Benzinga - by Zacks, Benzinga Contributor.

Despite underwhelming guidance sending Meta Platforms' (NASDAQ: META) stock lower following its Q1 earnings beat on Wednesday evening, several tech companies have seen their stocks pop after exceeding quarterly expectations yesterday as well.

Better still, these top-rated tech stocks look poised to outperform the broader market given slower GDP data and higher consumer prices led to a selloff in Thursday's trading session with the S&P 500, Nasdaq, and Dow Jones all down roughly -1% at the moment.

CACI International (NYSE: CACI)

Popping +5% today, CACI International's stock largely resisted Thursday's market downturn as its IT applications and infrastructure services to improve information systems appear to be in high demand.

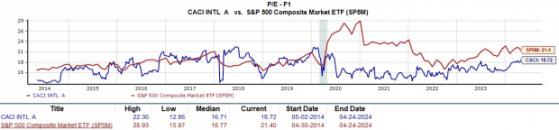

Reporting its fiscal fourth quarter results on Wednesday, CACI's Q4 earnings of $5.74 per share climbed 16% year over year and beat expectations of $5.52 a share by 4%. CACI also beat top line estimates of $1.86 billion by 4% with Q4 sales at $1.93 billion compared to $1.74 billion in the comparative quarter. Most appealing about CACI's stock is that the company is expected to post steady growth on its top and bottom lines in Fiscal 2024 and FY25 while trading at a reasonable 18.7X forward earnings multiple and 1.1X sales.

Image Source: Zacks Investment Research

Lam Research (NASDAQ: LRCX)

Lam Research's stock spiked over +2% this morning as the semiconductor equipment company's robust bottom line continues to stand out. Supplying water fabrication equipment and services to chipmakers, Lam Research reported earnings of $7.79 a share for its fiscal third quarter which exceeded expectations by 7% and rose 11% from EPS of $6.99 a year ago.

Comparable sales for Q3 dipped -2% to $3.79 billion but came in 2% above estimates of $3.7 billion. Notably, Lam Research's annual earnings are currently forecasted to dip -15% this year but rebound and jump 20% in FY25 to a whopping $34.72 per share.

Image Source: Zacks Investment Research

Teradyne (NASDAQ: TER)

Lastly, Teradyne's consistency may peak investors' interest with its stock jumping +7% today as a developer of automated test systems used to enhance semiconductors, wireless products, data storage, and complex consumer electronics. Teradyne's reach also extends to the automotive, industrial, aerospace, and defense industries among others with Q1 earnings of $0.51 per share comfortably surpassing the Zacks Consensus of $0.33 a share by 54%.

Expectations of a much wider earnings drop came as Teradyne posted EPS of $0.55 in Q1 2023. Still, quarterly sales of $599.82 million beat estimates by 5% although this was down from $617.53 million in the comparative quarter. Plus, Teradyne has exceeded the Zacks EPS Consensus for an astonishing 47 consecutive quarters dating back to October of 2012.

Image Source: Zacks Investment Research

Takeaway

CACI International, Lam Research, and Teradyne all sport a Zacks Rank #2 (Buy). After exceeding their quarterly expectations, earnings estimate revisions are likely to go up along with analyst price targets making now an ideal time to invest.

To read this article on Zacks.com click here.