Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

Northwest Natural Holding Co (NYSE:NWN)

- Dividend Yield: 5.19%

- Stifel analyst Selman Akyol maintained a Buy rating and raised the price target from $39 to $40 on May 7. This analyst has an accuracy rate of 69%.

- Janney Montgomery Scott analyst Michael Gaugler initiated coverage on the stock with a Neutral rating and a price target of $39 on Jan. 31. This analyst has an accuracy rate of 74%.

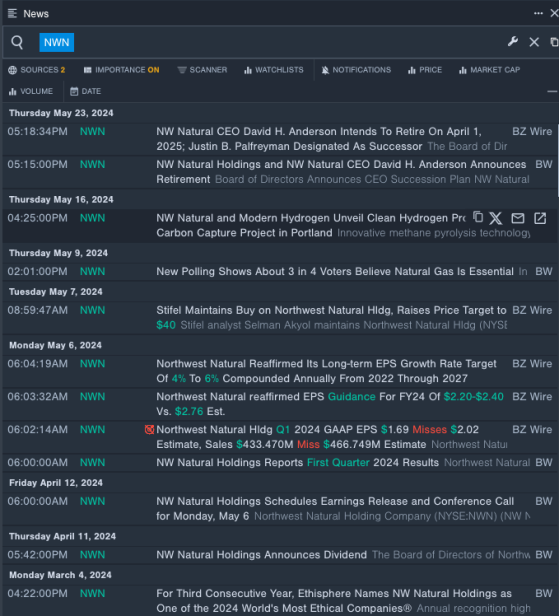

- Recent News: On May 23, NW Natural CEO David H. Anderson announced his intent to retire on April 1, 2025.

- Benzinga Pro's real-time newsfeed alerted to latest Northwest Natural's news

Dominion Energy Inc (NYSE:D)

- Dividend Yield: 4.97%

- B of A Securities analyst Julien Dumoulin-Smith upgraded the stock from Underperform to Neutral and increased the price target from $43 to $54 on May 10. This analyst has an accuracy rate of 69%.

- BMO Capital analyst James Thalacker maintained a Market Perform rating and boosted the price target from $51 to $52 on May 6. This analyst has an accuracy rate of 68%.

- Recent News: On May 7, Dominion Energy declares quarterly dividend of 66.75 cents per share.

- Benzinga Pro's charting tool helped identify the trend in Dominion Energy's stock.

Spire Inc (NYSE:SR)

- Dividend Yield: 4.93%

- Wells Fargo analyst Sarah Akers maintained an Equal-Weight rating and raised the price target from $64 to $66 on May 2. This analyst has an accuracy rate of 68%.

- Mizuho analyst GabrielMoreendowngraded the stock from Buy to Neutral and slashed the price target from $64 to $62 on May 2. This analyst has an accuracy rate of 70%.

- Recent News: On May 1, Spire posted weaker-than-expected quarterly results.

- Benzinga Pro's signals feature notified of a potential breakout in Spire shares.

Read More: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for NWN

| Feb 2022 | Wells Fargo | Maintains | Equal-Weight | |

| Jan 2022 | Guggenheim | Upgrades | Sell | Neutral |

| Nov 2021 | Wells Fargo | Maintains | Equal-Weight |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga