Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Global Payments Inc (NYSE:GPN)

- On May 1, Global Payments reported adjusted earnings per share of $2.59, beating the street view of $2.57. Quarterly adjusted revenue of $2.184 billion beat the street view of $2.176 billion. Josh Whipple, Senior Executive Vice President and Chief Financial Officer, said, "While trends in the business remain stable, our outlook continues to reflect the potential for a slightly more tempered economic environment than we saw in 2023." The company's stock fell around 11% over the past month and has a 52-week low of $95.12.

- RSI Value: 20.93

- GPN Price Action: Shares of Global Payments fell 2.7% to close at $99.08 on Monday.

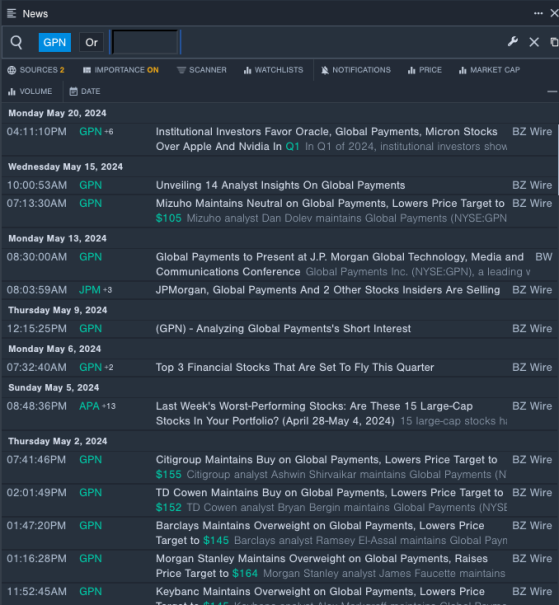

- Benzinga Pro's real-time newsfeed alerted to latest Global Payments news.

Factset Research Systems Inc (NYSE:FDS)

- On May 30, B of A Securities analyst David Chu downgraded FactSet Research Systems from Neutral to Underperform and lowered the price target from $500 to $407. The company's stock fell around 9% over the past five days. It has a 52-week low of $385.28.

- RSI Value: 23.11

- FDS Price Action: Shares of Factset Research fell 2.3% to close at $394.89 on Monday.

- Benzinga Pro's charting tool helped identify the trend in FDS stock.

Axos Financial Inc (NYSE:AX)

- On April 30, Axos Financial reported better-than-expected third-quarter financial results. “We delivered strong earnings per share and book value per share growth, driven by a 14% sequential increase in net interest income and a 5% sequential increase in non-interest income, ex-last quarter’s one-time gain on the FDIC Loan Purchase,” stated Greg Garrabrants, President and Chief Executive Officer of Axos. The company's stock fell around 12% over the past month and has a 52-week low of $32.05.

- RSI Value: 29.40

- AX Price Action: Shares of Axos Financial fell 2.6% to close at $52.46 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in Axos Financial's shares.

Read More: Donaldson, Hewlett Packard Enterprise And 3 Stocks To Watch Heading Into Tuesday

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga