1Spatial (LON:SPA) announced the signing of a new multi-year contract with Atkins to support delivery of the National Underground Asset Register (NUAR) project, with a total potential value of £6.5m over 37 months. The win followed a competitive tender process, and as a key supplier to the UK government’s Geospatial Commission, 1Spatial will be leading the development of the project’s multi-year data transformation and data ingestion programme. We make a slight upgrade to our FY22 and FY23 forecasts to reflect the £0.5m committed portion, while if all goes to plan, the £6.0m optional component would fall in future years. We are encouraged by 1Spatial’s continued contract momentum and see scope for an acceleration given current execution and structural trends.

Share price performance

Multi-year contract with Atkins to support NUAR

The latest phase of the government’s NUAR project involves building a digital map of the UK’s underground pipes and cables. 1Spatial will lead the development of the multi-year data transformation and data ingestion programme for Atkins. This platform will utilise 1Spatial’s patented 1Integrate and 1Data Gateway software to assist in uploading and transforming the asset data from many providers.

Contract adds £0.5m revenue over FY22 and FY23

1Spatial’s portion of the project is slated for a three-year period, with an initial commitment for seven months and c £0.5m revenue. The initial stage is then followed by two option periods spanning 30 months for c £6.0m in spatial technology licences and services. We are adding £0.2m to FY22’s top line and c £0.3m to FY23 to reflect the committed portion of the deal.

Valuation: Scope for further upside

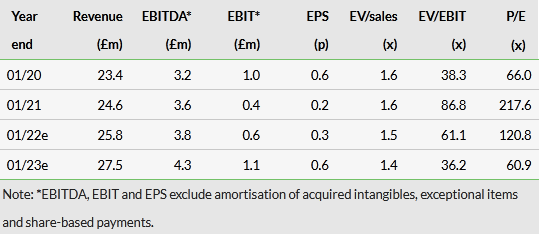

Trading at 38.5p (10 September closing price), 1Spatial’s share price is up 35% in the year-to-date. The FY22e P/E of 121x reflects modest margins at present while the company’s EV/sales at below 2x is well below most software and services companies. We see scope for growth to accelerate and margins to expand, driving further upside in the share price.

Encouraging win leads to updated forecasts

The NUAR digital mapping project for the UK’s underground pipes and cables forms part of the UK government’s ‘Build back better and greener’ initiative. The project is designed to assist in speeding up the delivery of housing and infrastructure projects and enabling critical and local services to be more efficiently maintained and delivered to customers. Atkins, a subsidiary of SNC Lavalin (SNC, TSX), is a global design, engineering and project management consultancy and is the prime contractor for the NUAR project. 1Spatial will be leading the development of the ‘data transformation and data ingestion platform that will allow many hundreds of Asset Owners to upload and automatically transform their underground asset datasets from their source representation to a target data model.’

The Atkins win is encouraging for 1Spatial, as it supports recent contract momentum in the UK (Defra, National Energy System Map) and the US (‘Next generation 911’ win, an extension with the US Federal Highways Administration, and contracts with Google (NASDAQ:GOOGL) and the California Office of Emergency Services).

Forecasts updated for committed portion of contract

We make a slight tweak to our forecasts for the committed £0.5m, now assuming revenues of £25.8m in FY22 and £27.5m in FY23. The remaining £6.0m from the contract is optional and while we did not add it to our forecasts, if exercised, it would materially benefit future years.

Valuation: Further contract wins should drive upside

At 38.5p (10 September closing price), 1Spatial is up 35% year-to-date and 29% over the last 12 months. 1Spatial’s FY22e P/E multiple of 121x and FY23e P/E multiple of 61x reflect modest margins, while the sub 2x EV/sales is well below most software and services companies. We see scope for revenue growth to accelerate and margins to expand driving further upside in the share price. Further contract wins in the UK and United States and continued execution should justify multiple expansion. 1Spatial will report interim results for H122 (the six months ending 31 July 2021) on 29 September 2021.

Click on the PDF below to read the full report: