Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Tyson Foods Inc (NYSE:TSN)

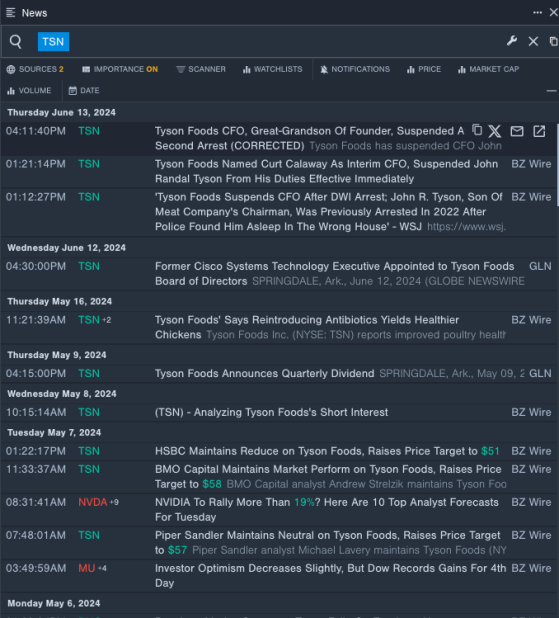

- On June 13, Tyson temporarily relieved its CFO, John R. Tyson, of his duties following his arrest on a charge of driving while intoxicated in Arkansas.. The company's stock fell around 11% over the past month and has a 52-week low of $44.94.

- RSI Value: 22.99

- TSN Price Action: Shares of Tyson Foods rose 0.2% to close at $53.97 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest TSN's news.

Estee Lauder Companies Inc (NYSE:EL)

- On June 14, Barclays analyst Lauren Lieberman maintained Estee Lauder with an Equal-Weight and lowered the price target from $140 to $136. The company's stock fell around 18% over the past month. It has a 52-week low of $102.22.

- RSI Value: 25.86

- EL Price Action: Shares of Estee Lauder fell 0.2% to close at $113.90 on Friday.

- Benzinga Pro's charting tool helped identify the trend in Estee Lauder's stock.

WK Kellogg Co (NYSE:KLG)

- On May 7, WK Kellogg reported a first-quarter FY24 sales decline of 1.9% year-on-year to $707 million, beating the analyst consensus estimate of $697.792 million. "Our strategy is clear, our integrated and engaged team is working end-to-end, and we are pleased with our progress as we continue to execute our strategic priorities," said Gary Pilnick, Chairman and Chief Executive Officer of WK Kellogg. The company's stock fell around 17% over the past month and has a 52-week low of $9.66.

- RSI Value: 28.49

- KLG Price Action: Shares of WK Kellogg fell 0.3% to close at $17.82 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in WK Kellogg's shares.

Dollar Tree Inc (NASDAQ:DLTR)

- On June 5, Dollar Tree In reported its first-quarter FY24 earnings and announced a review of strategic alternatives for its Family Dollar business segment. "The unique needs of each banner at this time – transformation at Family Dollar and growth acceleration at Dollar Tree – lead us to the decision to conduct a thorough review of strategic alternatives for the Family Dollar business," said Chairman and CEO Rick Dreiling. The company's shares lost around 13% over the past month. The company's 52-week low is $102.77.

- RSI Value: 29.11

- DLTR Price Action: Shares of Dollar Tree fell 0.5% to close at $106.03 on Friday.

- Benzinga Pro's earnings calendar was used to track Dollar Tree's upcoming earnings report.

Read More: Wall Street’s Most Accurate Analysts Weigh In On 3 Tech Stocks With Over 3% Dividend Yields

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga