Benzinga - by Anusuya Lahiri, Benzinga Editor.

On Thursday, Taiwan Semiconductor Manufacturing Co (NYSE:TSM) shares hit a record high due to the global AI frenzy.

Additionally, TSMC is in talks with ASML Holding NV (NASDAQ:ASML) to acquire advanced lithography machines, expected by year-end.

Meanwhile, Chinese AI chip firms are designing less powerful processors to comply with U.S. sanctions, underscoring the importance of TSMC.

Recent reports indicated TSMC’s plans to raise the prices of its services.

TSMC also announced a buyback of 3.25 million shares and plans for a $7.8 billion facility in Singapore with Vanguard International Semiconductor and NXP Semiconductors NV (NASDAQ:NXPI).

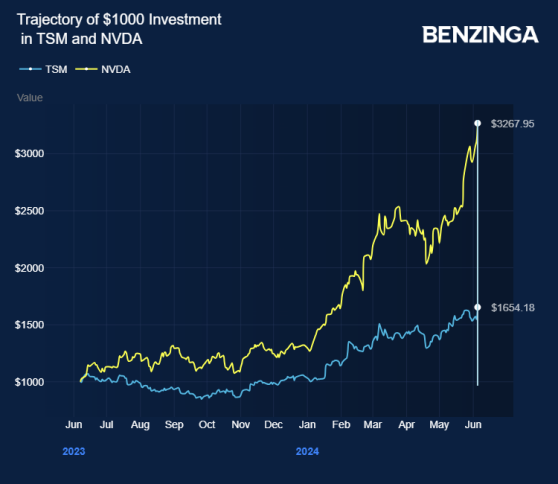

TSMC’s surge followed Nvidia Corp’s (NASDAQ:NVDA) stock gains, which reached a record high, breaching Apple Inc’s (NASDAQ:AAPL) market cap. TSMC is a key technology supplier for Nvidia’s AI chips.

Nvidia looks to boost its investments in Taiwan, including constructing another supercomputer in Taiwan following the launch of Taipei-1 in 2023.

Interestingly, Nvidia has also tapped Samsung Electronics Co for high-bandwidth memory (HBM) chip supply and is eying Intel Corp (NASDAQ:INTC) as a potential supplier as TSMC struggled with supply chain constraints.

TSMC, which won the crown of the leading global foundry with a 62% market share, indicated 10% annual growth in the semiconductor industry, excluding memory chips.

Analysts don’t see the fizzling of the AI demand anytime soon, hailing Nvidia as the key beneficiary. Nvidia’s moat extends beyond gaming, including artificial intelligence, cloud computing, and data centers.

TSMC stock gained over 63% in the last 12 months. Investors can gain exposure to the semiconductor sector via First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and ProShares UltraShort Semiconductors (NYSE:SSG).

Price Action: TSM shares were trading higher by 1.94% at $166.07 premarket at the last check on Thursday.

Photo by Jack Hong via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga