Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Inhibrx Biosciences, Inc. (NASDAQ:INBX)

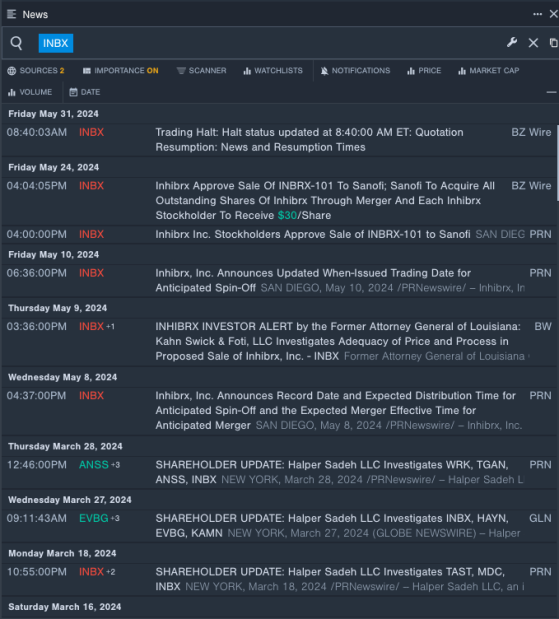

- On May 24, Inhibrx stockholders approved sale of INBRX-101 to Sanofi. The company's stock fell around 50% over the past five days and has a 52-week low of $12.95.

- RSI Value: 15.08

- INBX Price Action: Shares of Inhibrx Biosciences fell 4.5% to close at $17.21 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest INBX news.

Exact Sciences Corporation (NASDAQ:EXAS)

- On May 8, Exact Sciences said first-quarter revenue increased 6% year-over-year to $638 million, which beat the consensus estimate of $627.355 million, according to Benzinga Pro. The company reported a quarterly loss of 60 cents per share, which missed analyst estimates for a loss of 48 cents per share. "The Exact Sciences team is off to a strong start again in 2024. Our team delivered more than a million Cologuard and Oncotype DX test results to patients and advanced our deep pipeline of life-changing cancer diagnostics," said Kevin Conroy, chairman and CEO of Exact Sciences. The company's stock fell around 31% over the past month. It has a 52-week low of $43.30.

- RSI Value: 27.83

- EXAS Price Action: Shares of Exact Sciences fell 3.1% to close at $43.45 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in EXAS stock.

Teladoc Health, Inc. (NYSE:TDOC)

- On April 25, Teladoc Health posted mixed quarterly results. “We are pleased to report a solid start to the year, with strength in both revenue and adjusted EBITDA in the first quarter,” said Mala Murthy, acting chief executive officer and chief financial officer of Teladoc Health. The company's stock fell around 15% over the past month and has a 52-week low of $10.85.

- RSI Value: 28.75

- TDOC Price Action: Shares of Teladoc Health fell 1.9% to close at $10.87 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in Teladoc Health’s shares.

Agilent Technologies, Inc. (NYSE:A)

- On May 29, Agilent Technologies posted mixed second-quarter financial results. Agilent also revised its full-year outlook to reflect a slower market recovery. "In Q2, we delivered on our expectations and showed the resiliency of our diversified business. While we see the market improving, it is improving at a slower pace than anticipated," said Padraig McDonnell, president and CEO of Agilent. The company's shares lost around 12% over the past five days. The company's 52-week low is $96.80.

- RSI Value: 29.45

- A Price Action: Shares of Agilent fell 0.4% to close at $130.85 on Tuesday.

- Benzinga Pro's earnings calendar was used to track Agilent’s upcoming earnings report.

Now Read This: Dollar Tree, Hewlett Packard Enterprise And 3 Stocks To Watch Heading Into Wednesday

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga