Benzinga - by Anusuya Lahiri, Benzinga Editor.

U.S. short sellers are speculating that the surge in Chinese stocks is over.

Capital will likely shift to emerging markets outside of China. The trend has led to a selloff in Chinese stocks:

- Baidu, Inc (NASDAQ:BIDU)

- JD.com, Inc (NASDAQ:JD)

- Alibaba Group Holding Ltd (NYSE:BABA)

- Bilibili Inc (NASDAQ:BILI)

- PDD Holdings Inc (NASDAQ:PDD).

Another iShares ETF that includes both Hong Kong and mainland stocks has seen its highest short interest since February 2021.

Traders have significantly reduced their short positions against the iShares MSCI Emerging Markets ex-China ETF. This shows the lowest level of bearishness in 15 months, Bloomberg reports.

Short sellers sell borrowed assets anticipating a price drop to profit from the difference when they return the assets to the lender. A rise in short interest indicates stronger expectations of price declines.

Chinese and Hong Kong stocks have surged, adding $1.6 trillion and $1.2 trillion in market value, respectively, since January after Beijing introduced measures like lower borrowing costs and a $728 billion stimulus.

However, the outcomes have been mixed: while China’s industrial activity and employment show improvement, consumer demand is weak, and the housing sector is contracting.

Investors are cautious due to the risk of sudden regulatory crackdowns, a persistent issue since 2015.

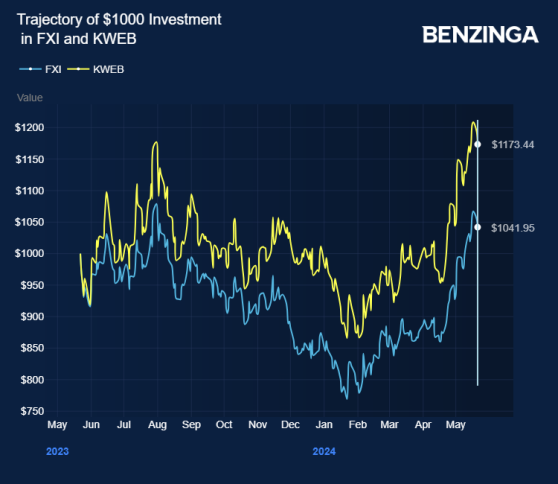

Investors can gain exposure to Chinese stocks via IShares China Large-Cap ETF (NYSE:FXI) and KraneShares Trust KraneShares CSI China Internet ETF (NYSE:KWEB).

Price Actions:

- BIDU shares traded lower by 2.58% at $106.06 premarket at last check Tuesday.

- JD is down 4.75% at $33.13, BABA is down 2.19% at $86.35,

- BILI is down 4.17% at $15.43

- PDD is down 1.51% at $144.55.

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga