Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

B&G Foods, Inc. (NYSE:BGS)

- Dividend Yield: 9.06%

- Piper Sandler analyst Michael Lavery upgraded the stock from Underweight to Neutral with a price target of $9 on May 16. This analyst has an accuracy rate of 71%.

- TD Cowen analyst Robert Moskow maintained an Underperform rating and cut the price target from $10 to $9.5 on Sept. 19. This analyst has an accuracy rate of 67%.

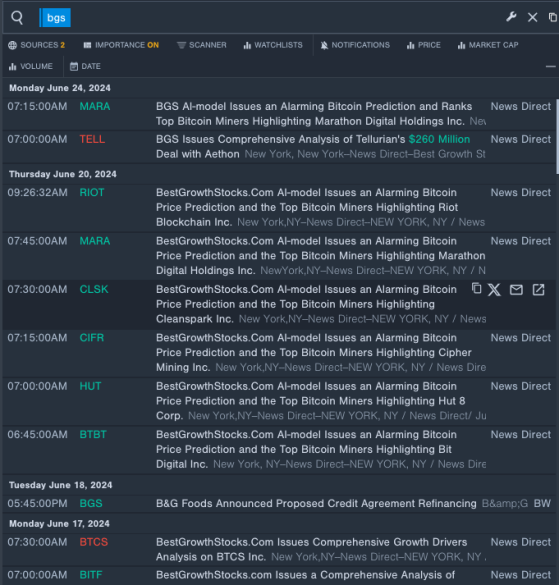

- Recent News: On June 18, B&G Foods announced a proposed credit agreement refinancing.

- Benzinga Pro's real-time newsfeed alerted to latest B&G Foods news

Altria Group, Inc. (NYSE:MO)

- Dividend Yield: 8.44%

- Stifel analyst Matthew Smith reiterated a Buy rating with a price target of $50 on March 25. This analyst has an accuracy rate of 60%.

- Morgan Stanley analyst Pamela Kaufman reiterated an Equal-Weight rating with a price target of $45 on July 18. This analyst has an accuracy rate of 69%.

- Recent News: On June 21, the U.S. Food and Drug Administration (FDA) has authorized the marketing of four menthol-flavored e-cigarette products from NJOY LLC, an affiliate of Altria Group.

- Benzinga Pro's charting tool helped identify the trend in Altria's stock.

Conagra Brands, Inc. (NYSE:CAG)

- Dividend Yield: 4.77%

- Stifel analyst Matthew Smithmaintained a Hold rating and raised the price target from $29 to $32 on April 5. This analyst has an accuracy rate of 60%.

- Wells Fargo analyst Chris Careymaintained an Equal-Weight rating and raised the price target from $30 to $32 on April 5. This analyst has an accuracy rate of 63%.

- Recent News: Conagra Brands is expected to release its fiscal 2024 fourth quarter and full year results on Thursday, July 11.

- Benzinga Pro's signals feature notified of a potential breakout in Conagra's shares.

Check This Out: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for BGS

| Mar 2022 | Credit Suisse | Maintains | Underperform | |

| Nov 2021 | Piper Sandler | Downgrades | Neutral | Underweight |

| Mar 2021 | Piper Sandler | Downgrades | Overweight | Neutral |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga