Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

American Woodmark Corporation (NASDAQ:AMWD)

- On May 23, American Woodmark posted downbeat quarterly earnings. “Our teams delivered another strong quarter despite the soft remodel market demand environment,” said Scott Culbreth, President and CEO. The company's stock fell around 15% over the past month and has a 52-week low of $65.01 .

- RSI Value: 28.69

- AMWD Price Action: Shares of American Woodmark gained 1.1% to close at $79.75 on Friday.

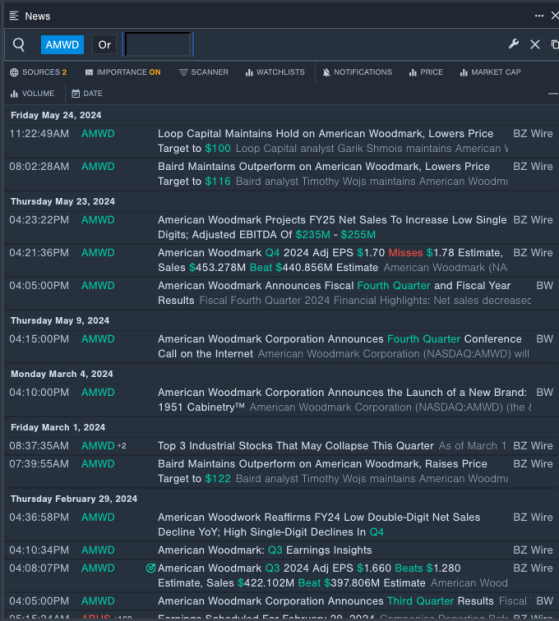

- Benzinga Pro's real-time newsfeed alerted to latest American Woodmark's news.

Atkore Inc (NYSE:ATKR)

- On May 7, Atkore reported worse-than-expected second-quarter sales results and cut its FY24 adjusted EPS guidance. “Atkore achieved solid results in the second quarter having met our projections for Net Sales and exceeding our projections for Adjusted EBITDA and Adjusted Diluted EPS we presented in February,” said Bill Waltz, Atkore President and Chief Executive Officer. The company's stock fell around 13% over the past month. It has a 52-week low of $121.00.

- RSI Value: 28.53

- ATKR Price Action: Shares of Atkore rose 0.2% to close at $134.49 on Friday.

- Benzinga Pro's charting tool helped identify the trend in Atkore's stock.

Corecivic Inc (NYSE:CXW)

- On June 11, CoreCivic announced that it received a notice from the U.S. Immigration and Customs Enforcement that the agency intends to terminate its inter-governmental service agreement for services at the South Texas Family Residential Center.. The company's stock fell around 27% over the past month and has a 52-week low of $9.06.

- RSI Value: 23.69

- CXW Price Action: Shares of Corecivic rose 0.4% to close at $11.37 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in CXW's shares.

Read More: $2M Bet On Exxon Mobil? Check Out These 3 Stocks Insiders Are Buying

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga