Friday was a mixed day for stocks on Wall Street, but the benchmark S&P 500 index still scored its third weekly gain in a row amid optimism surrounding the third quarter earnings season currently underway.

Earnings kick into high gear this coming week, with reports expected from the mega-cap tech stocks, including Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Google-parent Alphabet (NASDAQ:GOOGL), and Facebook (NASDAQ:FB).

We'll also see other high-profile companies reporting too, such as Boeing (NYSE:BA), Caterpillar (NYSE:CAT), McDonald’s (NYSE:MCD), Coca-Cola (NYSE:KO), General Electric (NYSE:GE), Visa (NYSE:V), Mastercard (NYSE:MA), Ford (NYSE:F), General Motors (NYSE:GM), United Parcel Service (NYSE:UPS), and Exxon Mobil (NYSE:XOM).

Add to the above important third quarter U.S. growth data releases, and the week is setting up to be abuzz with information.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand in the coming days and another which could see fresh losses.

Remember though, our timeframe is just for the week ahead.

Stock To Buy: Datadog

Datadog (NASDAQ:DDOG) will be in focus this week, as the high-flying enterprise software maker, which provides a monitoring and security platform for cloud applications, hosts a much anticipated investor day event on Wednesday, Oct. 27.

The Wednesday presentations—which will be broadcast live on the Datadog website starting at 9:30AM ET—are part of the company’s annual ‘Dash 2021’ user conference, which kicks off on Tuesday. Chief Executive Officer Olivier Pomel, and other members of the DDOG leadership team, are expected to reveal fresh details on the cybersecurity company’s new products and features.

Last year, Datadog shares rose 9% in the week following the event.

Datadog, which counts names such as FedEx (NYSE:FDX), AT&T (NYSE:T), and Airbnb (NASDAQ:ABNB) as customers, has been thriving this year, as it benefits from robust demand for its cloud observability solutions across the enterprise segment.

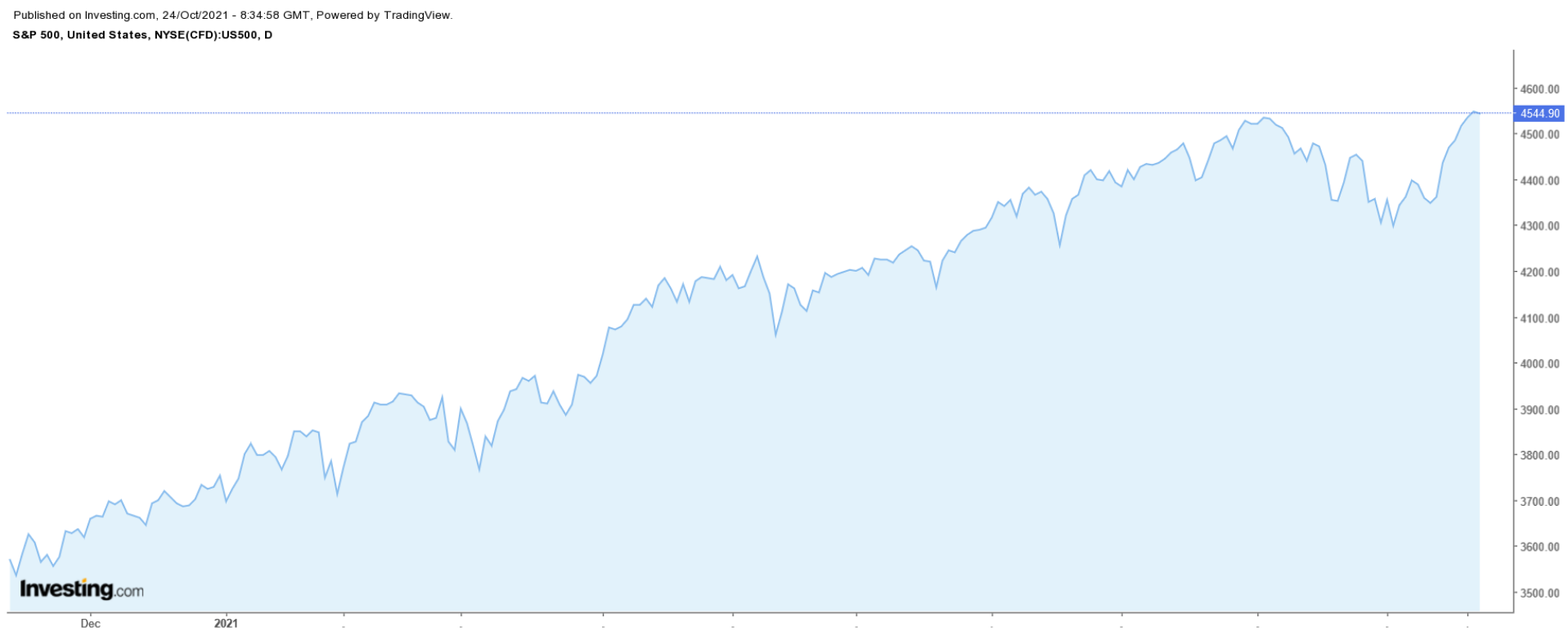

DDOG stock ended at a new all-time high of $162.39 on Friday, earning the New York-based monitoring and analytics platform specialist a valuation of $50.3 billion. Year-to-date, Datadog shares have climbed 65%, easily outperforming the S&P 500’s 21% increase over the same timeframe.

Datadog is scheduled to report third quarter financial results before U.S. markets open on Thursday, Nov. 4. Consensus expectations call for EPS of $0.06, improving 20% from the year-ago period. Revenue meanwhile is forecast to jump 60% year-over-year to a record $247.8 million, reflecting soaring demand for its cloud-based security tools.

Stock To Dump: Twitter

Twitter (NYSE:TWTR) stock is expected to suffer another volatile week as investors brace for disappointing financial results from the Jack Dorsey-led social media platform. The San Francisco, California-based tech company is scheduled to report third quarter numbers after the U.S. market close on Tuesday, Oct. 26.

Analysts are calling for earnings per share of $0.17, declining roughly 10% from EPS of $0.19 in the year-ago period. Revenue, meanwhile, is expected to rise around 38% year-over-year to $1.29 billion.

Beyond the top-and-bottom line numbers, investors will pay close attention to Twitter’s update regarding the number of its monetizable daily active users (mDAUs). Twitter said the key metric grew by 11% YoY to 206 million in the last quarter.

Perhaps of greater importance, Twitter’s outlook for the rest of the year will be eyed as it deals with the negative impact caused by changes in Apple’s iOS 14.5 release, which limits its ability to track users' activity across third-party sites.

Last week, Snap (NYSE:SNAP)—which like Twitter generates most of its revenue from advertising—reported awful Q3 results and sent an industry-wide warning that Apple’s privacy changes severely disrupted its ad business.

Based on moves in the options market, traders are pricing in a possible implied shift of 12.9% in either direction in Twitter shares following the results.

TWTR stock, which is up 15% year-to-date, closed Friday’s session at $62.24, well below the all-time peak of $80.75 reached on Feb. 25. At current levels, the social media network has a market cap of about $49.5 billion.