- For the week ahead, the focus will be on Fed Chair Powell's speech and the ISM Services PMI.

- ExxonMobil is a buy amid fresh oil-market developments.

- DocuSign is set to struggle on a worsening long-term outlook.

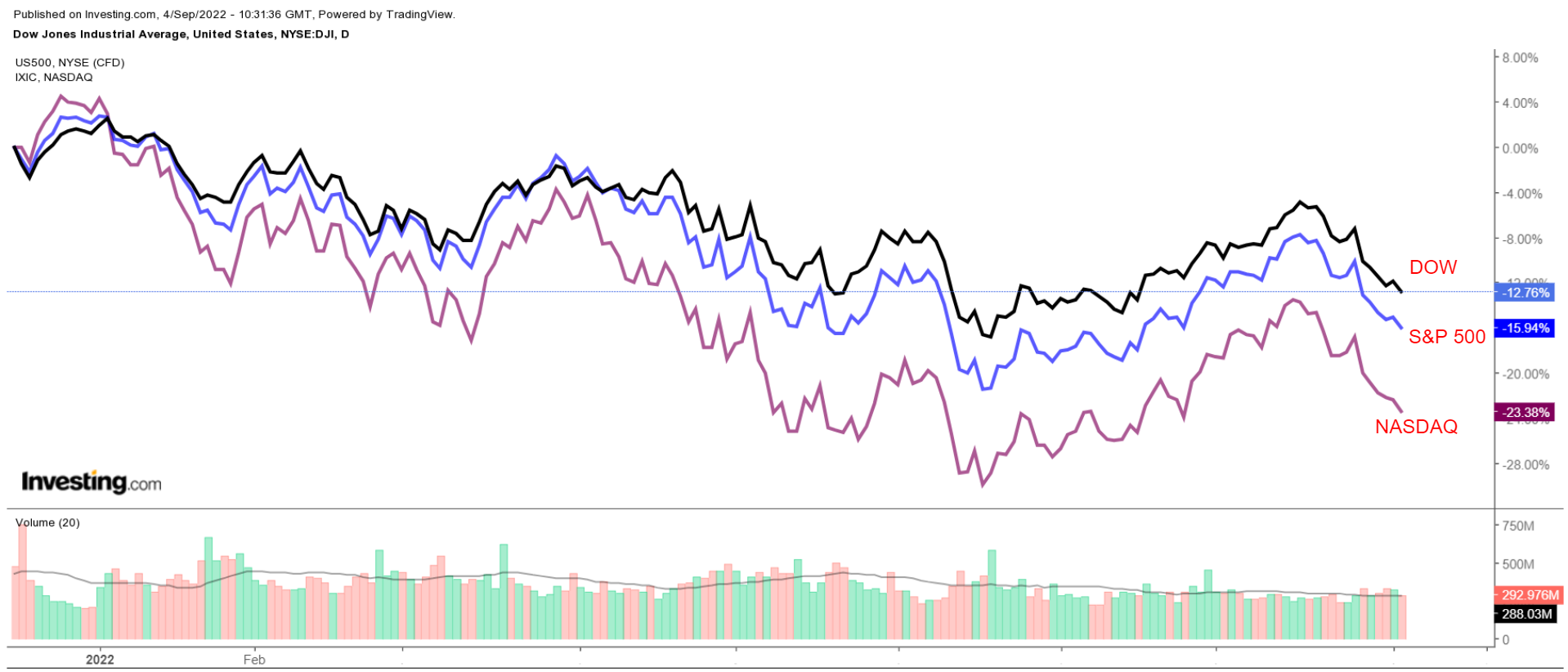

Stocks on Wall Street tumbled on Friday to suffer their third straight weekly decline, after upbeat nonfarm payrolls data failed to ease concerns that the Federal Reserve would keep hiking interest rates to tame inflation.

For the week, the blue-chip Dow Jones Industrial Average lost 3%, while the benchmark S&P 500 and the tech-heavy Nasdaq Composite declined 3.3% and 4.2% respectively.

Source: Investing.com

The holiday-shortened week ahead - which will see U.S. stock markets closed on Monday for the Labor Day holiday - is expected to be a rather quiet one.

On the economic calendar, most important will be comments from Fed Chair Jerome Powell, who is due to participate in a discussion at the Cato Institute's monetary policy conference at 9:10 a.m. ET Thursday.

Meanwhile, there are just a handful of companies reporting corporate results as earnings season winds to a close, including GameStop (NYSE:GME), Zscaler (NASDAQ:ZS), and Kroger (NYSE:KR).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another that could see further downside.

Remember though, our time frame is just for the upcoming week.

Stock To Buy: ExxonMobil

I believe shares of ExxonMobil (NYSE:XOM) could revisit their recent all-time highs in the coming week amid growing fears that fresh U.S. and European sanctions on Russia’s energy sector will result in a severe global oil-supply disruption.

The Group of Seven (G7) finance ministers agreed on Friday to implement a price cap on Russian crude and related petroleum products.

In response, Russia vowed to stop selling oil to countries imposing the cap, warning it would destabilize global energy markets.

Industry experts and analysts have previously cautioned that a disruption to Russian supply could see crude prices skyrocket to record highs above $200 per barrel.

Russia exports roughly 5 million barrels of oil per day, making it the world’s second-largest exporter after Saudi Arabia.

Speaking of the Saudis, oil will also likely continue to draw support from expectations that OPEC+ will discuss output cuts at this week’s meeting.

Source: Investing.com

XOM stock, which has outperformed the broader market by a wide margin this year, ended Friday’s session at $95.59, within sight of its record peak of $105.57 touched on June 8.

The Irving, Texas-based energy giant has seen shares rally 56.2% year to date to give it a market cap of $398 billion as it profits from higher commodity prices, improving global demand, and streamlined operations.

Exxon has also benefitted as investors seeking to shield themselves from further Fed-induced volatility piled into defensive-minded oil-and-gas stocks with reasonable valuations and a strong dividend.

Indeed, the energy sector remains one of the biggest winners of 2022 with a 44% gain year to date, despite a recent pullback.

Stock To Dump: DocuSign

I expect DocuSign (NASDAQ:DOCU) to suffer a challenging week as investors brace for disappointing financial results from the struggling e-signature company amid worries over its long-term prospects.

Moves in the options market are pricing in a sizable swing for DOCU stock following the update, with a possible implied move of 19.6% in either direction.

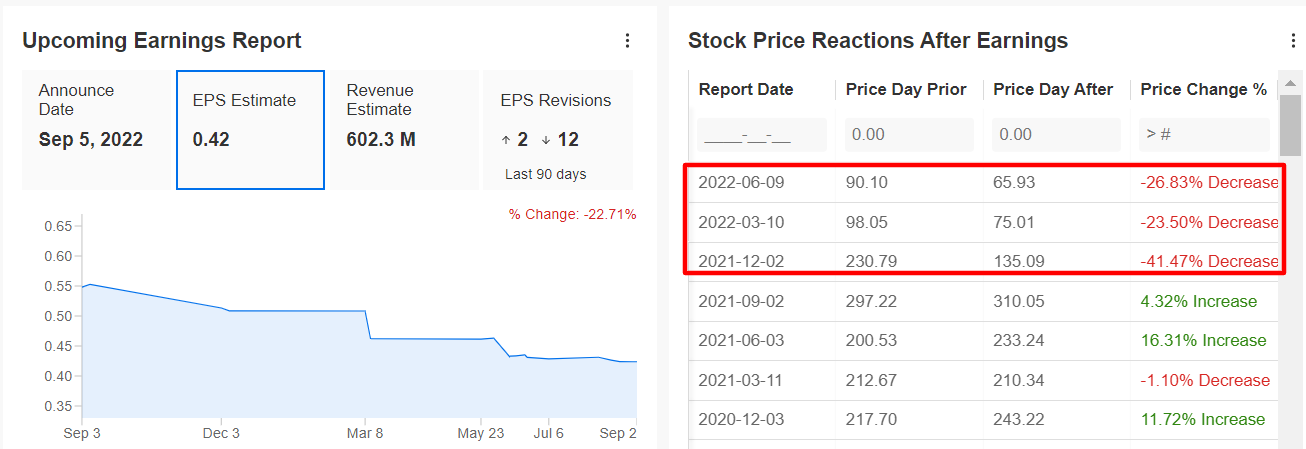

Source: InvestingPRO+

Consensus estimates call for the San Francisco-based firm to post earnings per share of $0.42 when it releases second-quarter numbers after the U.S. market closes on Thursday, Sept. 8, down 10.8% from a year ago.

Revenue is forecast to increase 17.7% year over year to $602.3 million.

If confirmed, that would mark the slowest pace of annualized sales growth in its history, reflecting receding demand for its e-signature tools due to fading COVID-era restrictions.

As a result, DocuSign’s update regarding its total customer additions will be in focus as it faces a challenging operating environment.

In addition, DocuSign’s guidance for the rest of the year will be scrutinized amid mounting fears that the company’s core growth story is coming to an end as it deals with several macro headwinds.

In fact, the digital-signature software company’s outlook in the previous three quarters fell far short of estimates and triggered a selloff in shares, which are currently languishing near their lowest level since September 2019.

Source: Investing.com

DOCU stock - which is down 64% year to date - closed Friday’s session at $54.45, roughly 82% below its record peak of $314.76 reached in July 2021.

At current levels, the electronic signature solutions provider has a market cap of $10.9 billion.

DocuSign, which soared throughout the pandemic and was widely viewed as one of the big winners from the shift to the work-from-home environment, has seen its valuation crumble amid steep declines in high-growth tech stocks, especially those that have expensive price-to-earnings ratios.

Disclosure: At the time of writing, Jesse has no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI