By Christiana Sciaudone

Investing.com -- Matchmaking isn't for love alone.

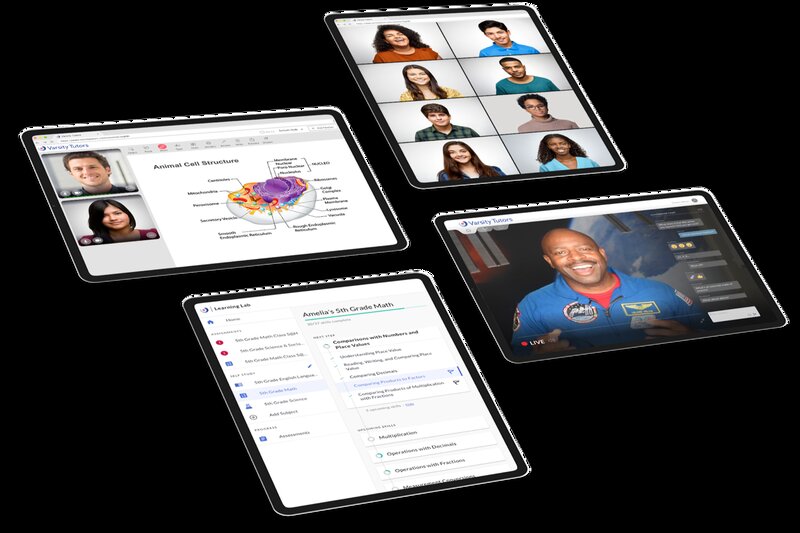

Nerdy, which runs the Varsity Tutors website, specializes in matching tutors and students using artificial intelligence to make the best connection. The company has seen sales boom over the past year and expects even more growth ahead. And it's about to go public via a special-purpose acquisition company owned and run by private equity giant TPG.

The company provides one-on-one tutoring, as well as free and paid group classes and self-guided study. It has 87,000 paid online active users and more than 500,000 free learners. The company is seeing an average compound growth rate of 45% in revenue, with sales expected to increase 30% from this year to next, and profit coming in 2023.

If the competition is any indication, Nerdy could be in for a good run. Rival Chegg Inc (NYSE:CHGG), which provides study help but not personalized live instruction, saw revenue rise through the pandemic as education technology firms gained relevance amid shutdowns and isolation. Shares of Chegg have about doubled since around the start of the pandemic, hitting a record early this year.

Chief Executive Officer and Founder Chuck Cohn says Nerdy has a unique model that will help it stand out. "Our superpower is high quality scaled live instruction, that's what nobody else has ever done before," he said in a video interview this month.

Nerdy has a market capitalization of $1.7 billion, and reported 100% growth in online revenue for the first quarter versus a year earlier. Active learner growth increased 67% and paid sessions increased 186% year-over-year. Paid sessions per active expert increased 60% year-over-year, and demand appears to be increasing with a return to in-person activities.

Its merger with TPG Pace Tech Opportunities Corp (NYSE:PACE) could be completed by July. SPACs had a strong run in the first three months of 2021, with the total number of mergers quickly surpassing all of 2020. Issuances slowed after the Securities and Exchange Commission published accounting guidance that, if made law, would force pending and existing SPACs to recalculate their financials for the value of warrants each quarter, CNBC reported. That could result in balance sheets with more liabilities than equity.

They're starting to make a comeback, though, according to SPAC Research, and particularly those with private investment commitments from name-brand investors. In the case of Nerdy, TPG has raised $150 million from Franklin Templeton, Healthcare of Ontario Pension Plan, Koch Industries and Learn Capital, among others. And unlike some SPACs, this one actually has sales that are growing at a fast clip.

"We have a great business," Cohn said. "We're not a flying car company with zero dollars of revenue."

Nerdy was born, as so many startups are, out of personal need. About 14 years ago, Cohn was studying calculus 2 at Washington University, and desperately needed help. He was convinced he was going to fail the course because he couldn't find a tutor. Eventually, two friends came to the rescue, but the idea that high-quality tutoring was badly needed and hard to find stuck with him.

"There was an inherent discovery problem in the market," Cohn said. He borrowed $1,000 from his parents and worked nights and weekends on his project, posting flyers in coffee shops, for three years while keeping his day job in private equity. The big differential at Nerdy is the level of expertise and the technology to match teaching and learning styles for the best outcome, Cohn said.

The company's just getting started. With about $300 million on the balance sheet expected from the SPAC merger, Nerdy will continue to improve on its products, and will look at acquisitions. Cohn noted there are some 5,000 tutoring companies in the U.S., on top of the 1 million to 2 million independent tutors.

"We're gonna have enough cash" that the company can go on the offensive, Cohn said.