By Kirstin Ridley

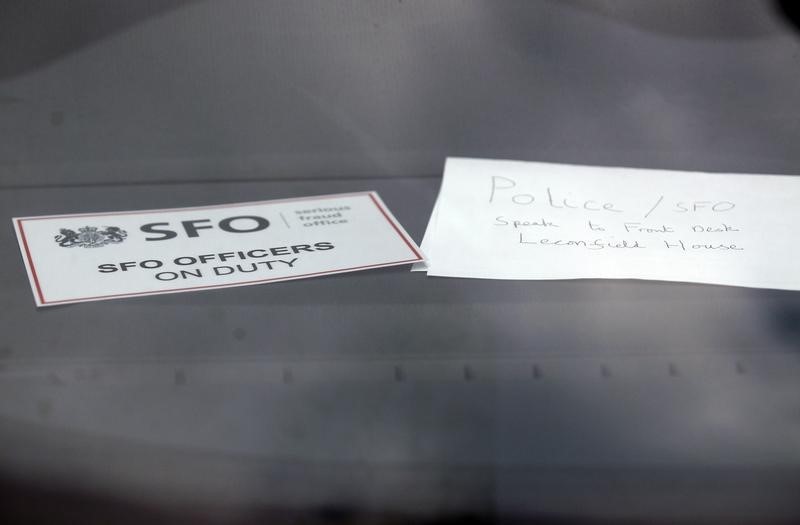

LONDON (Reuters) - Five former brokers were acquitted on Wednesday of conspiring with convicted trader Tom Hayes to manipulate crucial benchmark interest rates as London's second Libor trial dealt a blow to the UK's Serious Fraud Office (SFO).

Barely a day after retiring to consider their verdicts, the jury cleared former ICAP (L:IAP) brokers Colin Goodman and Danny Wilkinson, former RP Martin brokers Terry Farr and James Gilmour and former Tullett Prebon broker Noel Cryan of conspiracy to rig the London interbank offered rate (Libor), which helps set borrowing costs for about $450 trillion of loans globally.

Former ICAP broker Darrell Read, who was charged with two counts of conspiracy to defraud, was acquitted on one count but the jury had yet to reach a verdict on the second.

The world's third Libor trial, that kicked off four months ago, comes more than seven years after U.S. regulators first examined how Libor rates were set.

That U.S. scrutiny sowed the seeds of a global investigation that has culminated in authorities fining leading banks and brokerages $9 billion, charging about 30 people and overhauling how benchmarks such as Libor are policed.

The SFO alleged the six men helped Tokyo-based Hayes, the first person convicted by a jury of Libor manipulation offences, to persuade bank clients to skew interbank borrowing rates to suit his trading position.

Defence lawyers told the jury the defendants were scapegoats for a fundamentally flawed financial system, which was self-governing, and that the trial was unfair and unjust.

SFO'S GREEN STANDS BY PROSECUTION

Despite the swift verdicts, SFO head David Green defended the agency's decision to bring the prosecutions.

"The key issue in this trial was whether these defendants were party to a dishonest agreement with Tom Hayes," he said in a statement. "By their verdicts the jury have said that they could not be sure that this was the case.

"Nobody could sensibly suggest that these charges should not have been brought and considered by a jury," Green said.

Former UBS and Citigroup (N:C) trader Hayes, who earned about $300 million for his banks between 2006 and 2010, was jailed for 14 years in August, although the sentence was reduced to 11 years on appeal.

Some lawyers said the agency, whose independent future is often questioned by critics, should not be judged too harshly on the outcome of one trial, however costly the prosecution for the public purse.

Sarah Wallace, head of regulatory and criminal investigations at law firm Irwin Mitchell, said the SFO should review the evidence and realistic prospects of success on its outstanding financial benchmark investigations.

The SFO should also press the government to ease restrictions on prosecuting companies and rekindle discussions about a new criminal corporate offence for failure to have adequate procedures to prevent financial crime, she said.

The SFO is prosecuting a group of former Barclays (L:BARC) traders in its third Libor-related case, currently scheduled for February, and has also begun a case against six individuals for alleged conspiracy to rig Euribor, the euro equivalent of Libor.

That case is not scheduled to come to trial before 2017.

HYPOCRISY

Most of the six in the broker trial, aged between 44 and 54, told the court they had either exaggerated their influence over Libor rates to appease Hayes, whom they described as a volatile but valuable client, or had just pretended to do his bidding.

Only Farr, who left school at 15, said he sought to help Hayes by passing on his requests for lower or higher Libor rates. But he said he did not know he was doing anything wrong.

"Ultimately, there is a hypocrisy in charging brokers," said Matthew Frankland, partner at Byrne and Partners, which represented Wilkinson. "Brokers do not work for banks, they play no part in the Libor submission process and are not and never were regulated ... in relation to their Libor predictions."

A spokesman for Tullett said the company noted the jury's findings in relation to Cryan but had nothing to add. ICAP declined to comment and a call to RP Martin went unanswered.