- Fed rate hike, Q2 GDP data, mega-cap tech earnings in focus

- Exxon Mobil stock is a buy with record earnings coming up

- Roku set to struggle amid slowing revenue, weak outlook

Any company’s financials for the last 10 years

Financial health scores for profitability, growth, and more

A fair value calculated from dozens of financial models

Quick comparison to the company’s peers

Fundamental and performance charts

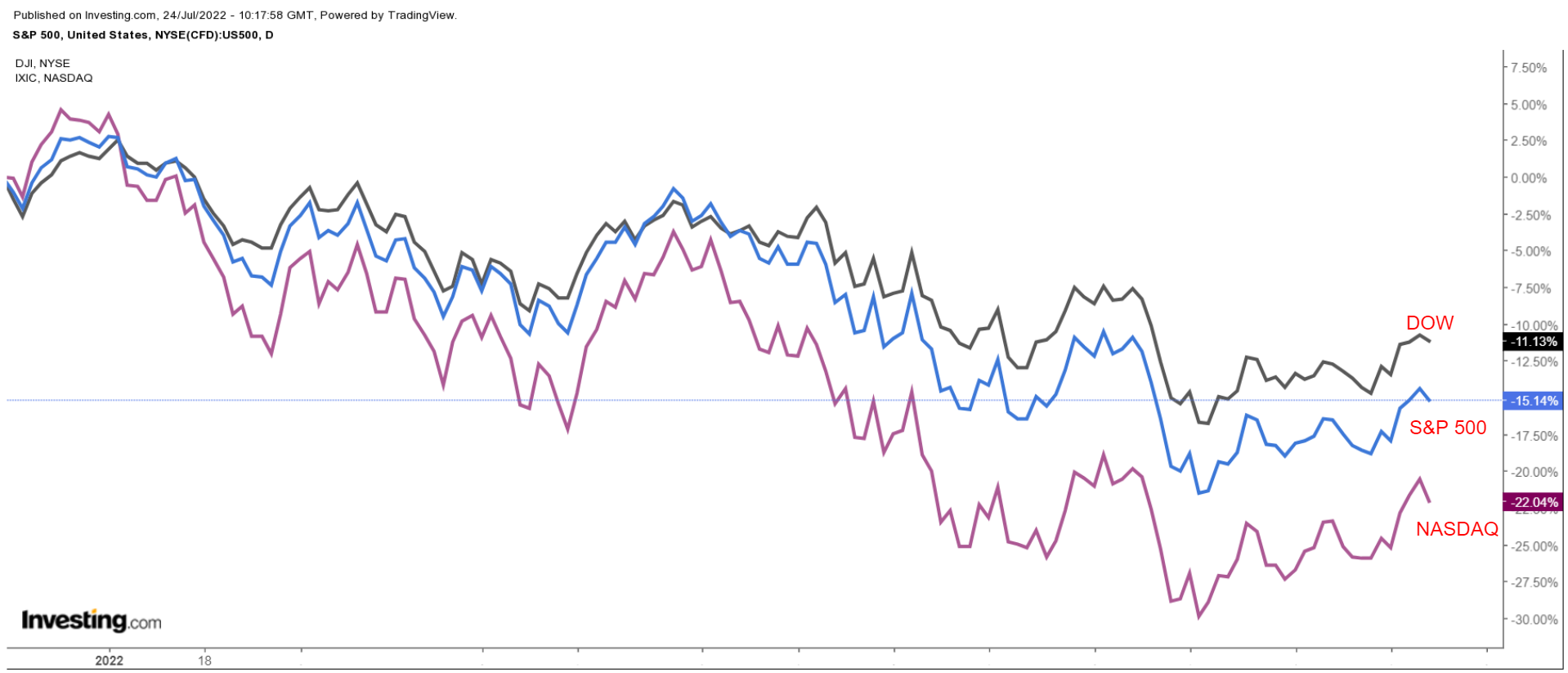

Stocks on Wall Street ended lower on Friday, as disappointing earnings from Snap (NYSE:SNAP) spooked investors.

Still, all three major indexes posted weekly gains, with the tech-heavy Nasdaq Composite closing out the week 3.3% higher. The benchmark S&P 500 advanced 2.4%, while the blue-chip Dow Jones Industrial Average gained 2%.

The busiest - and what could be the most important - week of the summer is coming up, with the Federal Reserve widely expected to deliver another jumbo-sized 75 basis point rate hike at the conclusion of its policy meeting on Wednesday.

In addition, Thursday will see important second-quarter growth data, which will provide more clues as to whether the economy is heading for recession.

The personal consumption expenditures (PCE) price index, which is the Fed’s preferred inflation measure, then comes out Friday morning.

Elsewhere, Q2 earnings season kicks into high gear, with reports expected from the mega-cap tech stocks, including Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Google parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META).

The earnings agenda also includes other high-profile companies, such as Boeing (NYSE:BA), UPS (NYSE:UPS), General Electric (NYSE:GE), McDonald’s (NYSE:MCD), Coca-Cola (NYSE:KO), Visa (NYSE:V), Mastercard (NYSE:MA), Ford (NYSE:F), General Motors (NYSE:GM), Intel (NASDAQ:INTC), Qualcomm (NASDAQ:QCOM), and Pfizer (NYSE:PFE).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another that could see further downside.

Remember though, our time frame is just for the upcoming week.

Stock To Buy: Exxon Mobil

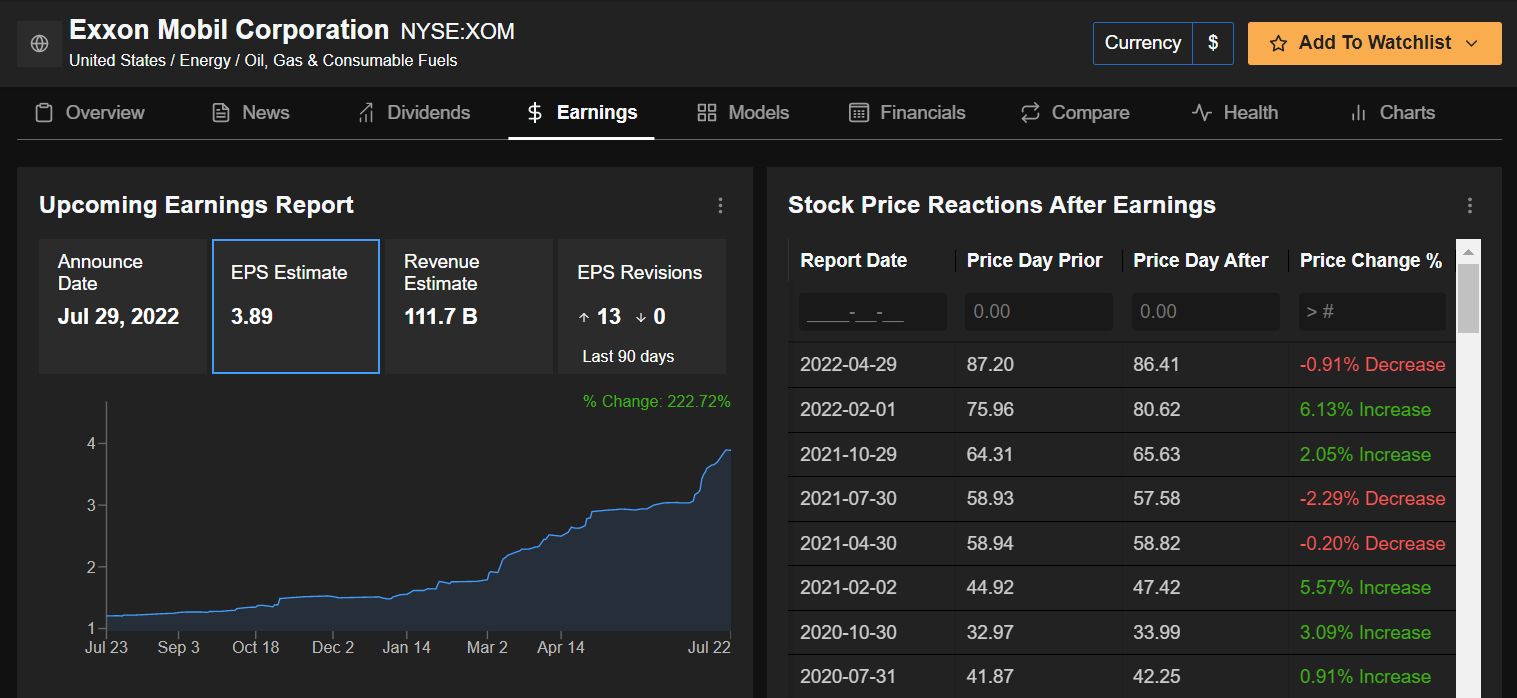

Exxon Mobil (NYSE:XOM), which has been a standout performer in the booming energy sector this year, could see increased buying activity this week as investors await strong quarterly earnings from one of the world’s largest energy companies.

Consensus expectations call for the Irving, Texas-based oil-and-gas producer to report second-quarter earnings per share of $3.89 ahead of the opening bell on Friday, July 29, improving by a whopping 253% from EPS of $1.10 in the year-ago period.

Revenue is forecast to jump approximately 65% year over year to $111.7 billion as the energy giant benefits from streamlined operations in its upstream segment, as well as robust commodity prices and improving energy market fundamentals.

If those numbers are accurate, Exxon’s quarterly profit and sales total will mark their highest levels since Q3 2008 - a sign of how well its core business has performed amid the current environment.

Beyond the top and bottom line, investors will be eager to hear if the "Big Oil" major plans to return more cash to shareholders in the form of higher stock buybacks and dividend payouts.

Exxon’s board boosted its share-repurchase program to up to $30 billion through 2023 in Q1, up from its prior plan to buy back $10 billion in stock. It also declared a cash dividend of 88 cents a share, the same level as the dividend paid in the previous quarter.

The oil-and-gas behemoth currently offers an annualized payout of $3.52 per share at a yield of 4.04%, one of the highest in the sector.

XOM stock, which hit an all-time high of $105.57 on June 8, ended Friday’s session at $87.08. At current levels, Exxon has a market cap of roughly $366.9 billion.

Year to date, shares have gained 42.3%, easily outperforming the S&P 500’s roughly 17% decline over the same time frame.

Stock To Dump: Roku

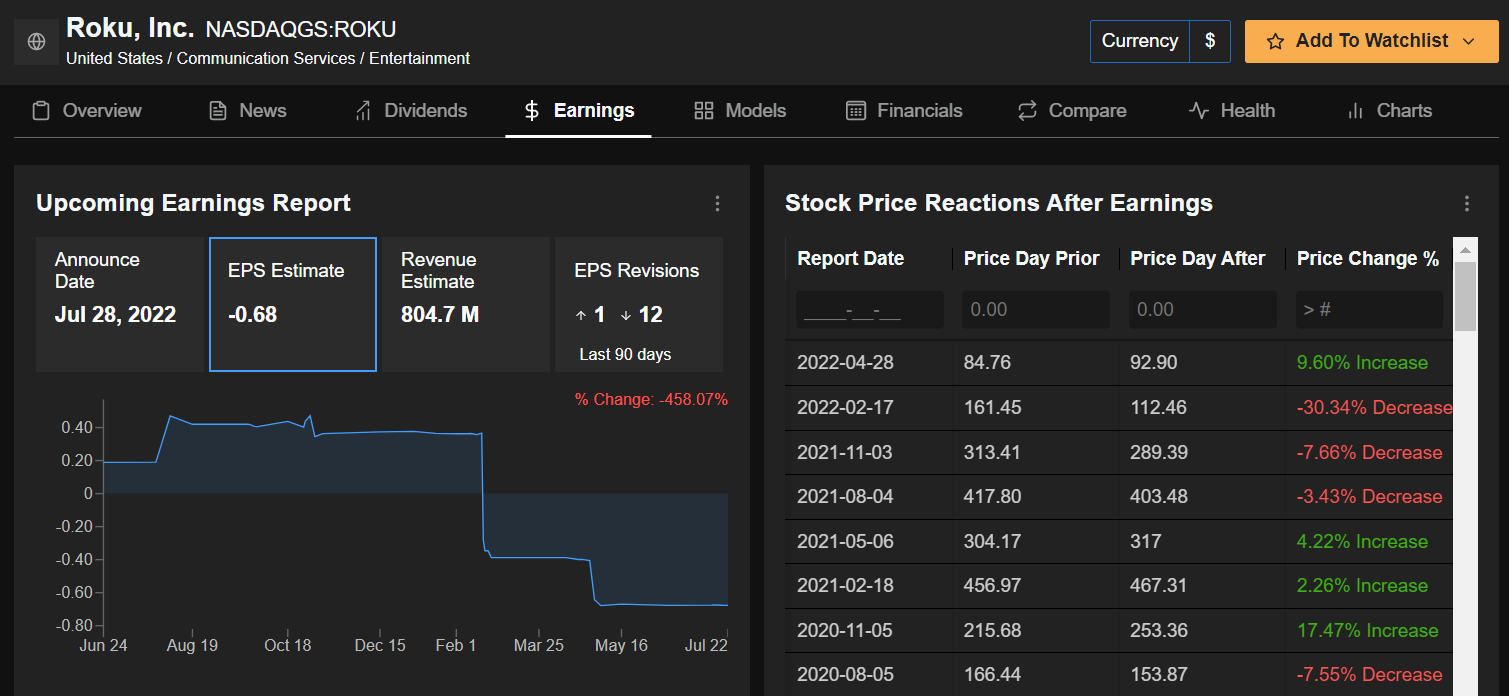

Roku (NASDAQ:ROKU) shares, which are currently languishing near their lowest level since March 2020, are expected to suffer a challenging week as investors brace for dismal financial results from the struggling digital media player manufacturer, due after the U.S. market closes on Thursday, July 28.

Consensus expectations call for the San Jose, California-based company, which sells devices and provides a platform that allows users to access streaming services, to swing to a loss of $0.68 per share in the second quarter, compared with net income of $0.52 per share in the year-ago period.

Meanwhile, revenue, which is made up mostly of advertising, is forecast to rise 24.6% year over year to $804.7 million.

If confirmed, that would mark the slowest pace of annualized sales growth in its history, reflecting a challenging operating environment.

In addition, investors will pay close attention to Roku’s update regarding its active user accounts. The key metric came in a touch below expectations at 1.1 million in the last quarter to reach a total of 61.3 million, marking the sixth straight quarter of decelerating growth.

Perhaps of greater importance, Roku’s guidance for the months ahead will be scrutinized as the company deals with several macro headwinds, including higher interest rates, mounting inflationary pressures, geopolitical conflict, and ongoing supply-chain disruptions.

ROKU stock, which is down 61% year to date, closed Friday’s session at $88.84, roughly 82% below its record peak of $490.76 reached in July 2021

At current levels, the streaming media platform provider has a market cap of $12.1 billion.

Roku has seen its valuation crumble over the last several months amid a broad selloff in high-growth tech stocks, especially those that are unprofitable or have lofty price-to-earnings (P/E) ratios.

Disclosure: At the time of writing, Jesse had no position in any stocks mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI