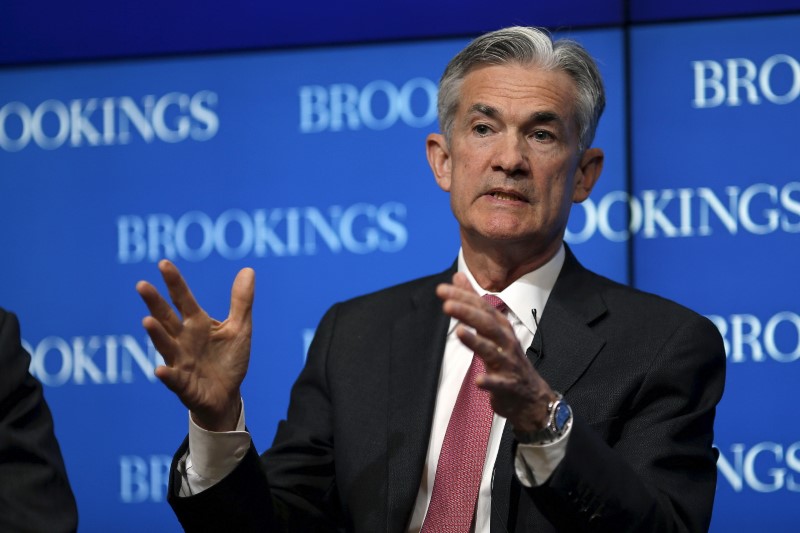

CHICAGO (Reuters) - Low interest rates have helped the Federal Reserve get close to meeting its goals for employment and inflation and have yet to create financial instability, Federal Reserve Governor Jerome Powell said on Saturday.

"Low rates can lead to excessive leverage and broadly unsustainable asset prices - things that we watch carefully for and do not observe at this point," Powell said in prepared remarks for an economics conference in Chicago.

Powell, a financial specialist at the U.S. central bank who has a vote on rate policy at every Fed meeting, did not comment on when the Fed will next raise rates or how many times it will do so this year.

He said the Fed's policy of keeping rates near zero for seven years through December 2015 had made the financial system more stable by helping the economy. Tighter regulations also have made Wall Street more sound, he said.

But the benefits of low rates also come with trade-offs and the Fed is watching the U.S. stock market, corporate borrowing and other potential weak spots for financial stability.

So far, he said, the areas where there are signs of excess are "isolated."

"Valuations in commercial real estate are high in some markets. And in the nonfinancial corporate sector, gross leverage is high by historical standards," he said, although he noted that firms held a lot of liquid assets so "net leverage is not elevated."