By Julian Luk

LONDON (Reuters) - Swiss commodity trader Trafigura has agreed to help Chinese smelters clear imports of copper concentrate from Australia, suggesting an informal ban has been lifted if the cargo clears customs, three sources familiar with the matter told Reuters.

China has gradually been easing a raft of unofficial curbs and tariffs on Australian imports, including copper concentrate and coal, that were imposed in 2020 at the height of a diplomatic spat over trade and security.

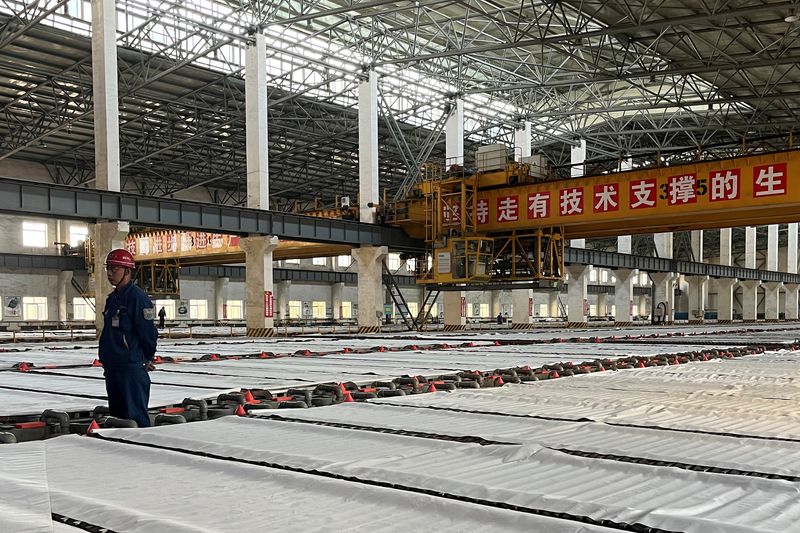

Despite a wider informal easing, state-owned Chinese smelters that turn concentrate into copper metal, have been reluctant to buy from Australia, which accounted for 5%, or 1.1 million tonnes, of China's total copper concentrate imports in 2019.

However a shipment of around 10,000 metric tonnes of copper concentrate mined from Western Australia's Golden Grove, owned by 29Metals, is on its way to Shandong province, where many major Chinese smelters are located, the sources said.

The passage of a large cargo of Australian concentrate through customs in China will ease smelters' concerns about a political backlash, the sources said.

"We have been waiting for others to be the first to resume buying Australia-origin concentrate," a source at a major Chinese copper concentrates importer said.

Copper is vital for the power industry due to its conductivity. China consumes nearly half of the global mined copper supply estimated at around 25 million tonnes this year.

Trafigura's Chinese affiliate will be responsible for clearing customs on behalf of domestic consumers once the cargo arrives at Shandong's Qingdao port, two of the sources said.

"Once Trafigura gets the clearance, it is official that the soft ban has come to an end," the source added.

Trafigura declined to comment. 29Metals did not respond to a request for comment.

Australian trade data shows exports worth A$60.5 million ($38.52 million) of copper ore and concentrate to China in January.

However, the cargo was not logged in Chinese data, which officially shows that in the first nine months of this year, only $10 worth of copper ore and concentrate were imported.

Australia produced 818,800 tonnes of copper in ore and concentrates last year and is, according International Copper Study Group, the world's eighth-largest producer of the metal.

The shipments from Australia come at a critical time, when Chinese smelters are starting annual negotiations with major miners on annual treatment charges and refining charges (TC/RC).

TC/RC is the income received by smelters for turning concentrates into refined copper, which typically rises with higher supply and falls during times of shortages.

($1 = 1.5706 Australian dollars)