(Bloomberg) -- Tyson Foods Inc (NYSE:TSN)., the largest U.S. meat producer, blamed the country’s escalating trade dispute as it cut its full-year profit forecast.

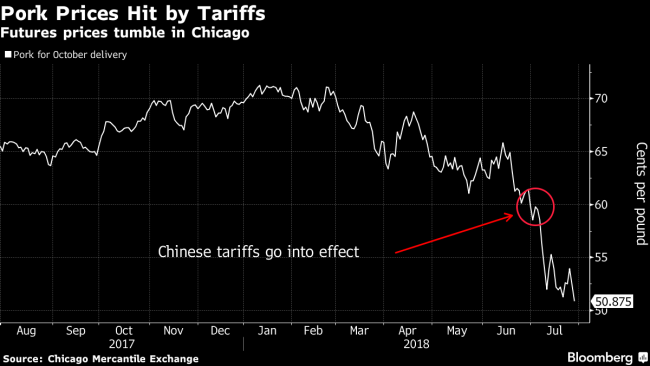

Both China and Mexico have imposed import tariffs on American pork recently in retaliation against U.S. duties on metal shipments. The measures have sent hog prices plunging, eroding the profitability at Tyson’s port business. The Springdale, Arkansas company said Monday it’s also grappling with higher commodity-market volatility and "sluggish" domestic demand for chicken.

"The combination of changing global trade policies here and abroad, and the uncertainty of any resolution, have created a challenging market environment of increased volatility, lower prices and oversupply of protein," Chief Executive Officer Tom Hayes said in a statement Monday.

Earnings in fiscal 2018 excluding one-time items will be about $5.70 to $6 a share, compared with a previous view of $6.55 to $6.70, the company said. Its shares slumped 7 percent to $59.40 at 8 a.m. in pre-market trading in New York. Rival poultry producers Pilgrim’s Pride Corp. and Sanderson Farms Inc. also declined.

“Through pricing and aggressive cost management, we’re working to stabilize the impact of freight and feed ingredient costs," Hayes said. "However, we still face pressure on chicken sales volume and pricing due to the abundance of relatively low-priced beef and pork on the market. We are working to mitigate these pressures, but our fourth quarter is off to a slower than expected start."

Tyson plans to report its fiscal third-quarter earnings on Aug. 6.

(Updates with CEO comment in third and penultiamte paragraphs.)