EDINBURGH (Reuters) - Engineering outsourcer Babcock (L:BAB) said its first-half underlying profit before tax climbed 4.9 percent, as expected, and expressed confidence in the outlook due to a strong performance from the marine division.

Its underlying revenue grew by 5.9 percent to 2.64 billion pounds, underlying profit before tax grew to 239.5 million pounds.

Babcock said 92 percent of budgeted revenue was now in place for the full year ending in March 2018, underpinning its confidence in the outlook. It expects a slight improvement in overall group margin during the second half, it said, without specifying further.

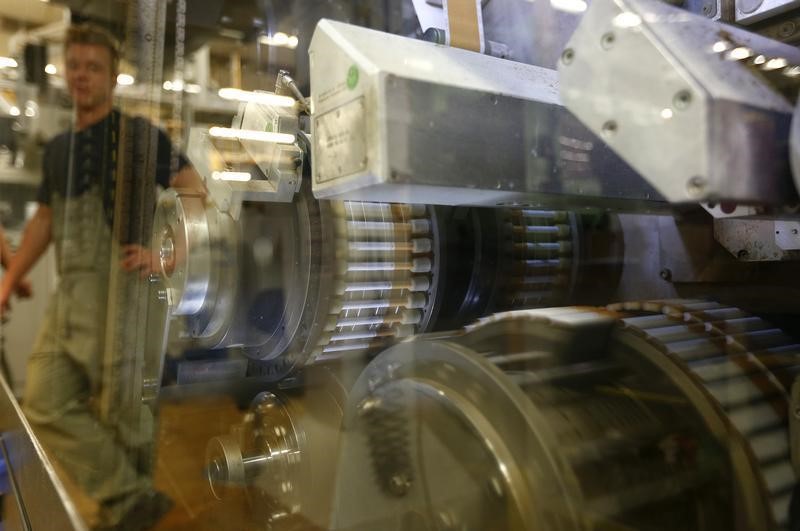

The British group provides specialist design, production, maintenance and training services for the defence and engineering industry, and three quarters of its revenues come from the United Kingdom.

"Our focus on technology-intensive critical services where barriers to entry are high has consistently enabled us to generate sustainable growth regardless of any decline in spending on original equipment," Chief Executive Archie Bethel said.

"I expect this to remain a key element of differentiation for Babcock in the coming months and years."

Babcock shares are down almost 20 percent in the past six months versus a 1.4 percent decline in the overall FTSE 100 index (FTSE).

It has been hit by political uncertainty over Brexit and a spillover of poor sentiment from its peers who specialise in administrative outsourcing and have suffered from slower private and public decision-making following the Brexit vote.