The backup in bond yields since mid-September did not surprise us. But it has surprised lots of other financial pundits, who are warning that this could be bad news for stocks. It could be, especially if the 10-year US Treasury bond yield revisits last year's high of 5.00%. That would probably bring a buying opportunity in the bond and stock markets. We think that bond yields have normalized. The 10-year yield should range between 4.00% and 5.00%, as it did in the years before the Great Financial Crisis. Consider the following related developments:

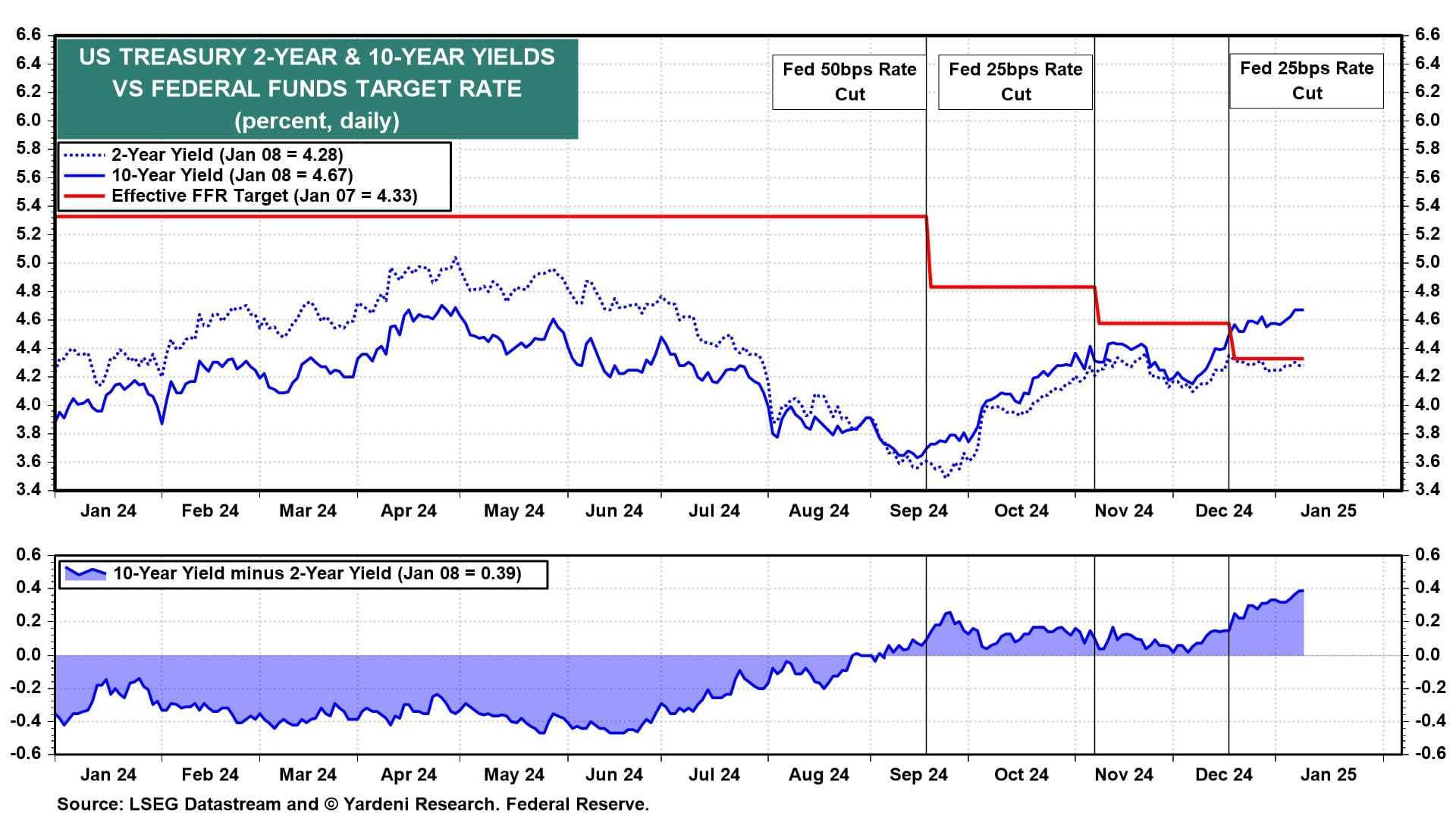

The US Treasury yield curve steepened to a positive 39bps yesterday, its highest reading since May 2022 (chart). The yield curve has "bear steepened," meaning the 10-year yield has risen faster than the 2-year yield.

The yield curve was roughly flat before the Federal Open Market Committee's (FOMC) jumbo 50bps cut on September 18. Despite strong economic data during Q4 and signs of stickier inflation, the Fed cut the federal funds rate (FFR) by additional 25bps on November 7 and again on December 18 for a full 100bps of easing.

That led the Bond Vigilantes to conclude that monetary policy is stimulating an economy that doesn't need to be stimulated. That's been our assessment since August of last year, and we predicted that yields would rise, especially after the Fed eased. The 10-year yield is up 100bps since the day before the Fed started easing on September 18.

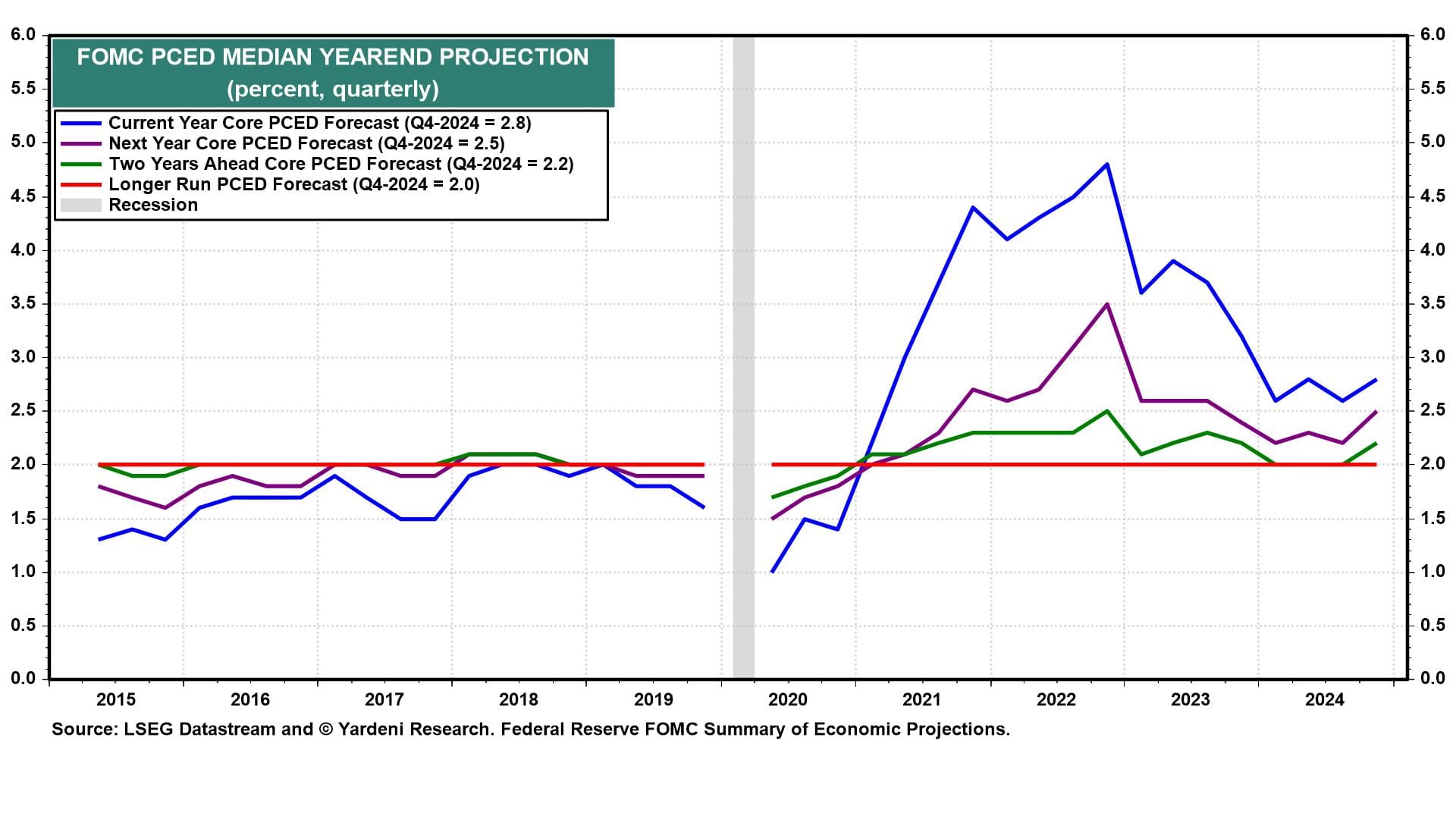

At the FOMC's December meeting, the median core PCED inflation projection of the participants rose from 2.2% to 2.5% (chart). Minutes from that meeting, released yesterday, showed participants partly raised their projections due to worries about tariff and deportation policies under Trump 2.0.

Meanwhile, Fed Governor Christopher Waller suggested in comments earlier yesterday that he expects to brush off any price impacts from tariffs:

"If, as I expect, tariffs do not have a significant or persistent effect on inflation, they are unlikely to affect my view of appropriate monetary policy."

His views and Fed Chair Jerome Powell's have aligned for several months.

FFR futures are pricing in roughly two or three more 25bps rate cuts this year (chart). We don't think the economy needs the extra juice. Additional rate cuts would likely prompt us to increase our odds of a stock market meltup from 25% to 30%.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.