Benzinga - by Anusuya Lahiri, Benzinga Editor.

Alibaba Group Holding Ltd.‘s (NYSE:BABA) online shopping platform Lazada Group has denied reports of the parent company planning to sell its Thailand unit.

The company refuted rumors of discussions with potential investors.

According to Crunchbase data, in 2023, Alibaba invested $845 million in July and $634 million in December, followed by an additional $230 million in May, bringing the total investment to $7.4 billion, SCMP reports.

Also Read: Alibaba’s 618 Shopping Festival Boosts Sales with Big Brands Like Apple, Xiaomi Leading the Way

Lazada is part of Alibaba’s International Digital Commerce Group, one of the six major business groups established during the company’s reorganization in March 2023. This group, which includes AliExpress, Trendyol, and Daraz, reported a 60% year-on-year revenue increase for the financial year ending in March.

In the first quarter of 2024, the international group’s revenue increased by another 45% year on year. Lazada also reduced losses per order through increased monetization and lower logistics costs.

January reports indicated Lazada initiating layoffs in its Southeast Asia operations, with Singapore being the most affected.

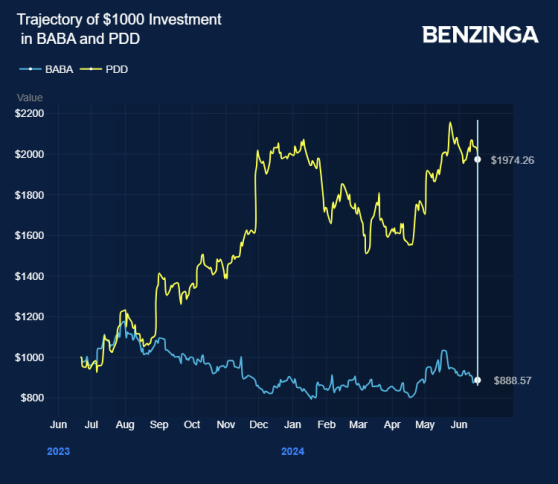

Alibaba stock lost over 15% in the last 12 months as it battled intense domestic competition and a weak domestic economy. Investors can gain exposure to the stock via Avantis Emerging Markets Equity ETF (NYSE:AVEM) and Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ).

Price Action: BABA shares traded higher by 0.43% at $74.78 at last check Thursday.

Check Out: Alibaba’s Fintech Affiliate Ant Group Boosts Global AI Efforts with Multi-Billion Dollar Investment

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga