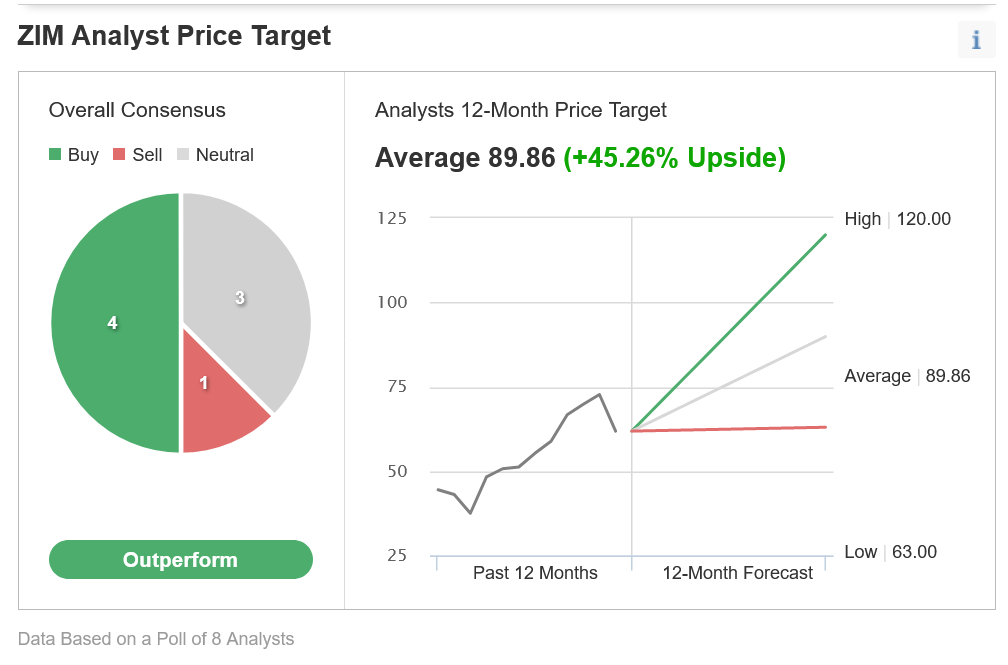

Analysts are also optimistic on the global container liner, citing strong shipping market fundamentals. The average ZIM stock analyst price target is around $90.00, representing an upside of approximately 45% from current levels over the next 12 months.

Source: Investing.com

2. Macy’s

Macy’s (NYSE:M) has been one of the standout performers in the retail sector over the past year, with the department store giant reaping the benefits of the vaccine-led return to normalcy.

Shares of the iconic department store chain have gained roughly 56% in the last 12 months as consumers flocked back to the mall in greater numbers amid the fading COVID health crisis.

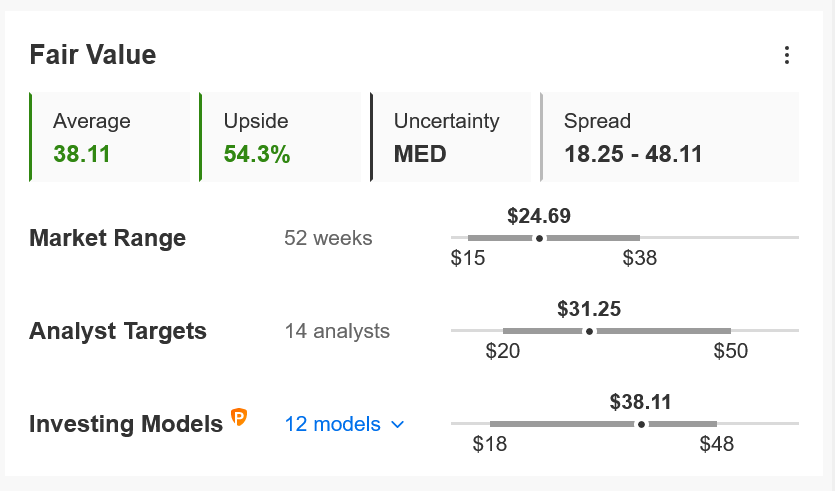

M shares closed at $24.69 yesterday, earning the New York, New York-based retail company a valuation of $7.0 billion. Macy's stock now stands approximately 35% below its recent 52-week high of $37.95 reached in November 2021.

Source: Investing.com

Macy’s appears as an excellent value pick for investors looking to hedge in the face of further volatility in the months ahead thanks to its reasonable P/E ratio of 5.3, and appealing annualized dividend of $0.63 per share at a yield of 2.66%. Indeed, with gross profit margins of 40.9% and EBITDA growth of 1,500%, the future appears bright for Macy’s.

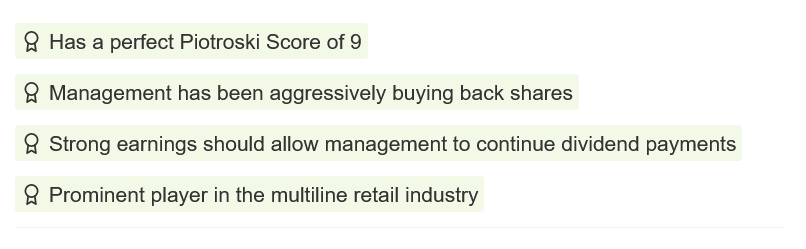

Pro+ calls out a few more key insights on the stock, with the share buyback and dividend payout points standing out the most:

Source: InvestingPro

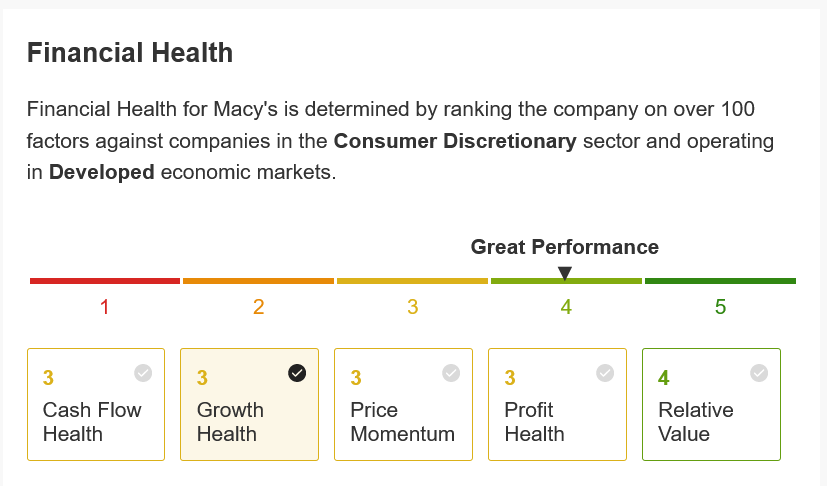

Then, Pro+ provides a quick snapshot of the department store chain’s financial health condition, which earned a score of 4/5:

At a price point under $30, M comes at an extreme discount according to the quantitative models in InvestingPro, which point to a roughly 54% upside in Macy’s shares from current levels over the next 12 months.

Source: InvestingPro

3. NRG Energy

Founded in 1989, NRG Energy (NYSE:NRG) is one of the largest independent energy companies in the U.S. The electric utility company is involved in the production, selling, and delivery of electricity and related products to approximately 6 million residential, commercial, industrial, and wholesale customers in 10 states across the Northeast and Midwest regions.

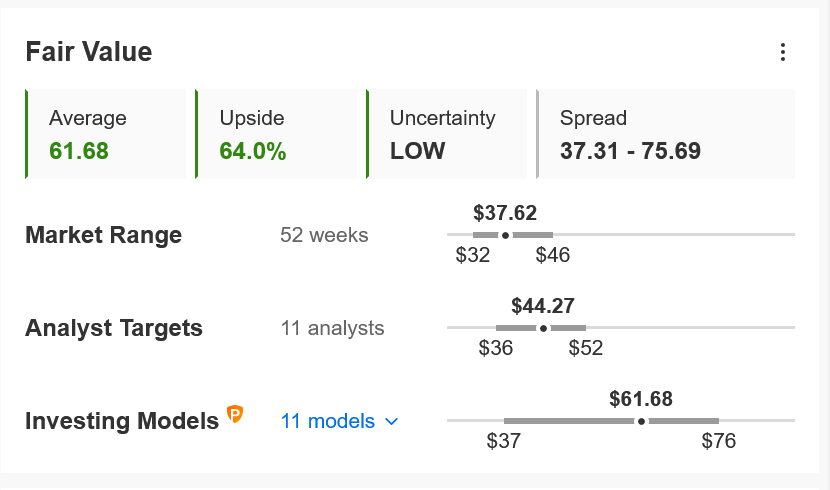

It also provides power through renewable products, including solar and wind, as well as carbon management services. Shares of the Houston, Texas-based integrated power firm ended at $37.62 last night, roughly 18% below their recent 52-week high of $46.10 touched in August 2021, giving it a market cap of $9.1 billion.

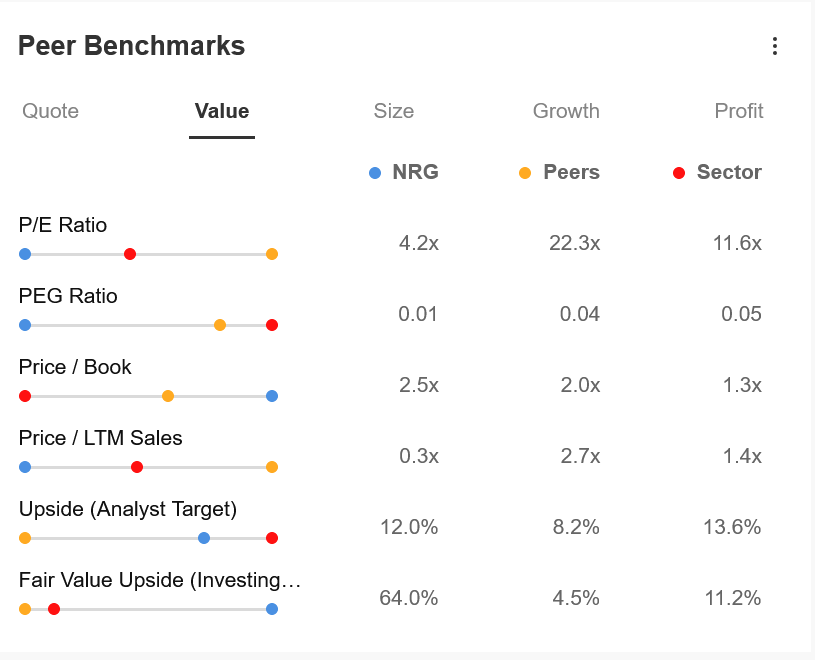

NRG is a bargain play compared to the broader market in the current environment thanks to its ultra-low valuation relative to others in the energy sector as well as ongoing efforts to return more capital to shareholders.

It trades at a P/E ratio of 4.2, much lower than the sector median of 11.6 and significantly cheaper when compared to its peers, which possess a collective P/E ratio of 22.3.

Source: InvestingPro

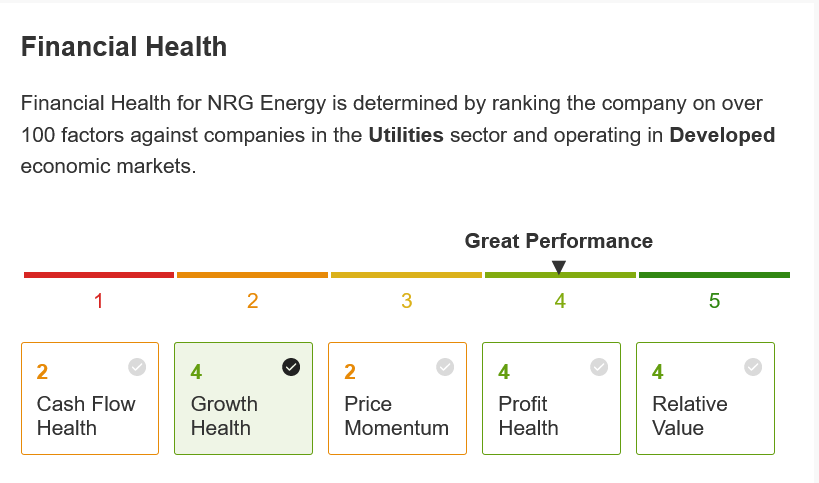

As Pro+ points out, NRG is in great financial health condition, thanks to strong profit and growth prospects, combined with its attractive valuation.

Source: InvestingPro

The stock’s hefty dividend payout and attractive yield make NRG an even likelier candidate to outperform in the months ahead. The company recently increased its quarterly cash dividend by almost 8% to $0.35 per share. This represents an annualized dividend of $1.40 and a yield of 3.51%, one of the highest in the sector.

Not surprisingly, NRG shares are undervalued at the moment according to InvestingPro models, and could see an upside of 64% over the next 12 months to its fair value of $61.68.

Source: InvestingPro

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.