Benzinga - by Zacks, Benzinga Contributor.

TotalEnergies SE (NYSE: TTE) announced that it has entered into an agreement with Hibiscus Petroleum Berhad to sell its subsidiary TotalEnergies EP (Brunei) B.V. for $259 million. Subject to necessary permission, the deal is expected to close in fourth-quarter 2024.

TotalEnergies EP (Brunei) B.V. owns and operates a 37.5% interest in Block B along with other partners. Block B, located 52.8 miles (85 kilometers) off the coast of Brunei, contains the Maharaja Lela/Jamalulam (MLJ) field, which started producing in 1999 and represented a net production of approximately 9,000 barrels of oil equivalent per day in 2023.

Acquisition & Divestiture TotalEnergies continues with its strategic acquisitions in high-potential areas and sells non-core assets to achieve its long-term objective of improving production by focusing on the promising hydrocarbon-producing regions of the world.

This current transaction syncs with TTE's strategy to actively manage portfolio by monetizing mature assets and to concentrate on the most promising assets. The company has less exposure to the mature North America region, and its upstream assets have lower natural decline rates and longer productive lives, which give the company a significant competitive edge against its peers.

In first-quarter 2024, it acquired $1.07 billion worth of assets and sold assets valued at $1.57 billion. The strategic acquisition will assist the company in further expanding its muti-energy assets across the globe.

Startups Boost Production TotalEnergies has one of the best production growth profiles among the oil super majors, characterized by an upstream portfolio with above industry-average exposure to the faster-growing hydrocarbon-producing regions of the world. It benefits from solid production from new startups.

Its first-quarter production was stable quarter over quarter, courtesy of contribution from Mero 2 at Brazil and Akpo West in Nigeria.

The restart of gas production from the Tyra offshore hub in Denmark after a major development will further improve the production volume of the company.

Focus on Clean Energy Per the International Energy Agency (IEA), globally, in the next five years, 3,700 GW of new renewable capacity will come online, driven by supportive policies in more than 130 countries. Per IEA, in 2028, renewable energy sources will account for over 42% of global electricity generation.

TotalEnergies strives to be a net-zero carbon emission company by 2050 and has taken the necessary steps to achieve the target. Gross installed renewable power generation capacity rose to 23.5 GW at the end of first-quarter 2024 from 22 GW at the end of 2023. It has a portfolio of gross installed capacity under construction and is in development of 35 GW by 2025.

The rising concern against emission and usage of clean energy will surely benefit the companies that are focused on generating clean energy for their customers. Companies like Constellation Energy Corporation (NASDAQ: CEG), NextEra Energy (NYSE: NEE) and The Southern Company (NYSE: SO), among others, are going to produce clean energy and reduce emission levels.

The long-term (three-to-five years) earnings growth of Constellation Energy, NextEra Energy and The Southern Company are currently pinned at 14.6%, 8% and 6.9%, respectively.

Constellation Energy, NextEra Energy and The Southern Company reported average earnings surprise of 49.4%, 8.8% and 9.3%, respectively, in the last four reported quarters.

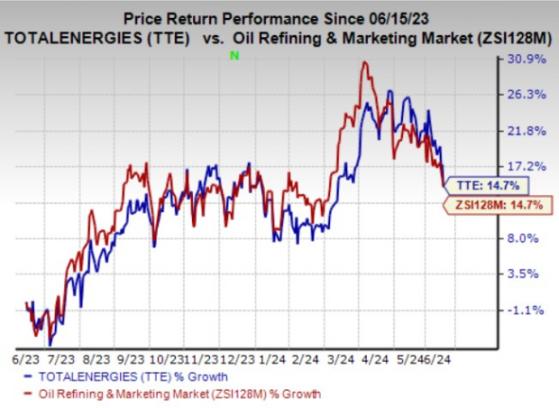

Price Performance In the past year, shares of TotalEnergies have risen 14.7% compared with the industry's 14.7% growth.

Image Source: Zacks Investment Research

Zacks Rank The company currently has a Zacks Rank #3 (Hold).

To read this article on Zacks.com click here.

Read the original article on Benzinga