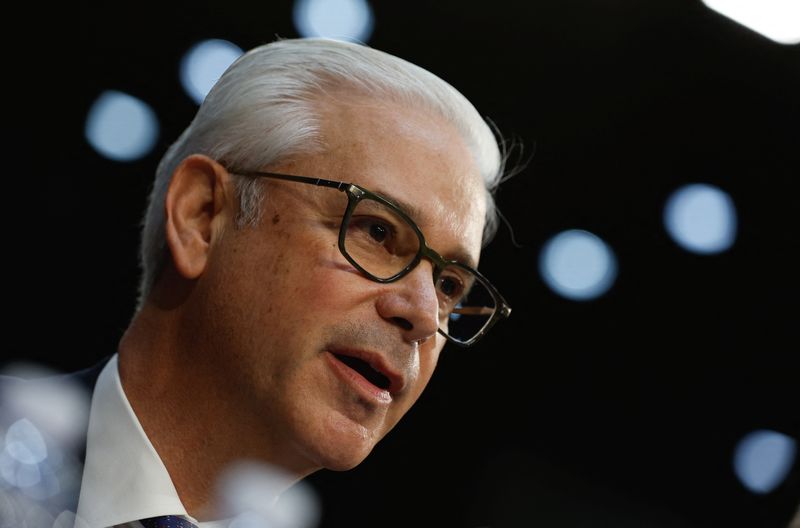

(Reuters) -Wells Fargo said on Thursday it has raised CEO Charles Scharf's total compensation for 2023 to $29 million.

The compensation consists of a base salary of $2.5 million and a total variable compensation of $26.5 million, which includes $6.6 million in cash and $19.9 million in long-term equity, the bank said in a regulatory filing.

The bank's board expressed strong confidence in Scharf's leadership in "driving the continued transformation of Wells Fargo (NYSE:WFC)".

Scharf's compensation for 2022 stood at $24.5 million.

The lender posted a rise in fourth-quarter profit as it cut costs, but warned of lower net interest income in 2024 as funding costs increase.

Last week, Wall Street giant JPMorgan Chase (NYSE:JPM) said it gave its CEO Jamie Dimon a 4% rise in 2023, while Morgan Stanley (NYSE:MS)'s Executive Chairman James Gorman received a 17% rise in his last year as CEO.