By Francesco Canepa

LONDON (Reuters) - The big story of recent stock market investment has been volatility, and the opportunities that sharp price swings can bring for those with strong nerves.

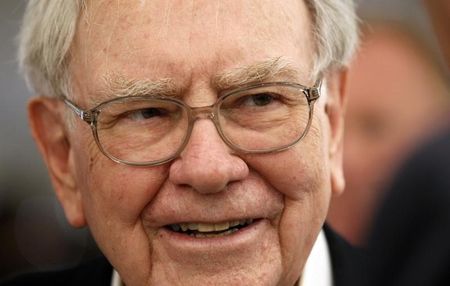

But good news is emerging now for those who prefer safer strategies: some of the best returns this year have come from stable stocks like billionaire Warren Buffett's holding company Berkshire Hathaway (N:BRKa) or Swiss toilet maker Geberit (VX:GEBN).

A basket of the two least volatile stocks in each STOXX Europe 600 (STOXX) sector index, as compiled by Thomson Reuters, up 8 percent year to date, or almost twice as much as the STOXX Europe 600 overall. (Here volatility is defined by the size of price moves in either direction.)

Though that high performance might seem odd - particularly looking at double-digit returns yielded by other European stocks that see-sawed at the prospect of a U.S. interest rate hike recently - in fact it demonstrates that low-volatility stocks are often stronger companies with healthier earnings power.

That distinction really matters when European companies' earnings recovery is still vulnerable - and it's one that more people are waking up to.

"Investors are ready to invest on the equity market but under the condition that they are not too exposed to risk and that's one argument for investing in the least volatile stocks," said Laurent Lagarde, head of quant equity management at investment firm THEAM, a unit of BNP Paribas.

The Reuters basket included traditionally defensive stocks like drugmaker Novartis, up 29 percent, but also benefited from similar gains by cyclical companies - those whose profits and share prices track the pace of the economy. Among those wereGivaudann (VX:GIVN), the world's biggest maker of flavours and fragrances, or media groupReed Elsevierr (L:REL).

Stocks from Switzerland - home to reliable earners such as Geberit - accounted for 13 out of 38 components.

The strategy also worked globally: BNP Paribas' World Low volatility strategy returned 15 percent in the first 10 months of the year, helped by a rally of nearly 20 percent in the shares of Berkshire Hathaway, among others.

A Lipper basket of 53 exchange traded funds which tracked stocks with low volatility returned 8 percent year to date. That compares to a 6 percent return for the MSCI World Index, Datastream data showed.

And the trend continues to pick up steam. As last month's volatility gripped financial markets, assets under management at low volatility stock funds attracted net inflows of over $1 billion (0.63 billion pounds) even as other stock funds lost money, Markit data shows.

This reflects investors' weariness with jumpy markets. After a rollercoaster October more jitters are expected as the United States shuts off the flow of cheap money that has been buoying its banks and businesses, and economies from the euro zone to China struggle to grow.

Fund manager Ossiam's head of business development Isabelle Bourcier said interest in its low volatility ETFs had grown.

"Expectations from clients that there will be volatility is helping us," she said.

Assets in low volatility ETFs have grown to $16 billion currently from $15 million when the financial crisis hit in 2008, Markit data showed.

(Editing by Sophie Walker)