Recent days saw the four major U.S. indices hit all-time highs. Yet, not every sector had a strong 2020. Namely, shares of companies in the energy, leisure, travel, insurance and real estate sectors, especially on the commercial side, suffered significant losses, particularly in the earlier part of last year.

Today, we concentrate on energy and real estate and introduce two exchange-traded funds (ETFs) that can appeal to contrarian investors ready to get bullish on either sector.

1. Pacer American Energy Independence ETF

- Current Price: $19.51

- 52-Week Range: $8.25-$23.31

- Dividend Yield: 7.34%

- Expense Ratio: 0.75%

The Pacer American Energy Independence (NYSE:USAI) provides exposure to U.S. and Canadian companies that generate revenue from midstream energy infrastructure activities.

In the oil and gas industry, companies usually concentrate on three types of activities:

- Upstream, which involves exploration, drilling and production;

- Downstream, which involves refining and turning crude oil and natural gas into finished products, like gasoline, diesel, jet fuels, asphalt and fertilizers, as well as marketing activities;

- Midstream, which is a bridge between upstream and downstream, and mainly involves transportation and storage actives. They make up an important link in the oil and gas value chain.

Energy infrastructure companies in the midstream sector typically have a ”toll-based” business model, whereby they earn a contracted fee for each unit of transport volume. As a result, volumes are crucial for midstream operators.

This means that if, for instance, the price of oil or the demand for it declines so much that upstream companies stop production, then transportation by midstream companies would not necessarily be required.

In the early days of the pandemic, the world saw a steep fall in the demand and price of oil. Shares of most energy companies crashed.

Oil majors like Chevron (NYSE:CVX), ExxonMobil (NYSE:XOM), BP (LON:BP) (NYSE:BP) and Royal Dutch Shell (LON:RDSa) (NYSE:RDSa)) (NYSE:RDSb) got beaten down. A large number of firms cut their dividends in an effort to strengthen their balance sheets and cash positions.

In June 2020, Moody’s announced, the “outlook for the global midstream energy sector has been changed for the first time to negative from stable.”

USAI, which has 34 stocks, tracks the returns of the American Energy Independence Index, which is rebalanced quarterly. The fund started trading in December 2017. As net assets are about, $17 million, it is still a small fund.

More than 61% of the fund's weighting is concentrated in the top 10 names. Kinder Morgan (NYSE:KMI), ONEOK (NYSE:OKE), TC Energy (NYSE:TRP) and Enbridge (NYSE:ENB) lead the roster.

The ETF is down about 15% in the past 52 weeks. However, since the start of 2021, the fund has returned 6.5%. Investors who believe midstream companies are likely to benefit from a potential increase in oil demand soon might consider buying the dips in USAI.

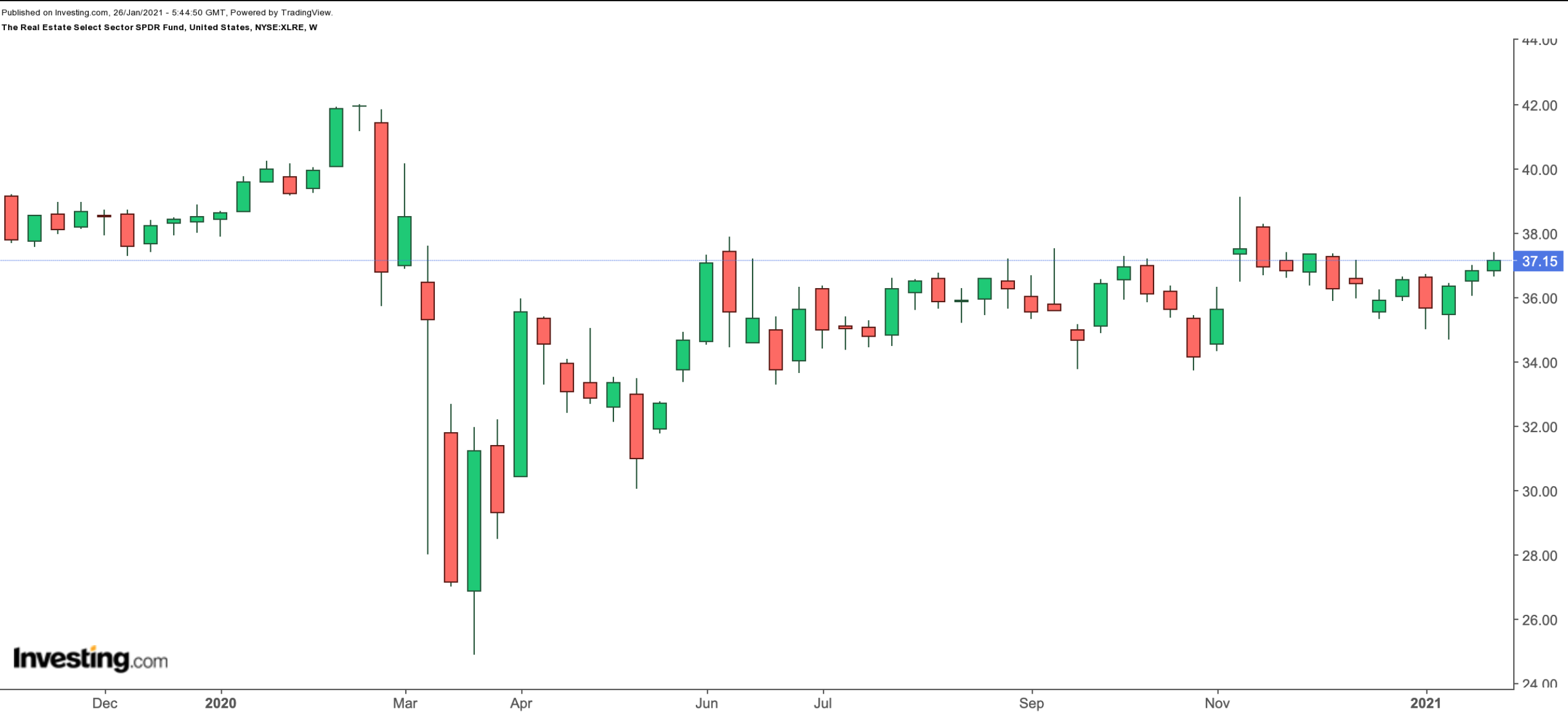

2. The Real Estate Select Sector SPDR Fund

- Current Price: $37.15

- 52-Week Range: $24.88-$42.00

- Dividend Yield: 3.13%

- Expense Ratio: 0.13%

The Real Estate Select Sector SPDR Fund (NYSE:XLRE) gives access to the real estate sector of the S&P 500 Index. Since the fund’s inception in October 2015, assets under management have grown to $2.2 billion.

XLRE, which follows the Real Estate Select Sector Index currently has 31 holdings. The index includes real estate management and development companies and equity real estate investment trusts (REITs), but excludes mortgage REITs.

About 65% of the assets are in the top 10 stocks. Boston-based REIT American Tower (NYSE:AMT); Prologis (NYSE:PLD), which invests in logistics facilities; Crown Castle International (NYSE:CCI); digital infrastructure company group Equinix (NASDAQ:EQIX); and Digital Realty Trust (NYSE:DLR), which owns and operates data centers, are among the leading names in the fund.

In recent months, the fund has allocated more weighting to industrial and specialty (such as digital infrastructure) REITs. Retail REITs, which have suffered significantly during the pandemic, are now not as important as they used to be.

Over the past year, XLRE is down about 7%, but year-to-date it has returned close to 2%. Potential investors could consider investing at around $35, a level that would offer an improved margin of safety.